Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

A voyage look of flat salt la Islands, located 3,950 meters above sea level near the Argentina border in the Atacama region, Chile, taken on May 16, 2024.

Rodrigo Orango | AFP | Gets the image

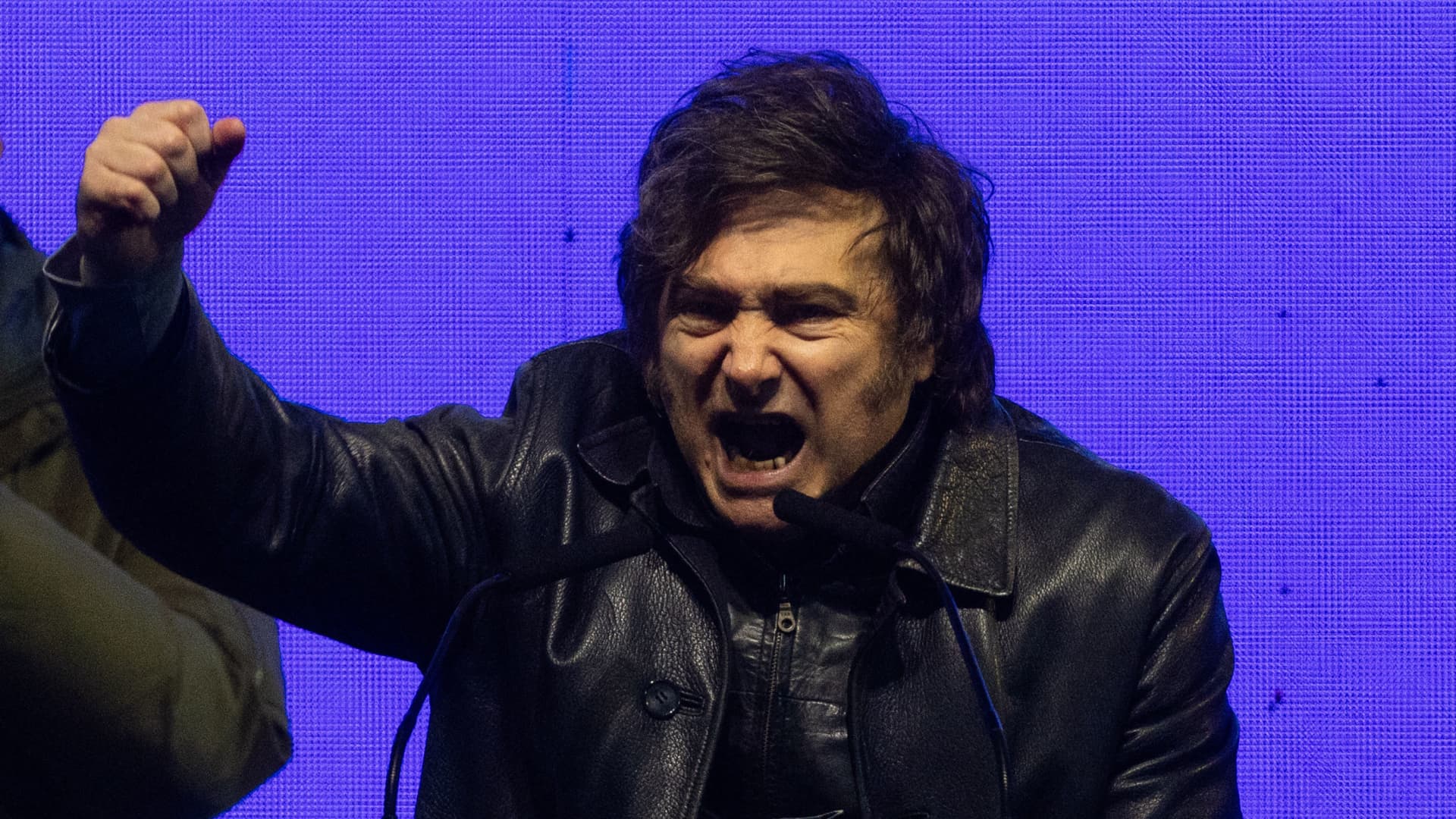

Argentina President Javier Miley struggles to unlock the copper potential of the South American country, trying to use Increasing global demand Among the impetus for electrification and renewable energy sources.

Mohler, self -attributed anarch of capitalist who won the shock election In 2023 presented a series Hard Reformer measures Seeking to stabilize the traditionally flying economy and “Make Argentina again big“

As part of this, the Milo administration hopes that the mining sector can play a key role, especially in copper and lithium.

One of the flagship policy of the Libertarian president was the introduction of a large regime of investment stimulating, or Rigi, a scheme designed to provide generous taxes, trade and foreign exchange payments to large investors for the 30-year period.

To date, 20 projects worth a little over $ 30 billion are looking for entry into Argentina’s Rigi, reports Global Risk Intelligence Verisk Maplecroft, three quarters of which are in mining. Copper estimates that copper is $ 16 billion, more than all sectors that have no proposals.

Main players, including BHP. Glencore and Red river They are one of those who make bold bids on copper and lithium, Argentina, and recently Glencore and Rio Tinto executives go to meet with Miles on a trip to Buenos -Aires.

Javier Miley, President of Argentina, shakes his hand with Jacob Stausholm, CEO of Rio Tinto Group, on the New York Stock Exchange during the morning trading on September 23, 2024 in New York.

Michael M. Santiago | Getty Images | Gets the image

Ro Dhawan, CEO of the International Mining and Metals Council (ICMM), a trading body representing approximately a third of the world industry, called Argentina, “perhaps the most interesting new copper today.”

There are other countries and jurisdictions that may be more geologically rich, Dhavan said, but not the one sitting on the intersection of a stable internal political environment, as well as providing the main infrastructure and objects and sufficient other investments that complement the mining industry.

Among the most notable copper projects in Argentina are BHP and Lundin Vicuna joint venture.

Located along the border of Chile-Argentina, the Vikun district is regarded as a geologically promising region. Indeed, deposits in Mines Josemaria and Filo Del Sol Vicuna According to estimates To contain 13 million metric tons of measured copper and 25 million tons of bred copper.

The policy sequence and social license will determine whether it is an Argentine moment or other mirage.

Mariana Mac

Chief Analyst Americas in Verisk Maplecroft

For Dhawan ICMM, the potential BHP and the Vicuna Lundin copper project is extraordinary.

“Copper has the same thing as Western Australia is an iron ore – and I’m not saying it is slightly. It’s a bold comparison, but I really believe,” Dhawan said.

BHP and Lundin’s Vicuna Copper Press School said last month that both companies intend to apply for Rigi’s benefits, Reports Reuters.

Updated Focus for Argentina Mining comes when expected sharply exceeds supplies Among the boom of artificial intelligence and shift from fossil fuel.

Analysts in Consultancy Cru Group have According to estimates that the pipeline potential copper projects of Argentina can represent about $ 47 billion for the economy by 2040.

This aggregate impact is comparable to a record loan for $ 44 billion received From the International Monetary Fund.

The Government’s press -secretary did not immediately respond to a request for a comment on CNBC.

Asked or Argentina A Long History of Economic Cycles and Construction Meaning that Argentina’s copper dreams can collapse again, Dhawan ICMM said, “Where is this risk, this is a question I would ask?”

He added: “I just think that people have adapted to a new normal expectation of rather significant volatility, and it almost worked in favor of Argentina. I think two things happened, I think the stability of Argentina has increased and the stability of the world has decreased.”

Dhawan said it was impossible to predict which side Argentina will go, but investors seem to be prepared for various political and economic scenarios, and this was evaluated sovereign risk.

Mariana Machada, the chief analyst of America in Verisk Maplecroft, said that while Argentina owns the minerals necessary to rearrange his export database, “politics and social license will determine whether it will be Argentina or other mirage.”

“The country’s political differences supported the investment below the potential levels, and the government’s inability to persuade the legislators in the opposition Union of the Motherland (up) to vote for Rigi, means there is a risk that less private sectors will challenge their provisions if they make a refund,” Macada CNBC said.

Salt Salinas Grandes’ salt production operations in the northwest of Argentina.

VW Photo Universal Image Group Gets the image

“The new prey boom can also take a picture of anti-mining activity,” he added. “Problems around water, glacier protection and wider human rights emphasize constant problems for companies to provide a solid social license for operation.”