Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Groww, India’s largest stockbroker, is positioning itself to file for an IPO in 10-12 months and is seeking a valuation between $6 billion and $8 billion, sources familiar with the matter told TechCrunch, in what would be a reference list for the country. fintech sector.

The Bengaluru-headquartered listing would be the first IPO by a digital-era trading platform in India. The target assessment, which sources warn could change, is more than double the value of $3 billion from its last round of funding in October 2021.

Groww, which counts Peak XV, Tiger Global and Alkeon among its backers, has started talks with investment banks and will soon choose advisers for the IPO, the sources said. The startup, which also allows customers to invest in mutual funds and make UPI transactions, he shifted his domicile to India from the US last year as part of its IPO preparation.

The startup declined to comment.

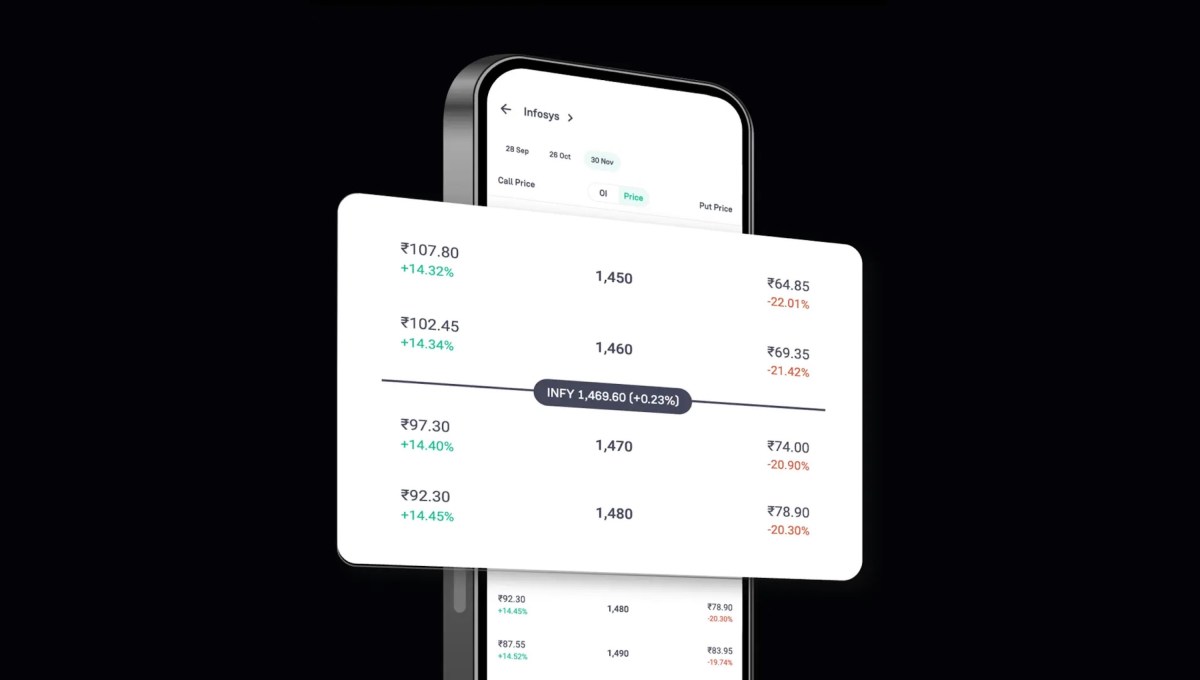

The business apps operator has edged ahead of competitors in India’s crowded retail investment market. It had 13.2 million active users in December, compared with 8.1 million for nearest rival Zerodha, according to data from the National Stock Exchange. Groww adds between 325,000 to 550,000 new users monthly, more than twice the rate of competitors.

India has emerging as a bright spot for technology listings around the worldwith seven technology startups having published in 2024 as part of 13 total startup lists. The $1.35 billion listing of food delivery platform Swiggy was the largest global technology IPO last year.

More than 20 Indian startups are planning IPOs in 2025, including business-to-business marketplace Zetwerk, managed workspace provider Table Space, Prosus’ PayU and pharma platform PharmEasy, TechCrunch previously reported.

JPMorgan’s India head of capital markets told TechCrunch in a recent interview that domestic capital growth in India and policy continuity were among the factors behind the rise in IPOs in the country.

India’s market capitalization has doubled to $5.3 trillion since 2019, while daily trading volume has tripled to $15 billion.

“No other country in the world provides you with this political certainty and policy continuity,” JPMorgan’s Abhinav Bharti told TechCrunch. “You can argue against a political decision, but you can’t argue against the fact that they have been consistent.”