Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Since its inception in 1979 the United States Department of Education (Doe) It has created a federal student loan policy that, in turn, influenced the increase in the cost of education and the loans that pay for it. As President Donald Trump goes to a significantly reduction in size, and eventually shutters, one expert says that a completely private loan system will work better than switching the administration to other government agencies.

“The Clinton Administration Introduced The Direct Loan Program, so this was the computeor to the quasi public-private system, where the Government was going to be the one osuing Coexisted for a couple years long, until 2010, when we get got obamacare, and that Basically used some of the paper profits from switching all the loans to government loans to help pay for obsceare, “Cato Institute Gillen Told Fox News Digital in an interview.

“And so, since 2010, we have been in the field of government loan solely,” he added.

California under the investigation of Trump administrator for allegedly hiding the “gender identity”

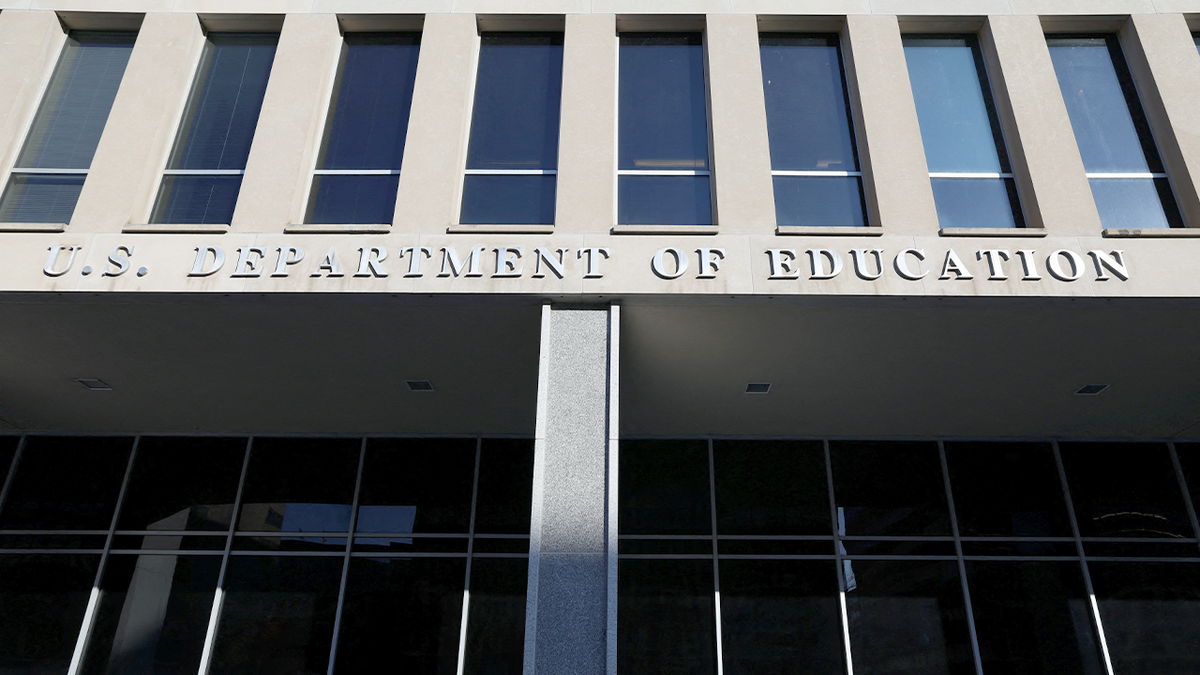

The morning sun sunbathing the front of the education department in Washington, February 4, 2025. (Reuters/Kevin Lamarque)

Originally After Trump In March, the executive order signed by DOE, the administration offered to transfer 1.6 trillion. Student loans to small business administration (SBA). However, recent developments show that the Ministry of Finance may take responsibility for federal student loans.

The Trump administration also proposes to transfer Pell grants and financing the titles and other federal agencies, effectively reducing the role of the department in control of major educational programs.

“If we just submit student loans to the treasury and don’t change anything else in the system, I don’t think it will have a real impact,” Gilen said. “Thus, all these loans are already established by Congress, and therefore just a change in the administrative house that manages the documents in the background, it will have no influence.”

The current system encourages “bad investment” by funding students either education Without a realistic expectation, Gilen said. Instead, private lenders who prefer the risk of repayment are likely to avoid financing such loans. He suggested that moving to a private system will provide better incentives for both colleges and students as universities will face pressure to produce students who may repay their loans, and students will most likely choose the fields that lead to a successful career.

Note Newsom “Unjust” on Girl Sports Affairs-How Governor: “Absolute Bulls —“

Education Secretary Linda McMahon talks to Brest Brester’s main political leading Fox News after President Donald Trump has passed to dismantle his agency. (Fox News / Special Report)

The government has aggravated the payment of student loans through bankruptcy, Gilen added, with rare exceptions, but this rule does not apply to private lenders.

“There are several things we can do to encourage private lenders to be prepared to make these loans. So you can clarify how bankruptcy law works with these credits that are conditioned by profit,” he said.

Some legislators have made efforts to resolve this issue. Democratic representatives Steve Cohen, Danny K. Davis and Eric Salvelle again submitted Law on the Justice of Private Student CreditSeeking to make private student loans brought in bankruptcy, similar to other types of consumer debt.

US Education Minister Linda McMahon is present at the signing ceremony of reducing the size and volume of the Ministry of Education in the eastern room of the White House on March 20, 2025 in Washington, Columbia County (Chip Somodevilla/Getty Images)

Currently, the government can decorate wages without requiring a trial, making the process more efficient and less expensive, which would be useful for private creditors.

Click here to get the Fox News app

In the 1990s, the introduction of revenue repayment plans, starting with the revenue repayment plan (ICR) in 1994 as part of the former President Bill Clinton. These plans allowed the borrowers to repay the loans depending on their income, extend the loan and increase the total paid interest. Although they provided immediate financial assistance, they also led to higher long -term costs for some borrowers.

By the financial year 2024, Lani spent Approximately 1.6 trillion. Dollars on loans, granting $ 85.7 billion of new loans, with $ 45.3 billion allocated to student education and $ 40.4 billion for postgraduate studies.