Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

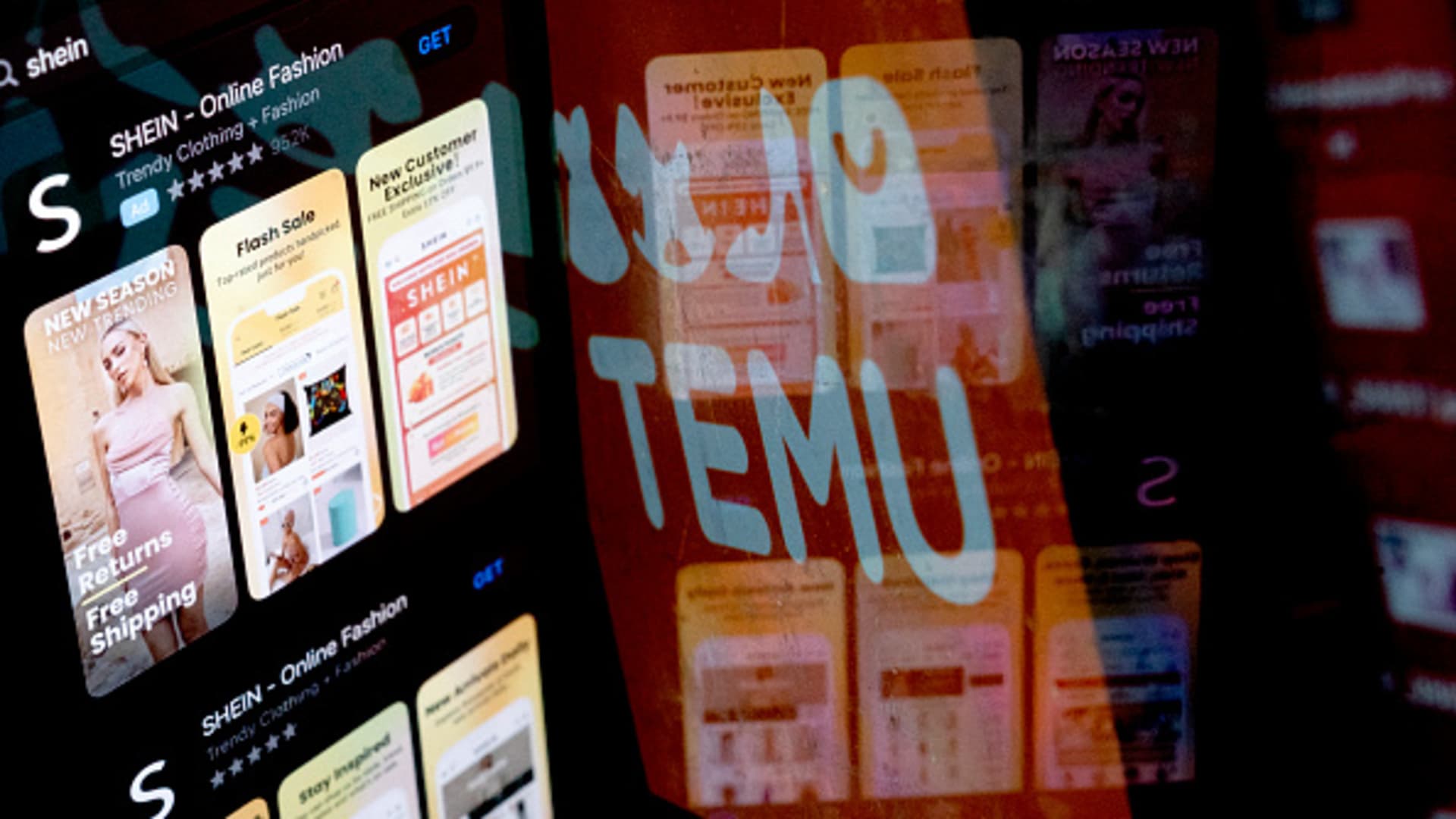

Photo illustration of the Shein app in the app store reflected in the Temu logo.

Stephanie Reynolds | AFP | Gets the image

Closing trading cracks and non -dimensional tariffs in China have recovered the Temu and Shein business model in the US. And yet experts believe that e-commerce companies will probably remain dominant in US internet trading.

On Friday, the de Minimis rule – a policy that released US imports worth $ 800 from trading tariffs – is officially closed for supply from China. This saw the topic and shein who are duty up to 120% Or the only $ 100 fee set up to $ 200 in June.

The exemption of tariffs for small packaging was key for the ability of companies to maintain the budget prices they send from China. Now that it has gone, prices on Temu and Shein consumedwith the former The end of direct shipments From the US completely.

Changes will welcome numerous unbearable de minimis, among which us legislators. Unions and retailerswho claimed that the topic and Shane abused the release of local business and flood the country illegal and counterfeit products.

But despite new trading problems that Theme and the Shane face. Experts on e-commerce and supply chain said CNBC that companies are still able to compete with their competitors in the US

“Don’t consider them … Not at all.

“I personally believe, if anything, the game (electronic commerce in America) accelerates for the benefit of Temu and Shein … I wouldn’t be surprised if the competitiveness gap actually continues to expand,” Vinsvig added, research and advisory firm, works with customers on technology, retail networks.

Loss of liberation from the minimum has long been expected when US President Donald Trump Temporarily closing It’s in February. In preparation theme and Shane accelerated localization strategies for the US

Scott Miller, CEO of the Consulting E -Commerce PDPLUS, said CNBC that Shane and the subject would continue to engage in US sellers on their applications to protect them from tariffs.

“Many of the current Temu and Shein sellers are in China or countries nearby, but not all. Local US companies join these platforms at the acceleration pace … Several of our customers on board or started the process over the past few months,” he said.

While margins for more localized brands and other sellers will not be as high as for sellers based on China on platforms, they can be competitive, he said.

He added that in the case of Temu suppliers attracts a decrease in the board, easier competition and great assistance in the set and setting up sales channels compared to what Amazon offers.

In the last days of Temu owned by the Chinese e -commerce giants PDD Holdings.

According to experts, many of these goods are still derived from China, but then sent on the basis of the United States. Although these volumetric items are subject to tariffs, they also enjoy saving.

This development is likely to see the variety of products on Temu, scalable back, said Henry Jin, Associate Professor of the Chale Deavance Department at Miami University. However, he added, the subject is likely to restore direct deliveries from China, depending on the results of the trade war between the US and China.

Meanwhile, Shane leaned toward expanding supply chains by creating production operations in countries such as Turkey, Mexico and Brazil, and justify Plans go to Vietnam.

It seems that the company is still sent directly from China and most likely has more opportunities to absorb tariffs because of its “high” stocks in the main fashion business, said Jin.

“If there is one thing in which Chinese companies work well, it works on a thin breeze stock in an intense competitive, if not an unfavorable setting … They find every scrap that they can survive,” he added.

In the side of emergency plans, experts agree that Trump’s trade policy is still affecting Temu and Shein prices. Companies for the first time announced that there is Increasing prices In mid -April to combat tariffs.

According to Coresipe, prices for the Shein purchases have increased from 5% to 50% in the second half of April, with the most sharp rise in toys and games and beauty and health.

However, many e-commerce experts remain confident that Temu and Shein will continue to prove the component prices.

Weinswig Coresive said both companies had previously been able to offer products by a third of Amazon prices for comparable goods. So, even if they are more than twice the prices for the uptake of tariffs, many goods may remain cheaper than those on US e -commerce sites and retailers.

Jason Wong, who works in the logistics of products for Temu in Hong Kong, noted this dynamics, talking to CNBC last month, comparing the Temu to the dollar store. If the prices in the dollar store go from $ 1 to $ 2, it’s still the dollar store, he said.

Moreover Trump’s trade tariffs China and other trading partners have also touched on American retailers and e -commerce sites such as Amazon.

When Forever 21 went to bankruptcy defense earlier this year, he accused Shane and the topic of using a minimum, which said he “trim” his business.

But experts say solely by attributing Shein’s success and the subject of this trading breakdown, lacking many other factors that made them break hits in the US

According to Ananda Kumar, Deputy Director for Research in Copeate Research, Temu and Shein owe a lot of success with their very agile supply networks that quickly adapt to consumer trends.

For example, dairy production of Sheini in which products are initially launched in limited quantities, usually about 100-200 items-it emits it effectively and scale products.

Another key is the applications of companies that use different strategies to maintain the interest of users, including frequent phone notifications, algorithms of products recommendations and perhaps most noticeable, constantly showing prices with discounts and flash selling.

On Monday, Temu offered “mega -economy” for US consumers. Some of the bestsellers on sale included $ 1.45 and a $ 11,54 lining is installed. It is unclear whether the local goods were reduced before the tariffs came into force.

In addition, application users are often found with mini-games that provide different coupons or ways to earn awards, as well as the ability to buy “mysterious boxes” with different products.

This “gameification strategy” certainly plays in the consumer psychology of many American buyers who often buy items from excitement from the opportunity to get a great deal, said Jin University Miami.

Experts also indicated that the topic and Shane were very effective marketerincluding through use living and social media.

On the other hand, according to Weinswig, US Coresicess’s American retailers failed to adequately recognize Temu and Shein threats and adjust their supply chains and price models.