Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

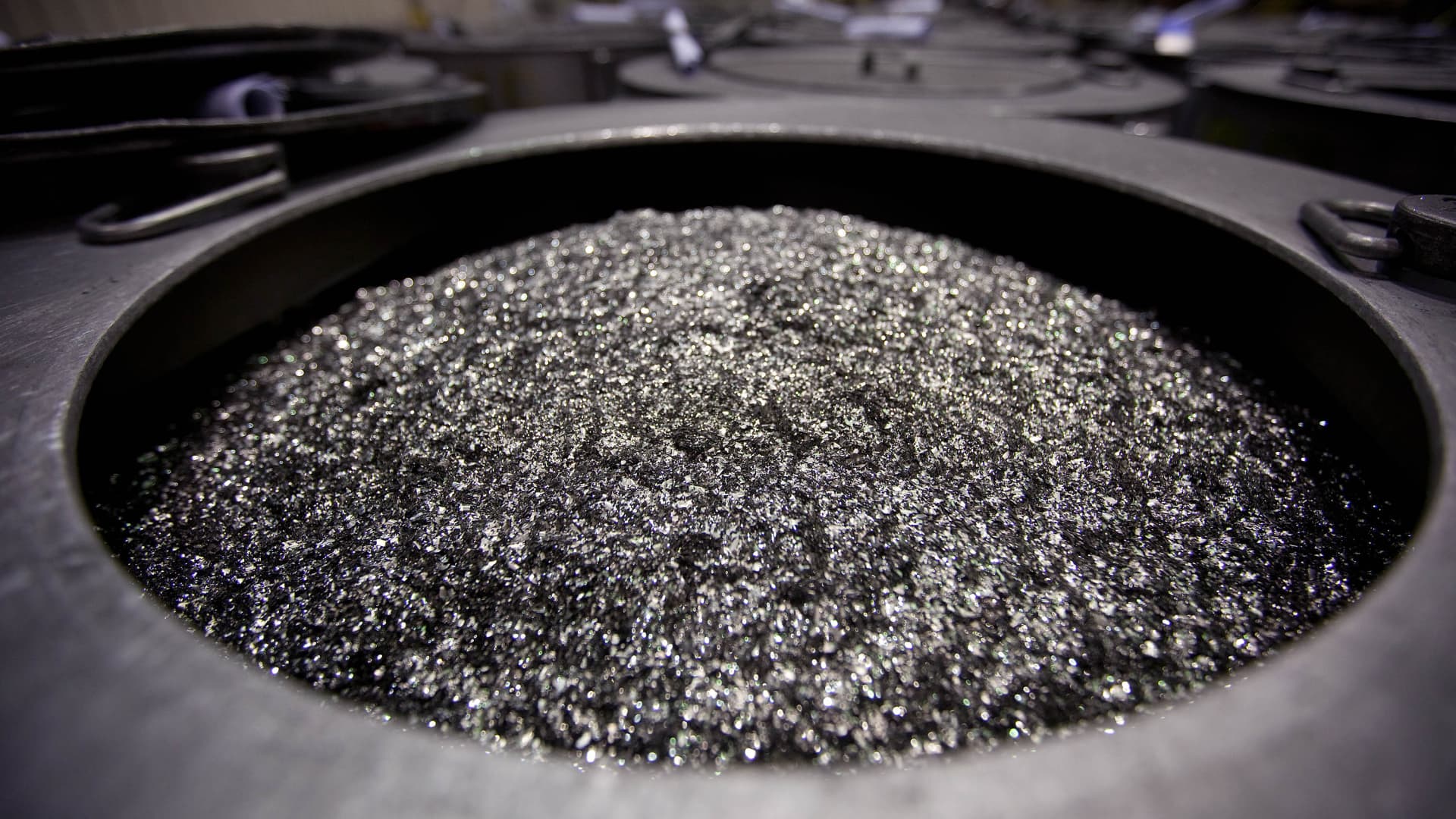

The indentant iron magnets that sit in the barrel before crushed into the Magnequench Tianjin Co. Neo Material Technologies Inc.

Bloomberg | Bloomberg | Gets the image

Beijing – As China tightens the contribution to the world proposal of key minerals, the West is working on a decrease on Chinese rare land.

This includes the search for alternative sources of rare land minerals, technology development to reduce dependence and restoration of existing reserves through the disposal products that reach the end of service.

“You can’t build a modern car without rare land,” said the consulting firm AlixPartners, noting that Chinese companies have come to dominate the supply chain for minerals.

In September 2024, the US Department of Defense invested 4.2 million dollars in rare landA startup aimed at mining oxide from household processed products such as fluorescent light bulbs. Toyota Japan has also invested in technology Reduce use rare elements of the earth.

As depending on US Geological ServiceChina controlled 69% of rare land production in 2024 and almost half of the world’s reserves.

Analysts with AlixPartners believe that a typical single -car electric vehicle includes about 550 grams (1.21 pounds) components containing rare land, unlike cars operating on gasoline using only 140 grams of rare land, or about 5 oz.

Soon the first generation of EVS will be for processing by creating a pool of ex-Chinese material, which will be under the control of the West.

Christopher Equelstone

Strategist by Main and Mining in Hallgarten & Company

More than half of the new cars sold in China are only battery and hybrid cars, unlike the US, where they still work in gasoline.

“With the slowdown in EV (in the USA) and the mandates for transformation from ice into EV formats, which retreat to the future, the imperative to replace the materials in China in EVS is declining,” said Christopher Ekslastun, chief strategist and mining in Hallgarten & Company.

“Quite quickly, the first generation of EVS will be for processing by creating a pool of ex-Chinese material, which will be under the control of the West,” he said.

Only 7.5% of the sales of new American cars in the first quarter were electricalModest growth compared to a year ago, Cox Automotive reports. It is stated that about two-thirds of the EV sold in the US last year were collected at the local level, but manufacturers still count on imports for spare parts.

“The current, full -scale trade war with China, the world’s leading EV supplier, distorts the market even more.”

With 1.7 kilograms (3.74 pounds) components containing rare land that are in a typical single-seat electric vehicle, 550 grams (1.2 pounds)-medium land. About the same amount, 510 grams, used in hybrid vehicles using lithium batteries.

In early April, China announced export management on seven rare land. These restrictions included Terbi, 9 grams of which are commonly used in single -scale EV data.

According to data, none of the six other rare earth land is significantly used. But the list of April is not the only one. A A separate Chinese list of metal controls This came into force in December, limited to the exports of Tsrieta, 50 grams of AlixPartners used on average in single -scale EV.

Control means that Chinese mineral companies must obtain a state permit for sale abroad. Caixin, Chinese Business, reported on May 15, just a few days after the US trading truce, this Three leading Chinese rare earth companies They received export licenses from the Ministry of Commerce to send to North America and Europe.

As for the international business, this is what is barely any alternative to China for rare land. Mines may take years to get operating, while the factories also require time and experience.

“Today, China controls more than 90% of the global delivery for four elements of the rare land magnet (ND, PR, DY, TB) used to make permanent magnets for EV Motors,” the International Energy Agency said. This refers to the neodymium, the pursuits, the dosprosis and the theraby.

According to AlixPartners, nickel metal hydride batteries in hybrid cars are less commonly used, the number of rare countrymen reaches 4.45 kilograms, or almost 10 pounds. This is largely because such a battery uses 3.5 kilograms of Lanton.

“I estimate that about 70% of more than 200 kilograms of minerals in EV goes through China, but it varies depending on vehicles and manufacturers. It is difficult to put on it a final figure,” said Henry Sanderson, an employee of the Royal Institute of Defense and Security of the Royal Services.

However, there are restriction restrictions that remain complex, energy dense and time consuming. And even if the EV acceptance in the US slows down, minerals are used in a much larger amount in defense.

For example, f-35 fighter Contains more than 900 pounds of rare landAccording to the Center for Strategic and International Studies Bas in Washington, Colombia County

Also restrictions in China rare land go beyond a careful list Released on April 4.

Large breeds containing chromite are crushed into smaller bites before passing the ore refinement and extraction process, which gives a vital stainless steel component, at the Logor province, Afghanistan.

Marcus Yam | Los -Angeles Times | Gets the image

Over the past two years, China has increased its control over a broader category of metals known as Critical minerals. In the summer of 2023, China said it would be Limit Export Gaul and GermanyBoth are used in chips. Approximately a year later he announced Restrictions on proportionalityused to strengthen other metals and a significant component in bullets, nuclear weapons and acidic acids.

The State Council, the country’s main executive body, released a whole policy for Strengthening export controlIncluding minerals that may have double use properties or use for military and civil purposes.

One limit that caught many in this area Surprisingly He was on a tungsten, appointed US critical mineral, but not rare land. Extremely solid metal is used in weapons, cutting tools, semiconductors and car batteries.

China has been produced near 80% of the worldwide Wolfrom supplies In 2024, and the US imported 27% tungsten from China, showed data from the US Geological Service.

About 2 kilograms of tungsten are commonly used in each battery of electric cars, said Michael Dornhofer, founder of the Consulting Consulting Business Partner. He noted that this tungsten can not return to the processing network at least seven years, and its low use may not even make it multiple.

“50% of the world tungsten is consumed by China, so they have a business as usual,” Wungsten Mining Company Almonty said in an interview with Lewis Black. “These are the remaining 40%produced (in China) that come to the West that does not exist.”

He said that if the future Mine Wolfrom mine in South Korea will open again this year, it will mean that there will be a rather non -Chinese metal to meet us, Europe and South Korean needs.

But for cars, medical and aerospace space, “we are just not enough.”