Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

We recently received a letter from Jane, who wrote us about the suspicious text message she received.

Her experience serves as an important reminder for all of us to be vigilant before them Digital threats develop.

Let’s plunge into Jane’s meeting and study what that means our financial security in 2025.

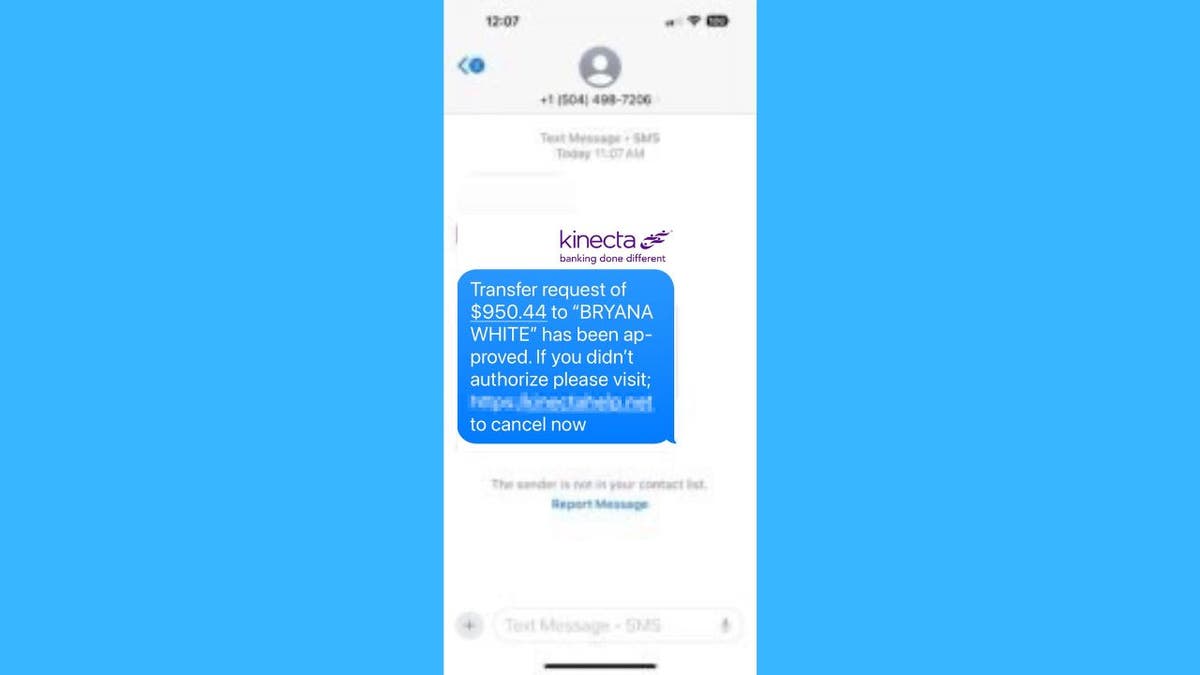

A person who receives the text of the transmission scam (Kurt “Cyberguy” Knutson)

Jane wrote us with the following problem:

‘I just got the text from Kinecta here in California This is written: “A request for a transfer of $ 950.44 in Brian White has been approved. If you haven’t allowed, please visit (link here) to cancel now. Is the text of the scam?”

A great question, Jane! Your caution is commendable and yes you need to be concerned. Let’s see this attempt at the scam and see why it raises so many red flags.

Text Kinecta scam (Kurt “Cyberguy” Knutson)

Best Antivirus for Mac, PC, iPhone and Androids – Cyberguy Picks

Jane’s text message demonstrates a few signs of the scam that everyone should know:

Urgency as a weapon: The scammers use our fear of financial losses to operate hasty actions. They use phrases such as, in this case, “act now” or “cancel”, and warn of grave consequences if immediate action is not taken. This urgency is designed to bypass rational thinking and prevent you from checking the legitimacy of the request.

Suspicious links: Legal banks Avoid sending a sensitive link through the text. These links can download viruses to your device or bring you to a fake web -shaped website designed to kidnap your personal information. Always check the URL before entering any sensitive data.

Specific but unfamiliar details: The mention of Brian Bely and the exact number of $ 950.44 is a reasonable tactic. Scammers often use specific details to create the illusion of legitimacy, even if these details are unfamiliar to the recipient. This approach is aimed at instilling doubts and urgency, increasing the chances that the victim will act hastily.

What is artificial intelligence (AI)?

Spending brand: Scammers often use brand output tactics using similar logos, fonts and color schemes to create a legitimacy facade. This deceptive strategy is designed to manipulate you, believing that you interact with the trusted institution, thereby increasing the likelihood of falling their scam.

Unwanted contact: Be careful about the unexpected texts that claim you are from your bank, especially if you have not signed up for text alerts.

Spelling and grammatical errors: Look for errors in spelling, grammar or signs. Legal messages from banks usually write professionals and have no mistakes.

Questions for Personal Information: Scammers often ask you to “confirm” the details such as your account number or password. Legal banks never ask for secret information through the text.

Too good to be valid sentences: Be skeptical of messages that promise great profit or unexpected thunderstorms.

Pressure tactics: Scammers often use a threatening language or impose hard terms to manipulate you quickly without thinking.

The person who receives the text of the scam (Kurt “Cyberguy” Knutson)

How to fight back against hackers debit cards that are after your money

These digital cheatrs have 3 clear goals:

Illustration of the cheat at work (Kurt “Cyberguy” Knutson)

9 cheaters ways can use your phone number to try to cheat you

As the scammers become more complex, it is very important to equip themselves with knowledge and take active steps to protect your personal information. Here are seven important tips to help you stay protected:

1. Never click suspicious links in text messages: In the case of Jane, by clicking on the link, it may lead to a fake Kinecta web -shaped website designed to kidnap the login credentials.

2. There is a strong anti -virus software: This can help detect and block malicious software that can be downloaded when Jane clicked on the fraud. The best way to protect yourself from malicious links that install malicious software is potentially access to your private information is to install antivirus software on all your devices. This protection can also warn you about phishing email letters and frauds of ransom while maintaining your personal information and digital assets. Get my elections for the best winners of the 2025 antivirus protection for Windows, Mac, Android and iOS devices.

Get the Fox Business on the go by clicking here

3. Contact directly to your bank using official channels: Jane must call the Kinecta official number to make sure that there is a real problem with her account rather than answer the text.

4. Report the text to your bank and forward it to 7726 (SPAM): Reporting this text, Jane can help Kinecta and her mobile carrier protect other customers from similar scams.

5. Include two -factor authentication (2FA) In your accounts: This extra safety layer can interfere with the cheaters access the Jane account, even if they have received its password.

6. Use SMS filtering tools provided by your mobile carrier: These tools may have caught and indicated the suspicious text “Kinect” before it reached Jane’s mailbox.

7. Invest in Personal Data Removal Services: This can help reduce the amount of personal information available on the Internet that complicate the scammers to focus on Jane and you with personalized attacks in the future. While the service does not promise to delete all its data from the Internet, having a removal service is great if you want to constantly monitor and automate the process of removing your information from hundreds of sites constantly over a longer period of time. Check my main election for data deletion services here.

Remember that legal financial institutions will never press on you to act immediately or click on the links in the text messages. If you doubt, always contact your bank directly with official channels. Thank you, Jane, for attracted it to our attention. Your vigilance not only protected you, but also helps to educate others. Together, we can stay a step ahead of the scammers and protect our finances.

Click here to get the Fox News app

How do you think the extra steps, as you think should take governments, regulatory authorities such as FCC or cellular vendors to stop rising scam texts and protect consumers from these malicious schemes? Tell us by writing us in Cyberguy.com/contact

For more information on your technological tips and security alerts, sign up for my free newsletter according to Cyberguy, heading for Cyberguy.com/newsletter

Ask the curtain question either tell us what stories you would like us to cover

Keep track of Kurt on his social channels

Answers to the most asked questions Cyberguy:

New from Kurt:

Copyright 2025 Cyberguy.com. All rights are protected.