Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

BBC NEWS

BBC Indonesian

Gets the image

Gets the imageWhen US President Donald Trump struck China in the first term, Vietnamese Hao Le La saw the opportunity.

His company is one of the hundreds of enterprises that compete with Chinese exports that are increasingly facing the West.

Le’s Shdc Electronics, which sits in the initial HAI Duong industrial hub, sells 2 million pounds in the US (£ 1.5 million).

But this income can dry if Trump imposes 46% tariffs on Vietnamese goods the plan that is currently on the content By the beginning of July. That would be “catastrophic for our business,” Le.

And the sale of Vietnamese consumers is not an option, it adds: “We cannot compete with Chinese products. This is not only our problem. Many Vietnamese companies are fighting in their home market.”

In 2016, Trump tariffs sent a superstitiousness of cheap Chinese imports, originally designed for the United States, in South -Eastern Asia, harming many local producers. But they also opened new doors for other businesses, often on global supply networks that wanted to reduce China’s dependence.

But Trump 2.0 threatens to close this door. And this is a blow for fast -growing economies, such as Vietnam and Indonesia that shoot to become key players in the fields: from chips to electric cars.

They also found themselves between the two largest economies in the world – China, a powerful neighbor and their largest trading partner, and the US, a key export market that could conclude a deal at the expense of Beijing.

Gets the image

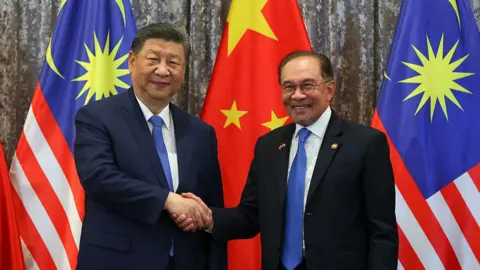

Gets the imageThis week, Chinese President Xi Jinping is visiting Vietnam, Malaysia and Cambodia, calling for unity against Trump tariffs. The trip has long been planned, but it has fresh relevance, given how significant southeastern Asia is for the Chinese economy.

China has earned a record 3.5 tN from exports in 2024 – 16% of its exports go to Southeast Asia, making it the biggest market.

“We cannot choose and we will never choose (between China and the US),” said the Minister of Trade in Malaysia Tengk Zafrul Aziz on Tuesday, on the eve of the SI visit.

“If the question is that we believe that we will defend (ourselves) against our interest.”

In A few days after Trump submitted his broad tariffsSoutheast Asian governments entered the transactions preparation mode.

The fact that Trump called a “very productive call” with Vietnamese Lam leader, the latter offered to fully collect tariffs for US goods.

The US market is crucial for Vietnam, a new electronics power plant, in which production giants, such as Samsung, Intel and Foxconn, Taiwanese firm, was concluded before creating an iPhone, created a store.

Meanwhile, Thai officials go to Washington with a plan that includes higher US imports and investments. The US is their largest export market, so they hope to avoid 36% in Thailand, which Trump can restore.

“We will say the US government that Thailand is not only an exporter, but also an ally and economic partner to which the US can count on in the long run,” said the Prime Minister of the Poetongton Shinovatt.

The Southeast Asia (ASEAN) Association has excluded revenge against Trump’s tariffs instead of emphasizing their economic and political importance to the United States.

Gets the image

Gets the image“We understand US problems,” Mr. Zafrul said in the BBC. “That is why we need to show that, in fact, we, ASEAN, especially Malaysia, can be this bridge.”

This is the role that the export economies of Southeast Asia played well – they used both from Chinese and from trade and investment in the US. But Trump’s levies may have stopped.

Indonesia, which may face 32% of the tariffs, is home to the big nickel reserves and has its sights installed in the global supply chain. Malaysia, which is preparing for a semiconductor center, can be reached 24%.

Cambodia, the Chinese ally, is facing the most steep levies: 49%. One of the poorest countries in the region, which it flourished as a center for Chinese business, which seeks to delays tariffs in the United States. Chinese business currently owns or operates 90% of clothing plants that mainly export to the US.

Trump may have hit these tariffs at the crawl, but “the damage is done,” says Doris Liv, economist of the Institute of Democracy and Economic Affairs in Malaysia.

“This is a call for waking up for the region not only for reducing the US dependence, but also for re -balance for any single trade and export partner.”

In these uncertain times XI Jinping is a tering to send an unwavering message: let’s join the hands and resist “bullying” from the US.

This is not a simple task because South -East Asia also has tension with Beijing.

In Indonesia, the ISMA Savitri business owner is worried that 145% of Trump’s tariffs in China means great competition from Chinese competitors who can no longer export to the US.

“Small business, like we feel compressed,” says the Helopy brand owner. “We are fighting to survive against the pressure of the ultra-tanks of Chinese products.”

One of the popular Helopophy pajamas is sold for $ 7.10 ($ 119,000). ISMA says she has seen similar projects from China, are about double the price.

“Southeast Asia, being nearby, with open trade regime and fast-growing markets, naturally became a landfill,” says Nguyen Khak Jong, visiting the Izea-Yacak Institute in Singapore. “In political terms, many countries are reluctant to withstand Beijing, adding another layer of vulnerability.”

Gets the image

Gets the imageWhile consumers greeted Chinese products that suffer competitively, from clothing to shoes to phones – thousands of local businesses were unable to match such low cost.

More than 100 factories in Thailand are closed every month in the last two years, according to the Thai Analytical Center. During the same period, about 250,000 textile workers were fired in Indonesia after about 60 clothing manufacturers were closed, local trade associations say – including Sritx as the largest textile manufacturer in the region.

“When we see this news, there are many imported products that pour the domestic market that runs our own market,” says BBC Mujiati, a worker who has been fired from Sritx.

“Perhaps it was just not our luck,” says a 50-year-old guy who is still a field for work. “Who can we complain? There are no one.”

Southeast Asian governments responded with a wave of protectionism, as local business demanded that Chinese imports be protected.

Last year, Indonesia considered 200% tariffs for a number of Chinese goods and blocked the Temu e -commerce site popular among Chinese merchants. Thailand has strengthened import checks and imposed an additional tax on goods worth less than 1500 Thai Baht ($ 45; £ 34).

This year, Vietnam twice introduced temporary anti -dumps into Chinese steel products. And after Trump’s last announcement in Vietnam, it is reported to hack Chinese goods transferred through its territory to the US.

Gets the image

Gets the imageThis week it would be on the agenda of XI this week.

China is concerned about sending its exports in the rest of the world related to the United States “ultimately feel and burns” its trading partners, David Reni, former head of the Beijing Economist, said Newshour BBC.

“If the tidal wave of Chinese exports eventually gain these markets and harm the employment and workplace … This is a mass diplomatic and geopolitical headache for Chinese leadership.”

China did not always have a simple relationship with this region. By baning Laos, Cambodia and the Myanmar war, the rest are cautious about Beijing’s ambitions. Terrium disputes in South China have collected ties with the Philippines. It is also a problem with others, such as Vietnam and Malaysia, but trade became a balance.

But it may change now, experts say.

Gets the image

Gets the image“Southeast Asia had to think about whether they really wanted to offend China. Now it complicates things,” says Chong Ja-In, Associate Professor of the Singapore National University.

China’s loss can be southeast Asia.

In Vietnam, Hao La says he saw an overload in requests from US customers who are screaming new electronics suppliers outside China: “In the past, American buyers needed months to switch suppliers. Today, such decisions are made for several days.”

Malaysia, with wide rubber plantations and the world’s largest producer of medical rubber, has almost half the worldwide rubber glove market. But ready to capture a large share from China’s main competitor.

The region still faces 10% basic tariff, like most of the world. And this is bad news, says Oon Kim Hen, President of the Malaysian Rubber Gloves Association.

But even if they entered re -tariffs, he said, customers will find an additional 24% on Malaysian gloves, which are much preferable to 145%, they will cough for Chinese gloves.

“We are not quite jumping with joy, but it may well benefit our manufacturers, as well as in Thailand, Vietnam and Cambodia.”

Additional Buy Tu reporting and Tessa Wong