Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

BBC

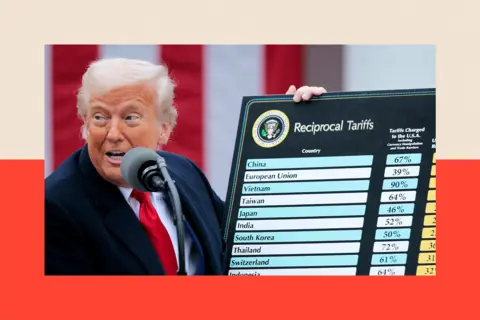

BBCIf you say the name of Donald Trump in the halls of wholesale markets and fairs in China, you will hear weak certificates.

The US president and his 145% fed fears in many Chinese traders.

Instead, they inspired the army of Internet Chinese nationalists to create mocking memes in a number of viral videos and reels of which include president, generated by AI, Vice President JD Vance and Tech Mogul Elon Musk Toing Based on Shoes and Iphone Building.

China does not behave like a nation that faces economic pain, and President Xi Jinping made it clear that Beijing would not back down.

“For over 70 years, China has always relied on independence and hard work for development … It has never relied on anyone’s gifts and is not afraid of any unreasonable suppression,” he said this month.

His confidence can come in part because China is much less dependent than 10 years ago on exports to the US. But the truth is that the Brinkmand Trump and the hiking tariffs press the pressure points that already exist within China’s own economy. With housing crisis, increasing work safety and aging, the Chinese simply do not spend as much as their government would want.

Si came to power in 2012 with a dream of rejuvenated China. This is now a brutal check – and not only by American tariffs. Now the question is whether the tariffs for Trump will weaken the economic dreams, or can it turn the obstacles that exist into the possibilities?

With a population of 1.4 billion, theoretically, in China a huge domestic market. But there is a problem. They are not ready to spend money until the country’s economic forecast is uncertain.

This was not caused by a trade war – but the housing market collapsed. Many Chinese families have invested their life savings into their homes, just watching the prices served over the past five years.

Housing developers continued to build, even when the real estate market was scattered. It is believed that the whole population of China will not fill all the empty apartments across the country.

Former Deputy Head of China Statistics Bureau, Ken, confessed two years ago that the most “extraordinary assessment” is that there are now enough vacant houses for 3 billion people.

Gets the image

Gets the imageTravel round Chinese provinces, and you see that they are littered with empty projects – lines of sublime concrete shells, which were marked with “gift cities”. Others were installed, the gardens were landscaped, the curtains put on windows, and they seem to be filled with the promise of a new home. But just at night, if you don’t see the lights, you can say that the apartments are empty. Just not enough buyers to match such a level of construction.

The government acted five years ago to limit the amount of money that could borrow. But the damage to housing and, in turn, consumer confidence in China, and analysts predicted a 2.5%decline in housing prices, Reuters reports in February.

And these are not just housing prices that are worried about Chinese middle -class families.

They are concerned or the government can offer them a retirement – Over the next decade, about 300 million people who are currently 50 to 60, leave Chinese labor. According to the State Chinese Academy of Social Sciences for 2019, the State Pension Fund may end by 2035.

There are also fears about whether their sons, daughters and grandchildren Can get a job Because millions of college graduates are struggling to find a job. According to official data published in August 2023, more than one in five people between the ages of 16 and 24 are out of work.

EPA – EFE/REX/ShUTTERSTOCK

EPA – EFE/REX/ShUTTERSTOCKThe problem is that China can’t just switch the switch and move from the sale of goods to the US to sell their local buyers.

“Given the pressure of the decline in the economy, it is unlikely that internal costs can be significantly expanded in the short term,” says Professor Nie Huihua of the University of Remmin.

“Export replacement with domestic demand will take time.”

According to Professor Zhao Mingao, Deputy Director of the Fudan University Center, “China has no great expectations for talks with the Trump administration … The real battlefield is in adjusting China’s domestic policy, such as raising domestic demand.”

In order to revive the slowdown economy, the government has announced billions of childcare subsidies, increased salaries and a more paid vacation. It also introduced a $ 41 billion program that offers discounts on items such as consumer electronics and electric cars (EVS) to encourage more people to spend. But Professor Zhang Jun, the Dean of Economics at the University of Fudan, believes it is not “steady”.

“We need a long-term mechanism,” he says. “We need to start an increase in residents’ income.”

This is urgent for XI. The dream of the prosperity he sold when he took power 13 years ago became a reality.

XI also knows that in China, a bewildered younger generation is worried about its future. This can write a great deal of trouble for the Communist Party: protests or excitement.

China Dessent Monitor’s “China House” claims that the protests caused by financial complaints have been steeply in the last few months.

All protests quickly obey and censor in social media, so they are unlikely to pose a real threat to the XI.

“Only when the country is doing well, and the nation can do well,” SI said in 2012.

This promise was made when China’s economic rise looked no stopped. Now it looks uncertain.

Gets the image

Gets the imageWhere the country has made great success over the last decade, areas such as household electronics, batteries, EVS and artificial intelligence in the turn of the best production.

He gathered for dominance in technology with Chatbot Deepseek and Byd, which won Tesla last year to become the world’s largest EV manufacturer.

However, Trump’s tariffs threaten to throw a wrench in the work.

For example, restrictions on the sale of key chips in China, including the last step that enhances exports from the American giant Nvidia, aimed at restraint of XI ambitions before technology update.

Despite this, XI knows that Chinese manufacturers have the advantage of decades, so American manufacturers have been fighting to find the same infrastructure and qualified work elsewhere.

XI president also tries to use this crisis as a catalyst for further changes and find more new markets for China.

“In the short term, some Chinese exporters will be badly affected,” says Professor Zhang. “But Chinese companies will bring the export schedule initiative to overcome difficulties. Exporters are waiting and looking for new customers.”

Donald Trump’s first term became a cane to look for buyers elsewhere. This has expanded the connection on Southeast Asia, Latin America and Africa, also the initiatives on trade and road and infrastructure that raised ties with the so-called global south.

China is reaping from this diversification. More than 145 countries have more trade with China than the US, the Low Institute reports.

In 2001, only 30 countries elected Beijing as a leading trading partner over Washington.

Because Trump aims at a friend and the enemy, some believe that XI may further raise the world world order in the US and reflect its country as a stable, alternative world trading partner and leader.

The Chinese leader chose South -Eastern Asia for his first trip abroad after the tariff announcement, feeling that his neighbors would get shivers for Trump’s tariffs.

About a quarter of Chinese exports are now being made or sent through the second country, including Vietnam and Cambodia.

Recent actions in the US can also present the chance of XI positively to form China’s role in the world.

“Trump’s tariff policy is an opportunity for Chinese diplomacy,” says Professor Zhang.

Gets the image

Gets the imageChina will have to step carefully. Some countries will be nervous that the products produced for the United States may flood their markets.

Trump’s tariffs in 2016 sent a redemption of cheap Chinese imports originally designed for the US, in Southeast Asia, harms to many local manufacturers.

According to Professor Huikhua, “about 20% of China’s exports go to the United States – if this exports are hidden by any regional market or the country, it can lead to dumping and angry competition, which causes new trades.”

Gets the image

Gets the imageThere are barriers for the XI, representing themselves to the arbitrator in the world.

In recent years, China has undergone other countries in trade restrictions.

In 2020, after the Australian government called for an investigation into the origin and early treatment of the COVID pandemic, which, according to Beijing, was a political maneuver against them, China posted tariffs for Australian wine and barley, as well as imposed measures for biological safety A lover. Some Australian exports of certain goods to China have fallen to almost zero.

Australian Defense Minister Richard Mars said earlier this month that his nation would not “hold China’s hand” when Washington grew its trading war with Beijing.

China’s past actions can interfere with the current global information work, and many countries may not want to choose between Beijing and Washington.

Gets the image

Gets the imageEven with all the different difficulties XI is betting that Beijing will be able to withstand any economic pain longer than Washington In this great competition of power.

And it seems that Trump blinked first, hinted at the potential turnout last week, saying that the taxes he still imposed on Chinese imports “will decline significantly, but it will not be zero.”

Meanwhile, Chinese social media acts again.

“Trump came out,” was one of the main tendency on the Chinese social media platform Weibo after the US president softened his approach to tariffs.

Even when and when negotiations happen, China is playing a longer game.

The last trade war made it diversify its export market from the US to other markets – especially in the south of the global.

This trading war makes China looking in the mirror to see its shortcomings – and whether it can fix them will depend on the policy made in Beijing rather than Washington.

Best picture: Getty Images

BBC Indepth is home to the site and application for better analysis, with fresh prospects that dispute assumptions and a deep report on the biggest issues of the day. And we demonstrate the contents that cause reasoning, from different BBC sounds, and iPlayer too. You can send us your reviews in the Indepth section by clicking the button below.