Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

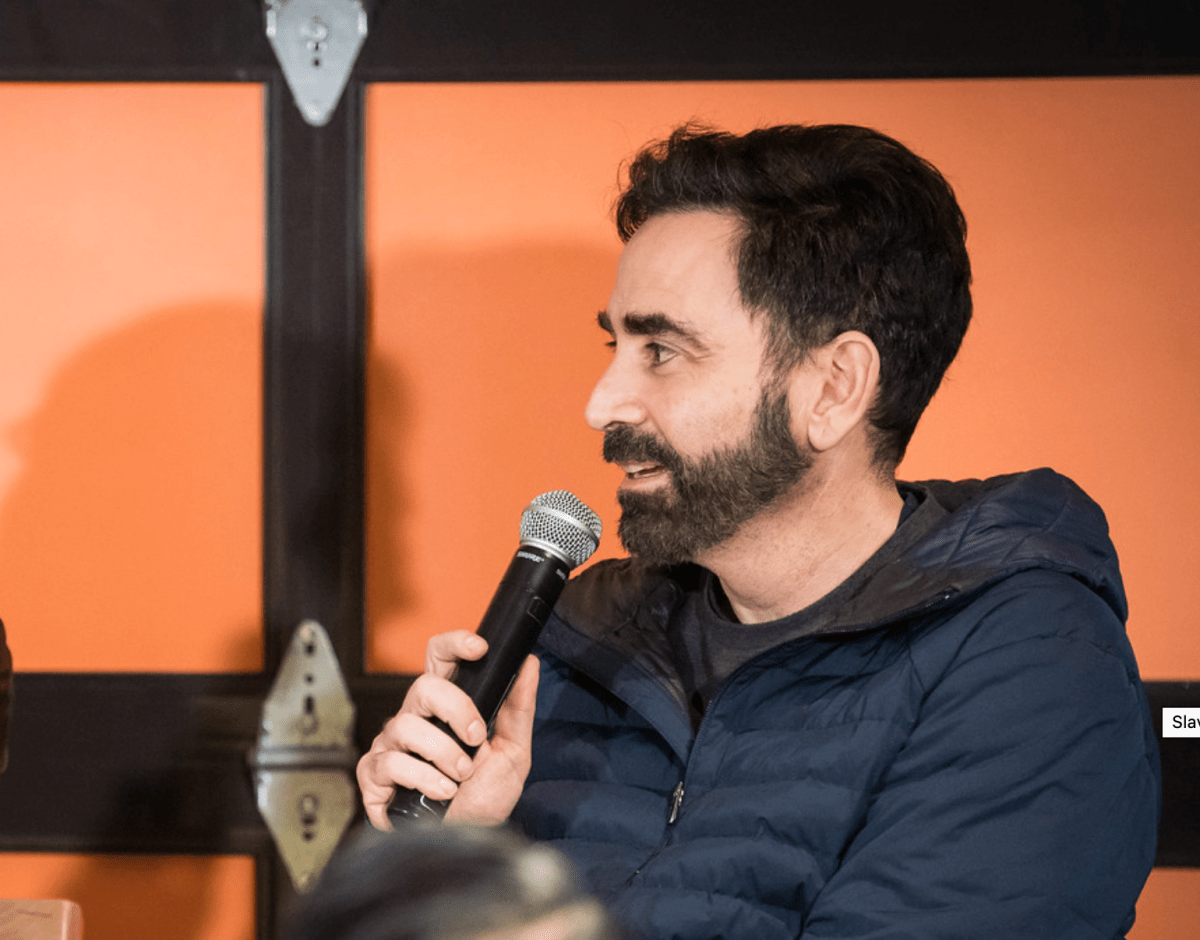

Eread gil started the bet on ai before most of the world took. To the investors of time starting to understand chatgpt, Gil implications had already written stage seeds checks like Perplexed, Cartarous.aiand it Harvey. I am Now, the first waves of waves you were giving up, the renumbing “only” is always more shooting on a fresh-opportunity and roll-up-UPS scale.

The idea is to identify the opportunity to buy the firms, people, help others impressive, help us through the AI, then use the other firms, and repair the process. Been to him for three years.

“It just seems so obvious,” he said gil over a zoom call before this week. “This kind of generative you are very good to find out the language, manipulable of the text, manipulation, is video, which include retail retails.”

If you can “turn it effectively some of these regrets in software”, “you can raise the margins dramatically and create a different types of business.” Math is particularly required if one own the business directly, added.

“If you have the asset, you can (processing) much faster than if you only sell software as a seller:” Gil said. “And why take the gross margin of a company from a company of, say, 10%, which is a huge mistake to the enterprises, and you have to make roll in ways that others may not”.

Until away, Gil supported two companies pursue this strategy. According to the information, one is a company of an aging Enam Co.Fire on the procedure to work, which has been assessed to more than $ 300 million from their backers, including the bottom of Horowitz and Andreessen Horowit Stage.

Although the Gil says I can’t argue of private bids specifics, suggest the approach represents something new. “Answhere you arc trees-enamed 10 years ago, more than them and exploit is that amount of technology”, says. “It was a LETGA as a pittained vernex thin to increase the company’s evaluation. I think in the case of ai, you can really change the cost structure.”

Either the approach trial as a lucrative as some of their other pets remains. The Gil famous a boring oyster of great marks having ebils, including Abasie, Trasses are achieved the assessment $ 915 billion before this year, when their previous backrs have purchased more of their actions.

Part of the challenge with the roll-ups lies the squad of the right-handed squads in a strong loved with someone who is “strong in pieces” said

Gil, having a deep relationship with the business in Silicon Valley, can also find competing with them more aggressively in roll-up as more clothes As khosla ventures Weight yes, or not, they should also be pursuing such offers.

A sense that, be, be, gil is not in this for the money to this point if ever it was. It says his or her spot capacity before most comes instead of the heart. “I love herer, and I like progress, and love only with people working on important but also technology”.

When the vp-3 has breakfast, eg, gil was already toward their mediacessor, he said. “When the Vptia is going out, it’s been like a kitten jump from the technology rapid. Is that resale” – all evident lists – ‘then it’s going to be transformed. “”

What Hands continues today with the small team Gil has assimble, including different engineers. A person we look at, and we will go up the strumy, and he looked at and a hand in the hands. ‘

It is because of that constant store that, after the years of uncertainty in the market AI, GIL See the emergent charters. “I had told me, even six months ago, that I know, because the markets were so dynamic; and techniques were so dynamic,” he had told you. “And I feel in the last few months of months – Perhaps the last two quarters – a market subset really crystallized.”

Legal: “We know who you are the one or two main winners should be. Here’s to successful success, they think their own companies, who mentioned our conversation.

Between these bets is Harvey, who develop the great language models and the legal teams and is reported in talking to lifting the new funding to a $ 5 billion assessment; Abridge, a company ahie Healthcare who is on purpose of improving the “doctors’s clinical job documentation (and that $ 250 million series d round was co-driven by Gil again in February); And Sierra ai, topuction of famil the Overroader Brat, which helps the firms that impose customer’s agents. (The company has been assessed in billions of dollars right out of the door.)

However, Gil is careful not to declare the game. “I don’t want to paint the picture that the game is over or that things are very tender a lot or even the probable winners.”

Meanwhile, it’s clear in conversation that this moment represents more than another investment cycle to him. “I just think it’s a really funny period of time, for so much change happened, and so is only one ton of doing,” he said.

Be at the intersection of two processing – not only bets on the future, but in the future of future futs-it is “very exciting”

We’ll have more than our conversation with Gil – that even touching, and as companies may further integrate that you will do or break up or break your episode of Strictlyvc download the podcastwho goes out on tuesday.