Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

All over the world, public health systems have struggled to reset post-pandemic, and in particular, increasingly aging populations in Western countries are putting pressure on services, not least in the United Kingdom where “NHS in crisis’ is a regular headline in the media. As a result, private companies, heavily fueled by technology, see a gap in the market. It is with this background that There wasa proprietary software platform and home healthcare provider in the UK, has raised $150 million in a mix of debt and equity. The company said most of it is debt, but refused to give a split and also demurred on its valuation.

The round was led by funds affiliated with BDT & MSD Partners and Schroders Capital in order to scale Cera’s platform. The company says that this is very much driven by AI, with a proprietary model based on its data, although it admits to using some aspects of Google’s Gemini AI platform and Microsoft’s version of ChatGPT.

In 2022 Wax resurrected $320 million (£260 million) in an equity and debt financing round, split roughly 50/50.

According to CrunchBase it has 14 investors. Recognized equity investors to date include Earlymarket, Guinness Ventures, DigitalHealth. London accelerator, and long-time British investor Robin Klein.

A spokesperson for Cera added that, although it is not yet reflected in the public accounts, the company was EBITA positive in 2023 and became free cash flow positive in 2024, and is “more of a self-sufficient company” , therefore, could raise this round of debt.

In an interview with TechCrunch, Dr. Ben Maruthappu MBE, Founder and CEO of Cera, said: “We have reached profitability, in addition we have very significantly tired how we use our technology and AI, and we have developed in more services. in home.”

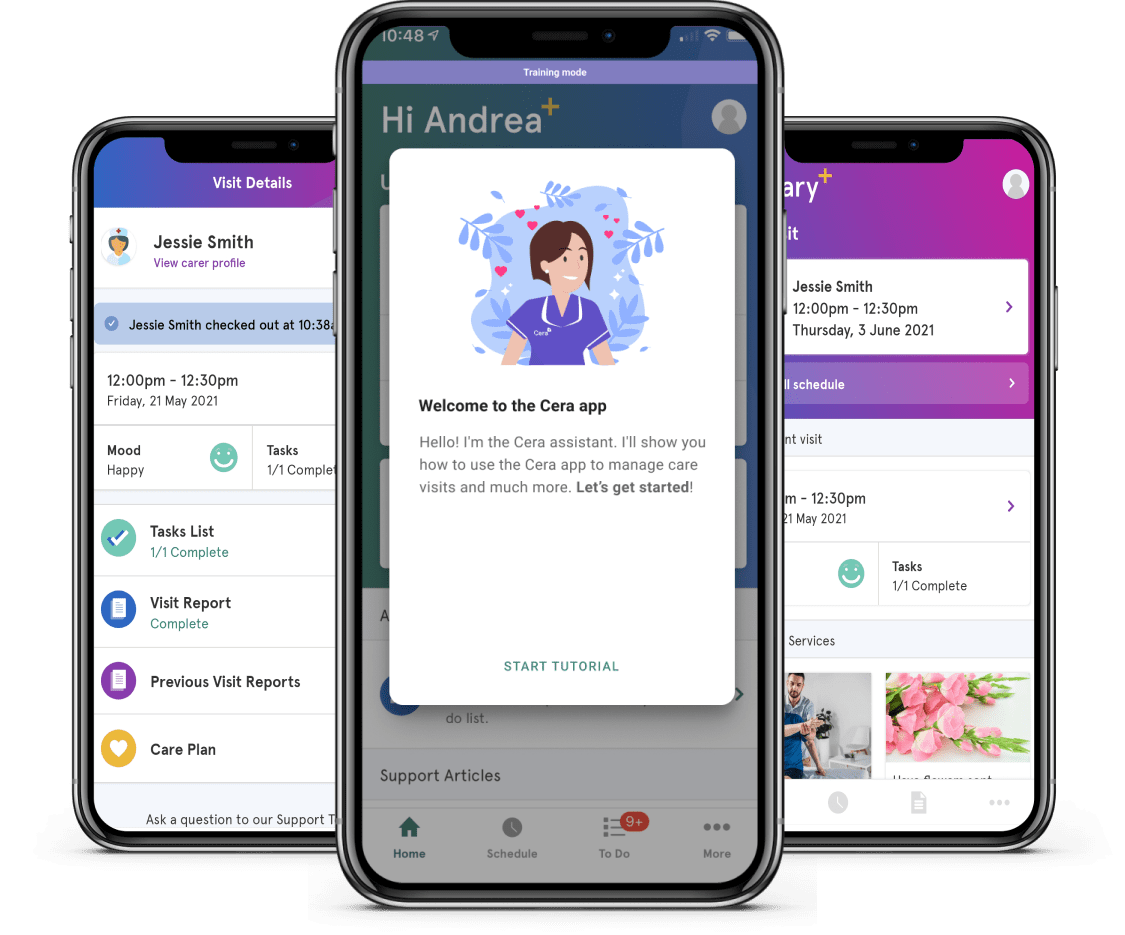

Cera carers use their app to plan their work and log patients’ symptoms. Using its AI model, Cera is then able to take that unstructured data (for example “patient had a fall in the night” etc.) and use it to predict the potential of patients to be subject to a greater risk of illness or injury. The company claims this has resulted in reductions in hospitalizations of up to 70%, a 20% reduction in patient falls, and hospital discharges that are up to five times faster, it said in a declaration

The company has raised more than $407 million to date in a mix of equity and debt.

Competitors in the UK include Home Instead and Bluebird Care, which use non-proprietary apps to manage their staff. In the US, Cera’s closest comparisons include Signify Health and CVS Health, both acquired by Nasdaq-listed CVS Health. Another is Honor, which has resurrected $625 million to date.

Maruthappu said: “We are taking pressure from the NHS and supporting it to have more capacity to look after other patients. We have also expanded into other service lines such as nursing services, physiotherapy, learning disabilities, physical disabilities, and also provide home mental health services. So we’re a much more comprehensive home health care provider.”

He also said that the AI-driven aspect of the business was based on the data it collects: “The other key advantage is what we do with technology, more specifically AI… We record patient information from these visits on our app which has now given us one of the largest healthcare data sets in the world, certainly the largest in Europe, and we have been able to analyze that. data sets in many different ways to build algorithms, algorithms that refer to whether someone is going to have a fall before doing so.

“We can predict more than 80% of falls a week before they happen. That’s statistically significant… So we actually reduce falls by more than 20% because of our AI algorithm… We can also predict about 83% of hospitalizations again a week before they occur … reducing hospitalizations by up to 70%,” he said.

In a statement, Rob Platek, partner and global head of credit at BDT & MSD, said: “Cera has achieved strong growth through a demonstrated ability to leverage technology to deliver exceptional care. We believe Cera is well positioned to further his activity”.

Cera says it is the UK’s largest non-NHS healthcare provider, covering around 30 million people with 10,000 carers and nurses and working with more than 150 local governments and two-thirds of NHS Integrated Care Systems .

It also claims that an independent analysis carried out by British consultancy Faculty found that Cera’s AI-driven home healthcare model saves the UK healthcare system £1 million a day.

Cera is obviously keen to avoid the appearance of health startups like Babylon Health, certainly a very different business, which is gone. failure and was sold for parts after trying to do healthcare through a mere chatbot.