Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

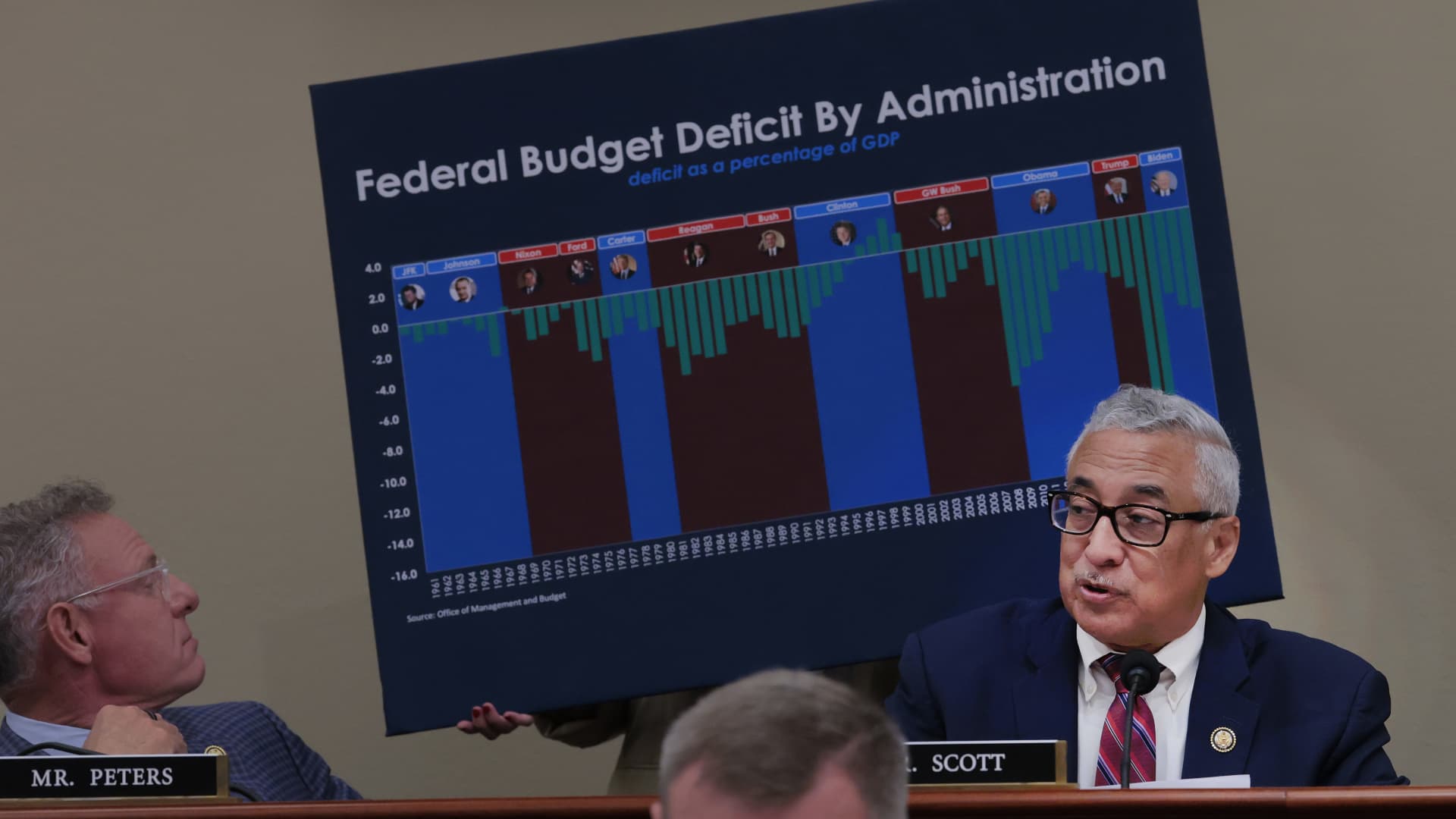

Res. Robert Scott (D-VA) (R) speaks during a meeting with the House of Representatives Committee on the Capitolian Hill on May 16, 2025 in Washington, the District of Columbia, the USA.

Anna Money Getty Images | Gets the image

“Big, Beautiful” US President Donald Trump Tax account The House of Representatives was adopted on Thursday and sent to the Senate for approval.

If the bill clears that it is hindering and becoming a law, it “reduces taxes for many people, it increases costs, especially for defense”, “” – Note Jed Elerbrook, ARGent Capital Management portfolio, in an interview with CNBC. Simply put, it will increase the economy in the short term, added EleRRBRK.

In addition, in the future, however, the bill is likely to be sitting in America with a higher budget deficit. Tax reduction means less profit. while Increase in defense costs means more money that flows from the state box office. This is a matter of simple arithmetic: less income and more costs.

Despite the fact that the US Treasury gives, which, in fact, state debt, are slightly moderate from their spike on Wednesday, they are still at an advanced level compared to the beginning of the year. This suggests that investors are not so confident in the loan of money to the White House, and therefore require greater safety in the form of higher crops.

In the stock market, investors accept the waiting approach, both the S&P 500 and the Dow Jones Industrial Medium, which remains mainly unchanged after the Trump bill.

There are at least one piece of good news since Thursday. The US Supreme Court has strongly suggested that members of the federal reserve may be defended against the president, reducing the risk of another market administration caused by the Trump administration.

US stocks are mostly unchanged

On Thursday, S&P 500 and Dow Jones Industrial Medium closed mainly flatwhile Nasdaq Composite Added 0.28%as the House of Representatives took the Trump’s tax bill. Regional Europe Stoxx 600 Index sliding 0.64%. The cost of long -term loans of the British government increased, with 30-year-old gilding The closing of the profitability at the level of 5.563%, the highest level since 1998.

Treasury slightly decreased

During the night of the state, 30-year-old US Treasury Yield Touching up to 5.044% after touching 5.161% – – the highest since October 2023 – and A 10-year yield It decreased to 4.535%, falling by almost 10 basic points since the beginning of the day. The sale in the Treasury pushes some market observers to review the status of US government bonds as a safe shelter and Turn your money to other global assets.

Fed members may have a dismissal protection

The US Supreme Court on Thursday urged Members of the Federal Reserve Council will have special protection Against the president’s dismissal. “The federal reserve system is a clearly structured, quasi-private person that arose from different historical traditions of the first and second US banks,” the federal agency’s dismissal on the dismissal of the Federal Agency said.

Anthropic launch of new AI models

Anthropic, Amazon-Was rival Openai, Thursday launched Claude 4, the last models of artificial intelligence. The company’s release said two models called Claude Opus 4 and Claude Sonnet 4 determine the “new standard” when it comes to AI agents. Claude Opus 4-It’s the best coding model in the world and can work autonomously throughout the seven-hour corporate work, Anthropic reports.

(Pro) Warning from the stock market

Markets stabilized Thursday after a double stock and bond sale but Key corner of the stock market Blinking with careful light for the economy, Jesse Pound CNBC PRO wrote. Although it does not indicate that the recession is inevitable, it is a reminder that the way forward is still a cliff.

In 2016, workers collect electronic devices in China.

Bloomberg | Bloomberg | Gets the image

Why Make-In-India is not guaranteed success despite tariffs in the US in China

While India has certainly become a significant, albeit charged, the center for assembling electronics, the path to it becomes a clear alternative to China, the result is not guaranteed, despite the tariffs for Chinese goods.

“The supply network and production network, these things take a long time to set,” said Nick McConwee, head of Asia Ex-Japan in Amundi Asset Management. “We saw that with Vietnam, who had to invest huge investment in the infrastructure.”

“I think India is only at the earliest stage of developing these types of world production facilities,” McConwe added.

The head of the fund also emphasized that while work costs in India may be low, it does not mean saving for companies that move their production base to India.