Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

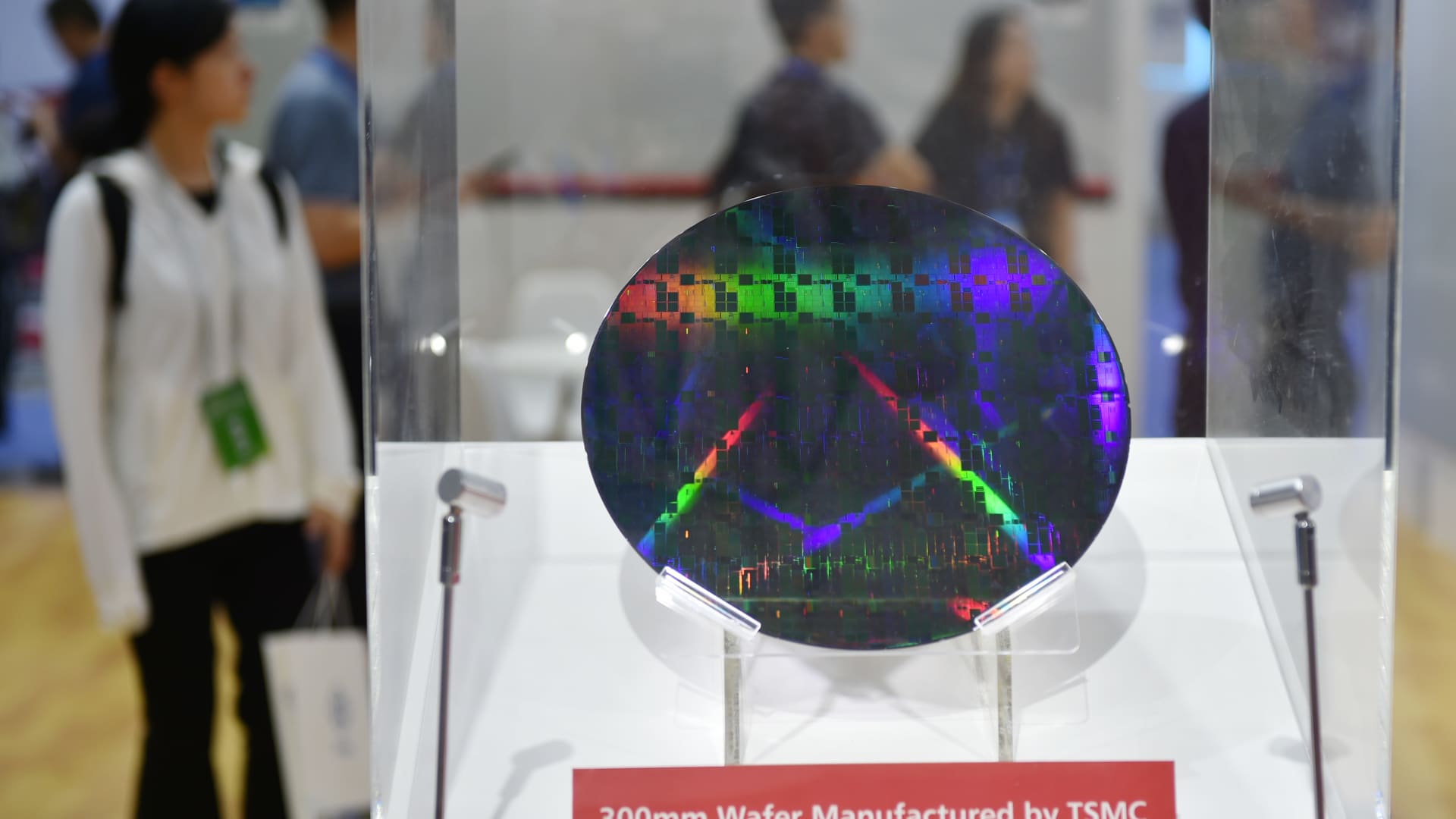

The 300 -millionm plate at the Taiwan Semiconductor ManuFactts production company at the 2023 semiconductor conference at the Nanjing International Exhibition Center on July 19, 2023 in Nancin, China.

VCG | Visual China Group | Gets the image

US had withdrawn the denial that allowed Taiwan Semiconductor Manufacturing Co. For exporting key equipment for the creation of chips and technologies to a production plant in Nancin, China, as Washington continues to increase efforts to limit the semiconductor in Beijing.

The change deleted the fast export export privilege known as the approved final user status (VEU), which operates on December 31, confirmed the TSMC CNBC on Wednesday.

The world’s largest contract was released immediately after the Department of Trade launched its initial restrictions on the sale of chips in the US in 2022.

According to the new policy, supplying tools for creating chips with American origin to TSMC production facilities in Nancin, China, will require US export licenses.

“While we evaluate the situation and take appropriate measures, including communication with the US government, we still fully strive to ensure the continuous work of TSMC Nanjing,” the company said.

South Korean memory that makers of memory SK HYNIX and Samsung were also withdrawn by their VEU privileges on Friday, the statement said Federal Register. Both companies work with Chinese memory premises.

At the same time, the Bureau of Industry and Security of the Ministry of Commerce stated in statement What he covered Leu “Bisen-epoch” for all foreign producers of semiconductors.

It adds that it intends to provide export licenses to allow former VEU participants to manage existing production facilities in China, but do not expand the power or upgrade technology in China.

Jeffrey Kesler, under the Ministers of Trade and Security, said the Trump administration “strives to close the prohibitions to control exports – especially those who have put US companies in competitive.

According to Brad Van, the deputy director of the Contropopoint Research, the policy changes “reflects the wider impetus of Washington to strengthen control over semiconductor equipment and technology export to China, strengthening the power over the production of china,” he said.

TSMC works in China two production sites, one in Shanghai and Nanjing, and the last facility is more advanced. To feed the plant manufacturing company uses equipment from multiple US chips, including Applied materials and Kla Corp.

However, according to Wang, since Nanjing FAB TSMC promotes less than 3% of TSMC’s total income and is a minor share of its global potential, the financial impact on the company “must be insignificant”.

Recent Veu reversals can be a surprise to some if they adhere to Trump’s administration, which will facilitate control over the export of some US artificial intelligence chips.

Last month the US said Nvidia and Amd would be allowed restore exports Some of them previously prohibited AI chips for China and signal that politics could be expanded.

Before that, the administration also struck The Rule of the Diffusion Age of BidenA step that could notice the expansion of export management on advanced AI chips.

US officials impose restoration of advanced CHIP restrictions as a way to maintain the rule of AI stack on a worldwide scale, including in China.

However, the removal of the VEU privilege shows that the same logic is unlikely to apply to memory and chips.

According to Ray Vanga, semiconductor research, supplies and new technologies in Futurum Group, politics shows that Washington remains committed to preventing China in raising local production facilities and growing local know-how and talents.

“Another major goal may be to limit the ability of companies to expand their traces of supply chain in China – especially in strategic sectors such as semiconductors that the administration seeks to prevent,” he said.

Conversely, the Trump administration is working to attract a more semiconductor supply chain to the US shores through tariff threats.

This year, TSMC, Sk Hynix and Samsung made new investments in their US production plans.

On Monday, Sk Hynix and Samsung shares hit the Veu news. However, TSMC shares were trading apartments on Wednesday after news about its Veu turn.