Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Caricory image elected President Donald Trump with cryptocurrency tokens, drawn in front of the White House in honor of his inauguration, exhibited at Coinhero store in Hong Kong, China, Monday, 2025.

Paul Jung | Bloomberg | Getty Images

After a few days President Donald Trump The second administration, Wall Street sings a different crying tune.

“For us the equation is whether we will be as a High -Organ Financial Institutioncan act as transactors, ” Morgan Stanley CEO Ted Peak said CNBC On Thursday at the St. World Economic Forum In Davos, Switzerland.

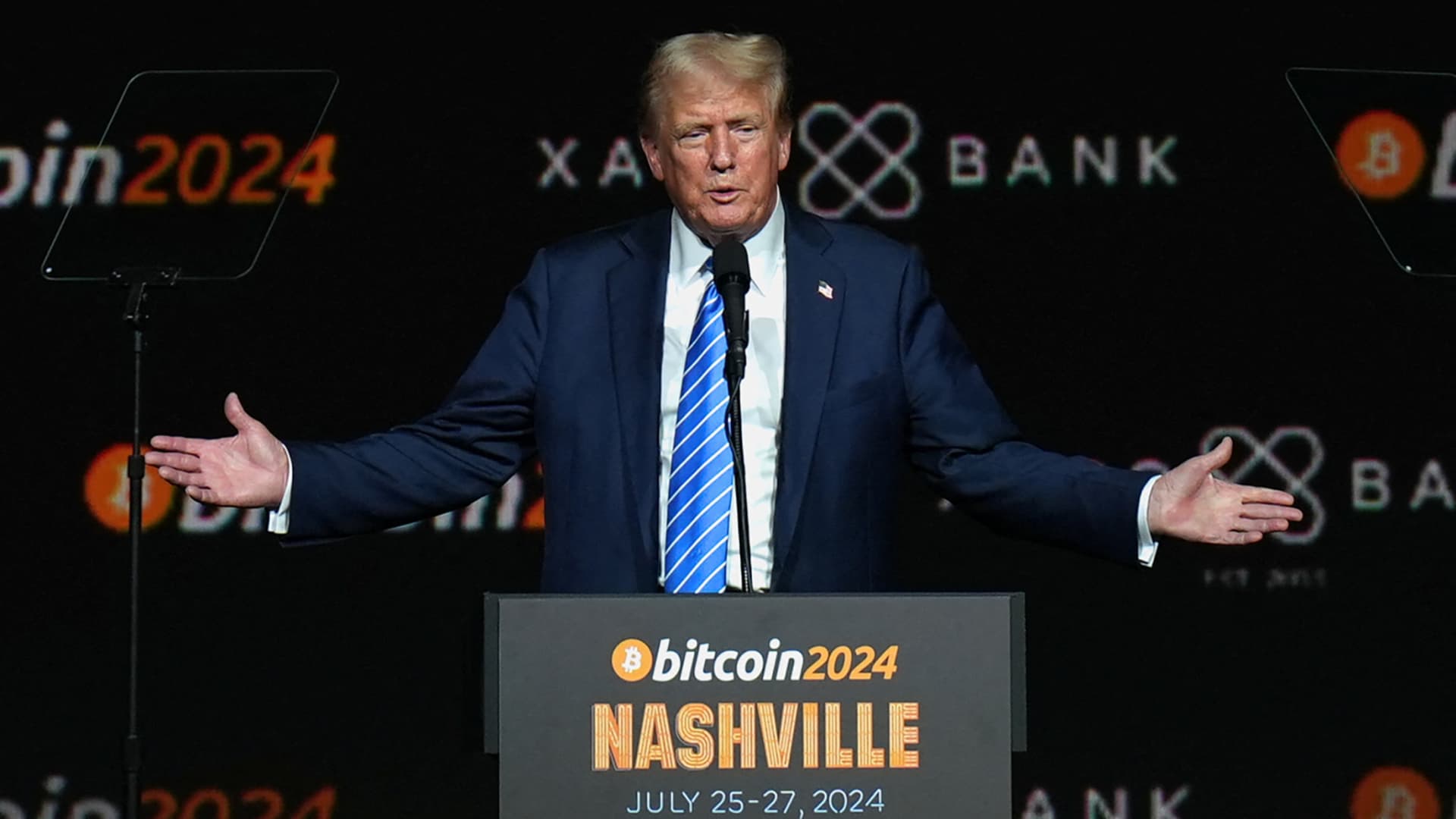

The new optimism is among the increasing number of bank executives that were in Davos this week related to the Trump’s proceedings. Trump, Cryptoskept during his first term, rolled over On this issue during his company 2024 and began to rely on Money is crypto -industry In an attempt to defeat former Vice President Kamal Harris.

The President on Thursday issued a A wide disposal about the cryWith a focus on “protection and promotion” of use and development of digital assets. Banks reluctantly supported the cry and allowed transactions to this point largely because of the government’s position. Since 2013, SEC has launched over 200 cryptocurrency lawsuits, According to Cornerstone Research.

“We will work with the Ministry of Finance and other regulators to find out how we can offer it a safe way,” Pick said.

Trump has appointed several adherents of cryography for important positions in his administration. They include Paul Atkins, the chairman of the Securities and Exchange Commission, where he was a commissioner under President George W. Bush. Howard Lutnit, CEO Cantor Fitzgerald, elected Trump as Minister of Commerce, and Scott Hedge Fund manager was appointed head of the Treasury.

In case of confirmation of the Besent will control IRS and the network to combat financial crimes that play a key role in shaping tax policy and policy of fulfillment

Peak says Morgan Stanley will collaborate with federal regulators to determine whether the bank’s ties with the cryptocurrency markets are possible. His firm was more aggressive than her Wall Street colleagues.

In 2021Morgan Stanley became the first major US bank to offer its wealthy customers access to bitcoins. Last August it was the first major player with Wall Street Allow your financial advisors Start to offer customers some exchange -traded funds that were launched earlier last year. Until now, wealth management businesses have only contributed to transactions in cases where customers requested access to new sport crystals.

The peak suggested that the more bitcoin penetrates the mainstream, the more it is regarded as the legal part of the financial system.

“The longer he trades, the perception becomes a reality,” he said.

Bank of America CEO Brian Muliniha Repeated readiness to accept cryptography, in particular as a payment option if the normative environment changes in the new administration. Speaking in Davos, Mainihan emphasized that the exact recommendations could unlock wider acceptance.

“If the rules enter and make it a real thing you can really run a business, you will see that the banking system will strongly affect the transactional part,” Mainen said in Interview on Tuesday with CNBC.

Mulinihan, who runs the second largest bank in the US by the number of assets, noted that the crystand may be “just another payment form” such as Visa. Mastercard or apple Pay. However, he evaded the discussion of cryptocurrencies such as bitcoin as investments or means of conservation, calling it a “separate issue”.

Another serious obstacle to the adoption of cryptocurrencies on Wall Street is the accounting rule released by the SEC in 2022, which requires banks to classify cryptocurrencies as liabilities on its balancen. The rule exposes these assets with strict capital requirements, significantly increasing the financial and regulatory risks associated with the custody service offer.

Attempts to cancel the rule known as SAB 121 received support for both parties in Congress last year. But then President Joe Biden He vetoed the proposed legislation, leaving the rule intact and further repel the banks from the adoption of digital assets. Banks are mainly forbidden to expand their crypresses outside trading tools and offer ETF customers to manage capital.

“At the moment, in terms of adjustment, we cannot possess” bitcoins, Goldman Sachs CEO David Solomon said this in an interview in Davos this week. He said the bank would revise this issue when the rules change.

With the scriptographic administration of Trump, which is now in power, there is an optimism that SAB 121 may be canceled or revised, which will allow banks to retain crystals without such difficult capital requirements.

Bitcoin reached a record of nearly $ 110,000 on Monday before Trump’s inauguration, which led to a broader cryptor. As of Thursday evening, he traded about $ 104,000.

. Hugh Dream with CNBC made his contribution to this report.