Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

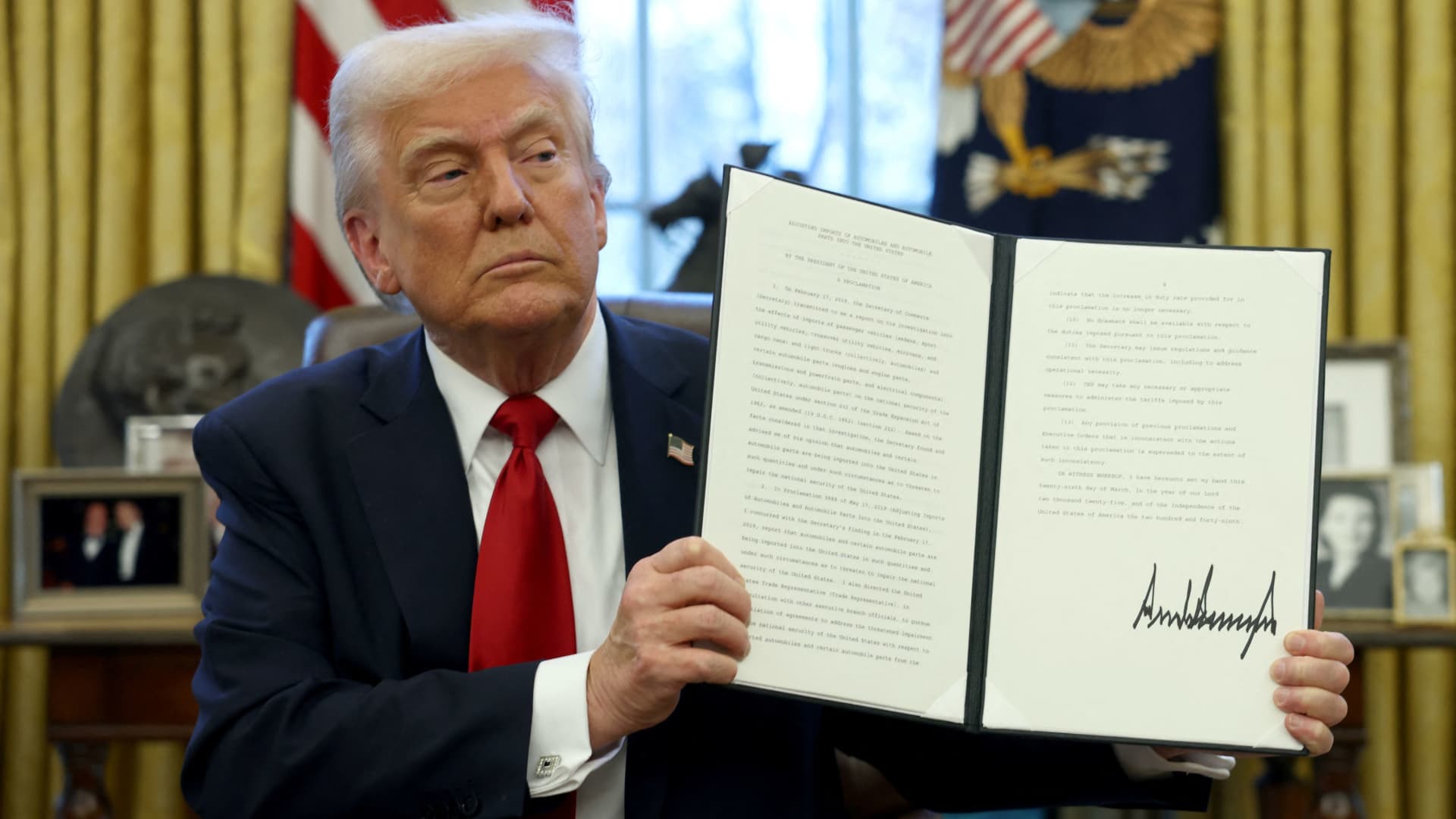

US President Donald Trump shows a signed document at the White House in Washington, Colombia District, March 26, 2025.

Evelyn Hokstein | Reuters

Another day, another tariff development from the Trump administration.

In its last step in the World Trade War, US President Donald Trump has announced a 25% tariff for “all cars that are not made in the US”, knocking on car stocks. This would be in addition to any existing duties.

The announcement goes ahead of Trump’s “Liberation Day” on April 2 that was Originally provided On the day that the US will clap mutual tariffs and impose duties in response to other detrimental trade politicians, such as the use of taxes.

But Trump and his officials have recently suggested that the release tariffs “Liberation Day” could become softer than expected.

Although this can reassure investors ‘shocks, it can really increase uncertainty, thanks to the nature of these ads “again, again,” leaving business executives unable to plan the future and undermine investors’ trust in US policy stability.

Paraphrase War seems simpleBut even the simplest things are difficult.

– Lim Hui Jie

25% tariffs on all cars that are not made in the US “…

US president Donald Trump Wednesday said He would have imposed 25% tariffs On “all cars that are not made in the US and added that” absolutely no tariffs “for cars built in the USA. The White House Assistant Will Sharf said that the new tariffs are spreading” cars made by foreign and light trucks. ”

… but April tariffs can be more “soft”

In another development tariffs Trump said the tariffs would probably be more “soft than mutual”, As the tariff period on April 2 emerges on a number of levies to take effect. Later the White House specified what it means the administration would no longer consider non -tariff barriers that countries raise against the United States, the value added tax for determining the mutual tariff rate.

Asian carmakers slide

Shares of Asia’s automakers Fell after US President Donald Trump announced that he would introduce tariffs to the country. Japanese automakers toyota and Honda decreased by 2.04% and 2.48% respectively. Nissan, There are three plants in Mexico, decreased by 1.68%, and Motor Mazda lost 6%. Mitsubishi Motor fell by 3.2%. Kia Motors South Korea, which also has Production Plant in MexicoShipped 3.45%.

Chinese Consumer Company Signal Costs Again Gathered

Recent reports on the income of Chinese companies Specify the improvement of consumer expenses, although it does not necessarily return to the level of the pandemic. Giants of e -commerce Alibaba and Jd.com In the last few weeks, both have stated that over the last three months of 2024, their retail business has been more rapid revenue growth a year than in 2023.

Industrial profits in China glide like deflation pressure, tariff risks increase

Industrial profit in China slipped into the opening of the months of the year Official data showed on ThursdayAs enterprises focus on sustainable deflation and growth of world trade tensions. Profit in large industrial firms decreased by 0.3% in the first two months of this year, after three consecutive years a sharp decrease with the support of improvement in production and raw materials.

Tariffs continue to put pressure on stocks

All three major US stock indexes Abandoned Wednesday led by Tech. Technological heavy Nasdaq Composite After 2,04%, with names such as meta, Amazon and alphabet, which are 2%-5%. Chip -gian Nvidia It decreased by almost 6%. A S&P 500 lost 1.12%and Dow Jones Industrial Medium decreased by 132.71 points, or 0.31%. In Asia, The markets were ambiguousThe Caspi from South Korea lost more than 1%.

(Pro) Gold that saw that by 2027 reached $ 3,500 per ounce

Gold can reach $ 3,500 per ounce Over the next two years, the central banks and the Chinese insurance industry are driven by the Bank of America. Yellow metal This year scored more than 15% For the first time, it will break $ 3,000 for an ounce, as Trump’s geopolitical tensions and trade war are pushing some investors into the assets of a safe shelter.

China focuses on large language models (LLMS) in artificial intelligence.

Blackdovfx | Istock | Gets the image

Boom of artificial intelligence of China can help mitigate some tariff pain

With the adhesion of AI in China, analysts expect the Chinese business to be more likely to vent any tariff ups from the US as AI tools can reduce the costs for companies and offset part of economic slowing.

Almost every day in the last two weeks, the Chinese firm has announced a new AI product – or how they earn money with technology that has raised expectations for Chinese corporate income next year.