Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

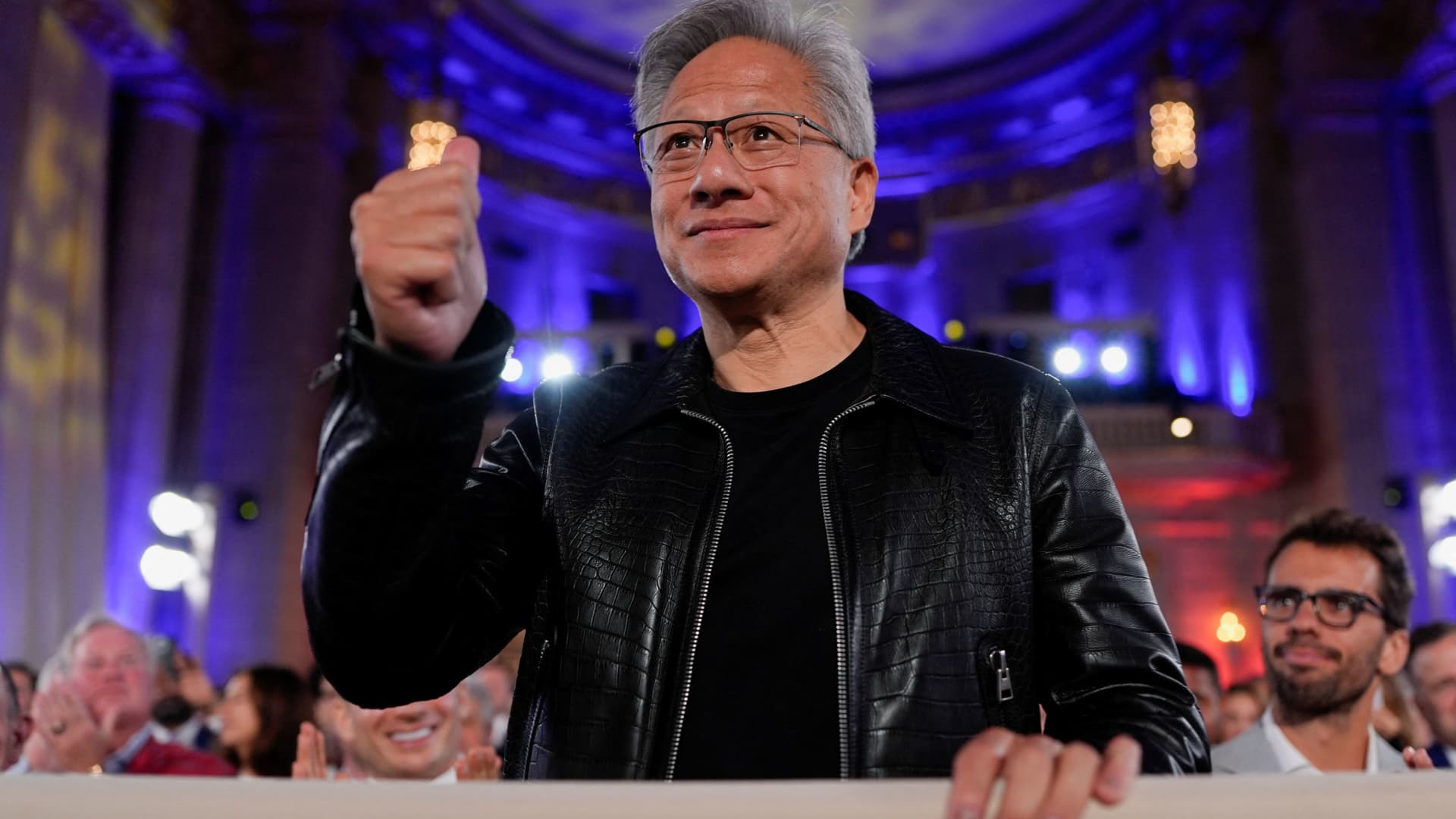

Nvidia Jensen Huang CEO at Victory in the race in Washington, USA, July 23, 2025.

Kent Nishimura | Reuters

Nvidia It is reported higher than expected, income and profit on Wednesday, and said sales growth in this quarter will remain above 50%, which signals Wall Street, that the demand for artificial intelligence infrastructure does not show signs of disappearance.

This year, shares that grew by 35% after almost triple in 2024, in the second period of direct trades, as the income from the data centers did not correspond to the assessment.

Here’s how the company did, compared to the estimates of analysts interviewed by LSEG:

Nvidia – Note He believes the profit in this quarter will be $ 54 billion, as well as minus 2%, although this number does not suggest any supplies to China. According to LSEG, analysts expected a profit of $ 53.1 billion.

The results of the second quarter of the 2026 company confirmed that the business center of NVIDIA data processing remains secured in the AI World Construction. Nvidia Colette Kress Finance Head told analysts at a salary that the company expects from $ 3 to $ 4 through AI infrastructure costs by the end of the decade.

The company’s total profit rose by 56% in the quarter from $ 30.04 billion a year ago, Nvidia said. Revenue per year exceeded 50% for nine direct quarters dating from mid -2013, when the AI generative boom began to appear in the results of Nvidia. However, the second quarter noted the slowest period of Nvidia growth during this stretch mark.

During the quarter after meeting CEO Jensen Juan from President Donald TrumpNvidia reported that the United States is expected to receive the HP20 chip to China. CPU that was the order built for sale to China, cost Nvidia 4.5 billion to Writedowns and could add $ 8 billion in the second quarter if it were available in a commercial plan during this period, the company reported earlier.

Nvidia said they did not sell H20 chips for the quarter, the BU took advantage of the $ 180 million inventory in the amount of $ 180 million outside China. KRESS said Nvidia could deliver from $ 2 to $ 5 billion in the H20s during the quarter if the geopolitical environment would allow.

Net income increased by 59% to $ 26.42 billion, or $ 1.05 per share, with $ 16.6 billion, or $ 67 per share.

Nvidia growth is due to its data centers focused on graphic processors, or graphic processors, as well as free products to connect and use them in large quantities. Revenue in the division increased by 56% from the period to $ 41.1 billion, which lacked the street estimates of $ 41.34 billion per quarter.

Kress said in a statement that Nvidia’s 33.8 billion dollar data centers were “Compute” or Nvidia GPU, which fell by 1% from the first quarter from $ 4.0 billion less H20 sales. KRESS said $ 7.3 billion of data sales centers were from the network parts needed to create more sophisticated NVIDIA systems, which was almost twice as much as the number of the year.

The company said large suppliers of cloud companies are about half of the Nvidia data center, the company reports. Currently, these customers buy Blackwell chips, the last generation of the company.

Nvidia said Blackwell sales rose 17% compared to the first quarter. In May, Nvidia said its new product line reached $ 27 billion, which is about 70% of the data centers.

The Nvidia’s income report comes a few weeks after the company’s largest customers, including Meta. Alphabet. Microsoft and AmazonThe results are announced. All four companies conduct tens of billions of dollars per quarter of the construction of infrastructure if they race To develop AI models and services used by consumers and businesses.

The Nvidia Gambling Department reported $ 4.3 billion, which is 49% compared to the period of the year. The department was the largest to Nvidia before sales of AI BOOM data centers. During the Nvidia quarter, its graphic processors are designed for games to start some Openai models on personal computers.

The robotics department of the company that the management has nominated as the possibility of growthA small part of the Nvidia business remains, with $ 586 million per quarter, which is 69% annually.

Nvidia said his council approved an additional $ 60 billion of stock ransom, without shelf life. During the Nvidia quarter, he purchased $ 9.7 billion.