Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

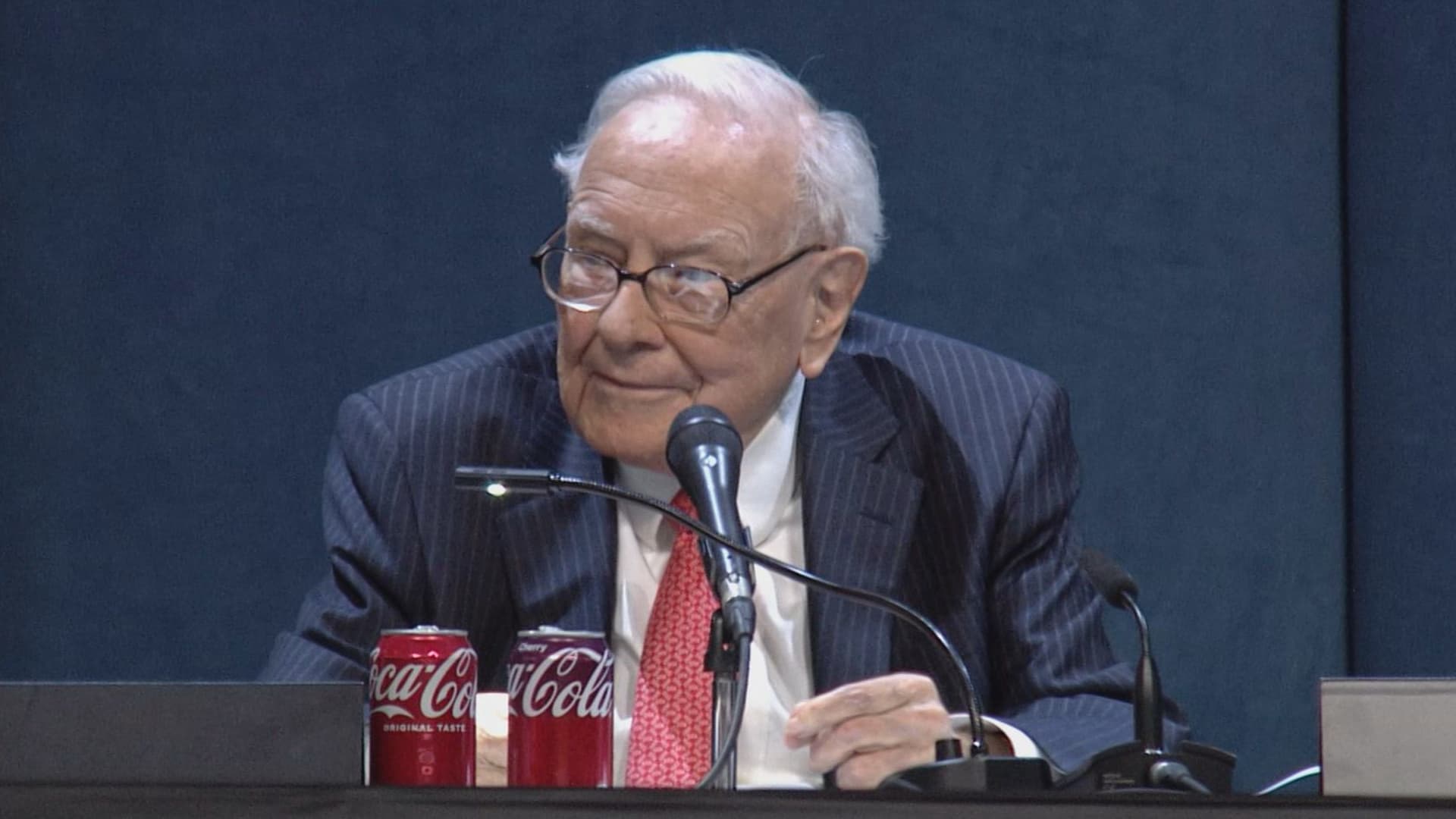

Warren Buffett on Saturday rejected the recent stock market volatility, which has been knocking on investors over the past few weeks.

“What happened in the last 30, 45 days … Actually nothing,” Berkshire Hethai The CEO said during an annual conglomerate meeting.

Buffett noted that in the last six decades it has been three times when Berkshire Hethai’s shares decreased by 50%. He noted that during these periods there was no major problem with the company.

Given this, he said the last US stock market does not have to characterize as a “huge” step.

“It was not a dramatic bear and what is like that,” Buffett said.

S&P 500, ytd

These comments from “Oracle of Omaha” when investors are wondering what the markets were further after the wild trade gaps saw against the backdrop of the controversial tariff policy of President Donald Trump.

A S&P 500 Friday got it The longest victorious series Since 2004, when the Wall Street claw is rejecting losses in the original sale after Trump’s initial policy. This means a stunning rebound for US stocks after the indicators at one moment introduced bear market On an internal basis last month, the term used to describe the fall of more than 20% of the recent maximum before returning the soil.

Buffett said other periods were “sharply different” than the current investors. He reminded investors that the market had risen to the age of 94, warning that they should be ready for the steps of problematic actions.

Berkshire, long -term

He shared this Dow Jones Industrial Medium He sat in 240 on his birthday on August 30, 1930 and fell for 41 years. Despite the events of “moving the hair” he survived, on average, on Friday, above 41,300.

“If you change the situation for you, or decrease your stock by 15% or not, you need to get a slightly different investment philosophy,” Buffett said. “The world will not adapt to you. You will need to adapt to the world.”

“People have emotions,” he added. “But you have to check them in the door when stacked.”