Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

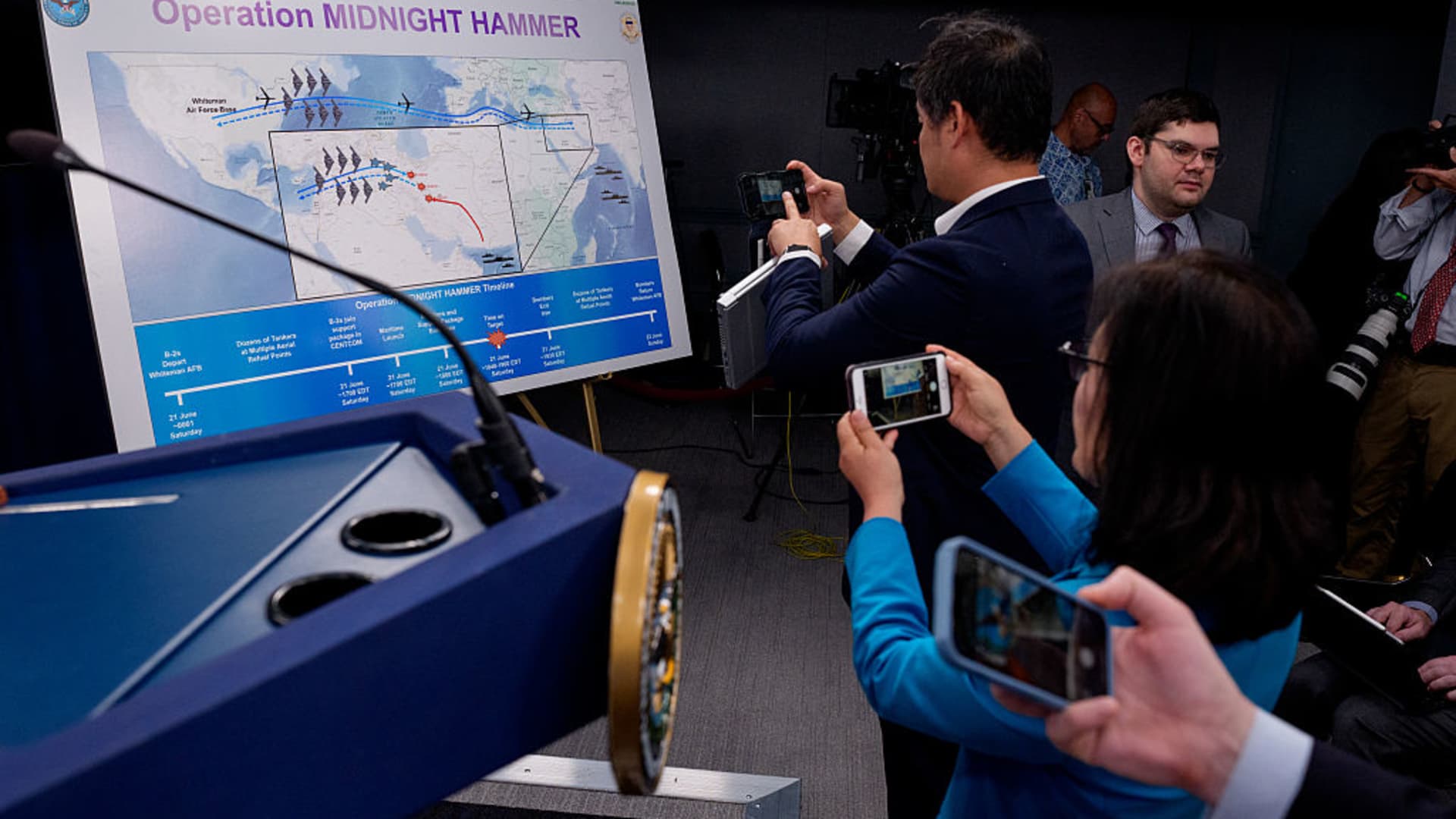

Reporters photographed the operating scale of Iran’s strike in Pentagon on June 22, 2025 in Arlington, Virginia, USA

Andrew Harnica | Getty Images | Gets the image

On Saturday, the United States conducted air strikes at three Iran atomic sites, entering Israel’s war against Tehran. The terms were unexpected. On Thursday, US President Donald Trump said he was still considering his participation and will come to the decision “For the next two weeks“

Financial and political analysts have largely perceived this phrase as a code for inaction.

“There is also skepticism that the” two-week “schedule is too familiar with the statement used by the president to delay any serious decision,” Jay Woods wrote, the main global strategist at the Freedom Capital Markets Markets.

Indeed, Trump usually neglected after giving “two -week” terms on major actions, reports NBC NEWS.

And who can forget Taco trade? This is an acronym that deciphets as “Trump is always chickens” – which describes the scheme of the US president, which threatens a heavy tariff, weighing the markets, but stopping or reducing their burden, helping the shares.

“Trump should bury the taco before he buried him … He was forced to stand down, and it cost him a lot of trust,” said David Wu, CEO David Vuanda.

That is why Trump followed his threat and ahead of the proposed two -week temporary scale.

“There will be either peace or in Iran will be much greater than we have watched over the last eight days,” Trump said on Saturday night.

But given Trump’s criticism to the fact that we participate in the wars under other presidents, or adds America to Iran to his authority, or destroys it further?

American strikes Iran

US President Donald Trump on Saturday said The United States attacked Iran’s nuclear placespushing America into the war of Israel with his longtime competitor. Defense Secretary Pete Hegset said on Sunday that “Iran’s nuclear ambitions were destroyed‘Murders that repeated Trump which underlined What “Aliterate – this is the exact term. “The decision to attack Iran is attracted US military personnel in an active war in the Middle East – The fact that Trump promised to avoid.

Iran calls the attacks “flamboys”

Foreign Minister Iran Abbas Arakhchi on Sunday – Note Tehran leaves all options for protecting its sovereignty and people after the “flamboys” of the United States on three of its major Nuclear premises for enrichment. Meanwhile, Iranian state media reported this Iran’s Parliament supported the closure Hormus Strait, citing the senior legislator. US on Sunday urged China to prevent this Iran.

Investors estimate US attacks

We have futures on Sunday night on Sunday As investors responded to Washington strikes in Iran. Futures associated with S&P 500 lost 0.17%, Dow Jones Industrial Maven Futures fell on 0.24% and Nasdaq 100 futures decreased by 0.21%. On Monday, Asia-Pacific markets mostly fell At 13:45 the Singapore time. Japan Nikkei 225 slipped 0.15%while South Korea Kospi index retreated 0.3%. However Hong Kong Hang the Index She raised the tendency to rise by 0.29%.

Oil prices are increasing

We have raw oil grew by 1.1% to $ 74.65 a barrel, while global landmark Brent rose by 1.12% to $ 77.88 a barrel early in the day of Singapore. Item that increases from the beginning of the day when prices jumped over 2% At the first trade session after Saturday events. In view of this, several analysts raised Perspective Oil Dollar BarlEspecially when exports are influenced through the Strait of the Mountains.

(Pro) eyes on reading inflation

Where are markets this week It will depend on whether the conflict in the Middle East is outgrowing. Investors should also monitor economic data. Personal consumption price index. Tariffs begin to heat inflation.

Trader on the floor of the New York Stock Exchange during the first New Year session on January 2, 2025 in New York, USA

Timofey A. Clair | AFP | Gets the image

Why are world markets reflected from US strikes on Iran

In the US, joining the war between Israel and Iran, it may seem like a geopolitical flash that would send markets.

Instead, investors are largely abandoning escalation, and many strategists believe that the conflict should contain – and even bulls for some risk assets.

“The markets view the attack on Iran as a relief with the nuclear threat that have now gone to the region,” said Dan Ius, the head of the Wedbush director, adding that he sees the minimum risks of the Iran-Israel conflict, which extends to the rest of the region and thus more “isolated”.

In addition, the rhetoric around the idea of closing the Hormuz waterway is repeated from Iran, but it has never acted, and experts emphasize that it is incredible.