Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Business -Reporter

Allamits

AllamitsNike Air Jordan 1 is something to be a landmark coach of the United States. This is a popular big American brand, created four decades ago for Michael Jordan’s basketball legend.

But although Nike sells most of its products in the US, almost all its coaches are manufactured in Asia – Region aimed at President Donald Trump tariffs Salvo against foreign countries, he accuses the “rogue” of Americans.

Nike shares decreased by 14% the day after the tariff announcement, about the fears of the influence they could have had on the company’s supply chain.

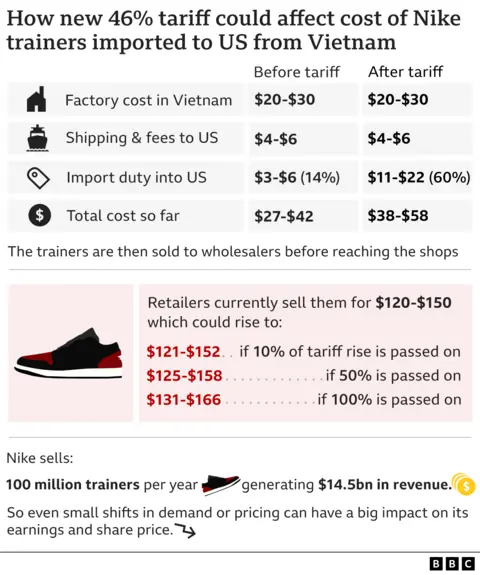

So what will all this mean for the cost of the Nike coach?

It depends on how much Nike’s increased expenses decide to pass on to customers, if any, and how long they think the tariffs will actually be in place.

Vietnam goods, Indonesia and China face some of the most difficult import taxes in the US – from 32% to 54%.

Hope will remain that Trump may be ready to agree on these rates below. On Friday, he stated that he had a “very productive” call with Vietnam leader, helping Nike’s shares to restore some land after their steep Thursday falls.

But most analysts believe the firm’s prices will need to rise.

Swiss Bank UBS suggests that 10% to 12% increases the prices of goods coming from Vietnam – where Nike produces half its shoes.

Meanwhile, Indonesia and China make virtually the whole balance of its coach production.

“Our opinion is that, given the wide list of tariffs, the industry will understand that there are several ways to mitigate the medium -term impact except for raising prices,” said UBS Jay Sole analyst in the note.

David Swartz, Senior Analyst Morningstar, agrees that the price increase is likely, but says that any big price increase will reduce demand.

“This is a very competitive industry. I suppose Nike would be difficult to raise prices by much more than 10-15%. I don’t think it can offset most of the tariffs,” he says.

Many other Western brands such as H&M, Adidas, Gap and Lululemon will face the same difficult position.

Nike will already turn to the dense bottom line.

In the last financial year, it amounted to about $ 51 billion (£ 39.6 billion). The cost of manufacturing products, including delivery, profit from other sides and fees for the warehouse, consumed only about 55% of the income, which gave it a healthy gross profit of more than 40%.

But this income breaks off as soon as you add the cost of other businesses. For example, a third of the profit is consumed by sale and administrative costs.

As long as you take into account interest and taxes, Nike’s profits declined to approximately 11%.

This is all its products, because they do not reduce the costs separately to different subjects.

Rahul Cee, which created a single review on the Trainer Review site, says there are other ways that Nike can keep the retail prices low.

D -Cee, who trained as a shoe designer and worked in Nike and Vans in India, says one way to lower the technology level.

“So, instead of using high-performance foam and construction, follow the expelled EVA injection (ethylene-winila acetate),” he says.

Another option will be instead of deduce a new design every one -two years to update the design cycle every three -four years.

Reuters

ReutersSimeon Siguegel, Head Director Bmo Capital Markets, says most companies viewed the ad on Wednesday as “far from the final conclusion”.

“I don’t think many people believe that these numbers are still wrapped in stone,” he says.

Theoretically Nike is such a big brand that it should be able to set prices without knocking down their sales, he says, but adds: “Do they have a question now, and do they have another?”

Even before the announcement, Nike faced a drop in sales that held back its ability to manage the full price for its shoes.

Matthew’s finance head also cited tariffs as an example of events that influenced consumers’ confidence.

And Nike largely relies on sale in the US, and the market promotes approximately $ 21.5 billion – almost everything it sells in its largest North America market.

Settings in the US raise “considerable concern” for Nike, as it directly affects the demand for its shoes, says Shan Lou, Professor Fashion and Clothing at the University of Delaware.

But in the end, he says firms can be forced to transfer the consumers.

“Nike is likely to raise prices when the tariff war persists. It is impossible for brands to absorb the cost of search by 30% to 50%.”

He adds: “As American trading partners respond against mutual tariff policy, it will also have a great influence.”

China already reflected its own 34% tariff.

A part of Trump’s tariff policy justification is that it wants more companies to produce its goods in the US.

However, Professor Lou does not see Nike or other companies, significantly removing his supply chain in the near future “out of the complexity involved in the production of shoes.”

This includes the time required to “consider a long list of factors, when deciding on where to find their products – quality, expenses, speed and various risks of social and environmental conservation.”

Matt Pauers from the PowerS Advisory Group says that the lack of US textile factories will make it “difficult and expensive (for Nike) to return production to the United States.”

Mr. Powers added: “This transition, if you pursue, will take years and require significant investments.”

Nike did not respond to BBC requests for this article.

We also contacted 30 suppliers in Asia, but no one answered.

Additional Natalie Sherman report in New York