Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

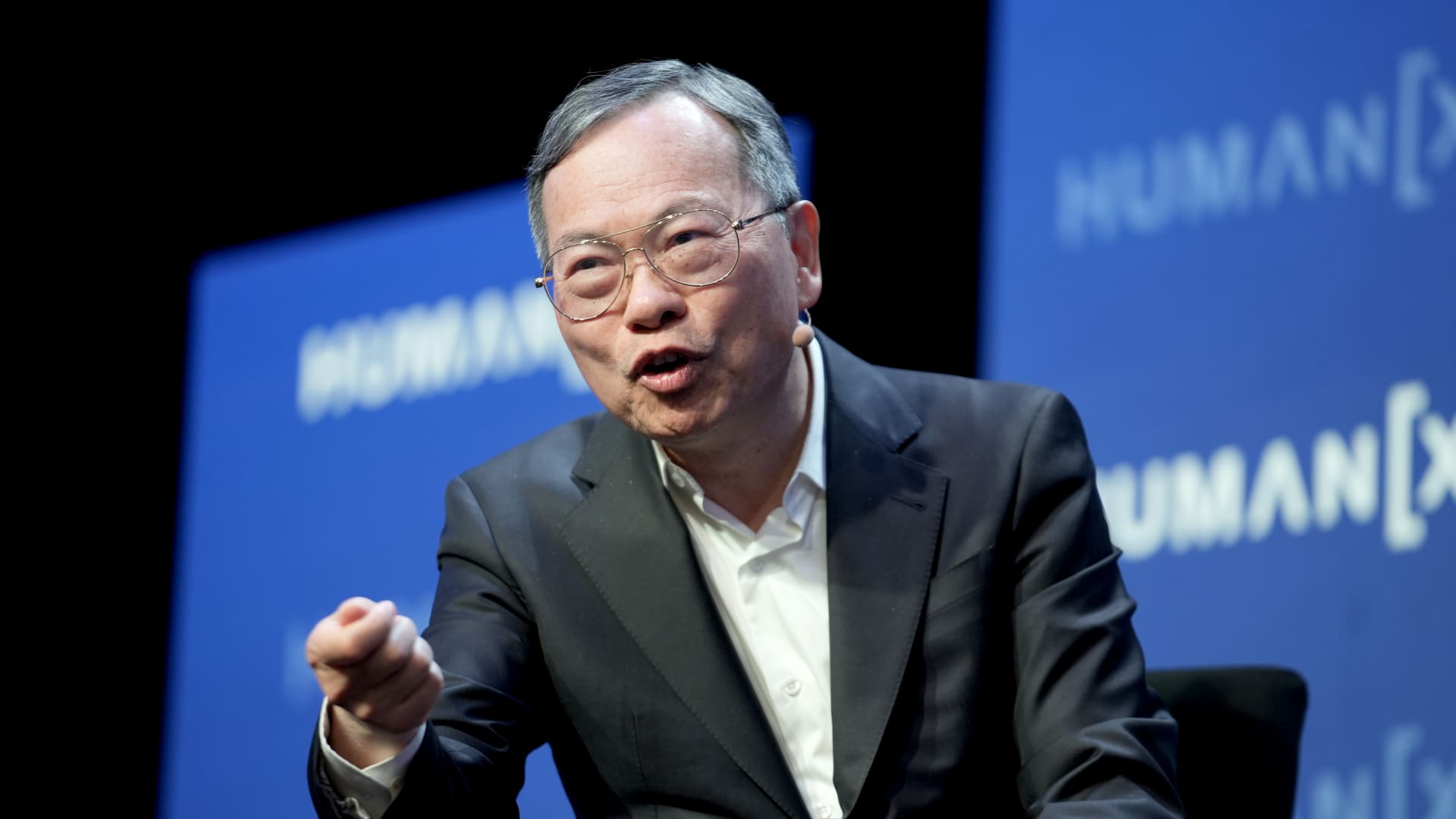

Charles Liang, CEO of Super Micro, speaks at the Humanx AI conference in Las Vegas on March 10, 2025.

Big Media Activities Humanx Conference | Gets the image

Super micro Issued disappointingly control On Tuesday, a week after the server manufacturer presented preliminary results for the last quarter, which was much ashamed of Wall Rate expectations. The stock slid about 4% in expanded trade.

That’s what the company reported compared to the LSEG consensus:

While the latest numbers were below the analytics’ estimates they were in accordance with Early results This super micro opened last week. The company stated at the time that the profit in the financial third quarter will be from $ 4.5 to $ 4.6 billion, and that the stock will fall into the range of 29 cents to 31 cents. The stock fell 12% after this release.

But the Super Micro on Tuesday gave investors their first look at the fourth quarter results, and it is also below expectations. The Super Micro has called for 40 cents to 50 cents with an adjusted income for $ 5.6 billion to $ 6.4 billion. Analysts surveyed by LSEG searched 69 cents with a $ 6.82 billion company revenue.

The macroeconomic environment is likely to weigh the results of the work, the campaign notes after the announcement of President Donald Trump in early April about the broad new tariffs for imported goods.

During the financial third quarter, Super Micro saw that “the client was waiting and evaluating AI platforms between the current bunker and the upcoming GPU Blackwell, which has delayed obligations,” said CEO Charles Liang during a conference with analysts. He said he expected a commitment to come in June and the September quarter.

Liang said the company does not give financial recommendations in 2026 due to tariff uncertainty.

Super Micro’s revenue grew by 19% a year for the quarter, ended on March 31. Net income of 17 cents per share declined from 66 cents in the same quarter a year ago.

Last year it was insidious for Super Micro. Before this action were on the tear from the company’s position on the artificial intelligence market that sold servers filled Nvidia’s Graphic processing of blocks.

During the summer a short seller Hindenburg Research Issued a report On the super -mick, claiming that he found evidence of “accounting manipulation”. In October Ernst and Young fell As an auditor of the company after increasing the internal control over financial reporting and other issues.

Independent A special committee investigated But “did not cause any significant concern about the integrity of the Supreme Management or the Super Micro Audit Commission, or their commitment to make the company’s financial report significantly accurate,” the statement said.

In February Super Micro has fallen Annual report For its 2024 financial year, which ended on June 30, helping to avoid shares on NASDAQ. Exchange staff reported Super Micro that the company has returned in accordance with the requirements of the application, the report said.

As of the final bell on Tuesday, Super Micro scored 9% so far in 2025, while the S&P 500 index decreased by 4%.

This is conducting the news. Please check the updates.