Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

NewNow you can listen to Fox News articles!

President Donald Trump Sign a wide package of domestic policy with the Republican Republicans, which it calls “one big beautiful bill” on Friday at the White House.

Massive Tax reduction and cost cost This week, the house and the Senate on thin razors were passed through almost party lines.

But the political battle for the bill is far from over when it crosses the Capitol hill to the campaign trail.

“I am deeply concerned about this bill and what it will do. We will talk a lot,” said Democratic Representative Chris Pope from New Yampshire on Friday.

Game on: Republicans, Democrats, Trade Fire over a large, beautiful bill

A great beautiful text of the bill, which is approximately 940 pages, delivered to the US Senate to read Cherks, Saturday, June 28, 2025, on the Capitol Hill in Washington DC (Dan Scully/Fox News)

Poppas, which works in the decisive race of 2026 to succeed the old senators Zhanna Shakhin, so that the Republicans, preserved by the Democrat, would like to turn over, aim at the bill.

“These were one-party efforts, and unfortunately he came to the conclusion that I think it is not good for our country and for our country,”-

Trump Touts “Big Big Bill” “Very Popular” despite the poll

Former Senator -Republican Scott Brown, who last month announced his candidacy to the Senate, sees everything in another, and he praised the president for helping GOP executives in Congress to get an account to his White House table.

“What he said he would do he actually finished. To make someone in politics, what I think is very rare,” Brown said about Trump.

The bill is filled with the promises of Trump in 2024 and priorities on tax reduction, immigration, protection, energy and debt limit.

It includes an extension of tax reduction for 2017 and eliminating tips and overtime.

By making your first term Tax rates Permanent – they had to end at the end of this year – the bill would reduce taxes by almost 4.4 trillion. Dollars for the next decade, according to the analysis of the Congress budget and the Committee on the responsible federal budget.

‘Big beautiful bill on the way to the White House after narrow final obstacles in Congress

The measure also provides billions of border security safety and codifies the contradictory presidential repression.

And the bill also restructures the Medicaid-amal 60-year federal program, which provides healthcare about 71 million low-income Americans. In addition, the Senate Republicans increased the Medicaid reduction over the fact that the House was initially passed in late May.

Changes in PhysicianAs well as the reduction of food marks, another major security programs in the country, were partly drafted as a compensation for paying Trump’s tax decline. The measure includes a number of new rules and rules, including work requirements for many who seek to cover Medicaid.

And the legislative package of 3.4 trillion. Dollars are supposed to increase government debt by $ 4 trillion in the next decade.

Democrats have exploded for several months over the social security network.

“We will talk about this bill because the results are that 46,000 people in New -Hampshire lose health insurance. We will have people who will be hungry who will not be able to access help, “the Pope warned.

Annual Naturalization Ceremony of Independence Day new US citizens in PortSmute, New Hampshire, July 4, 2025 (Paul Steinhauser – Fox News)

The four-year congressman, which was questioned by Fox News on Friday, when he arrived at the annual naturalization ceremony in Partsmute, New Hampshire, noted that “we heard from people and interacted with people across the state.”

Democrats are the focus last month, which indicate the popularity of the bill in the negative territory.

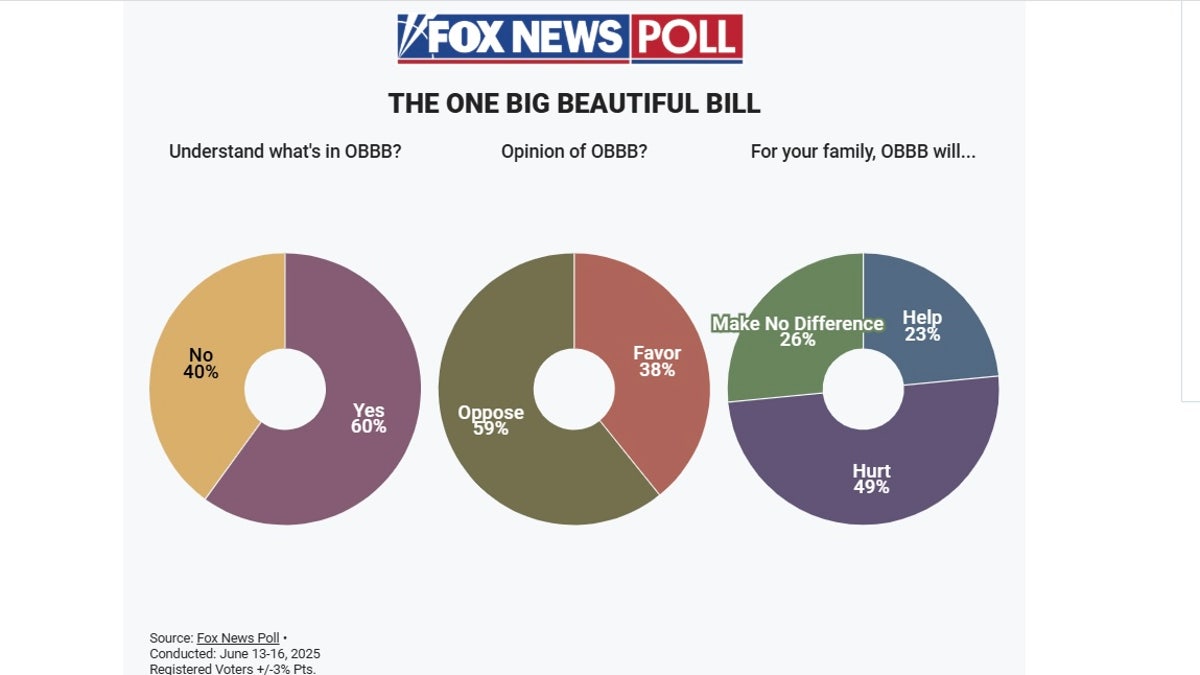

By 21-point reserves, voters asked in the last National Survey Fox News He opposed the bill (38% opposed 59% against).

Go here for the last Fox News survey

The bill was also under water in other national surveys conducted last month by the Washington Post (minus 19 points), Pew Research (minus 20 points) and Quinipiak (minus 26).

About half of the respondents were requested in the Fox News poll, they said the bill would harm their families (49%) and one quarter believed it would help (23%) and the other quarter did not think it changed the situation (26%).

Voters polled by Fox News, in a survey conducted last month, opposed the “one big beautiful bill” with a stock of 59% to 38%. (Fox News)

Asked about the criticism of the Democrats on the “Medicaid Cruts”, Brown said: “My mom was in welfare. These are very important programs, and I have already said that people who actually need them, those who are disabled, those who cannot go out and work, they should have them.”

“It is designed for low and medium-income people, and I support their benefits. But I do not support who is illegally receiving here,” Brown said.

And he added that he did not support the benefits of “people who worked and can absolutely go out and make a volunteer, go out and work.”

What is actually in the “big beautiful account” Trump “

Republicans also continue to be resentment for the bill, focusing on the Democrats for voting against tax reducing.

Republicans cover attention to the latest surveys conducted by GOP groups that indicate strong support for the bill due to tax reducing provisions.

Brown, who questioned the Fox News after he passed in the annual Brntwood, New Yampshire on July 4, said: “Obviously, keeping tax reducing 2017. Of course, it is really critical for people and businesses.”

Candidate from the Republican Senate in New Yampshire, former Senator Scott Brown, with a supporter, marching in the annual Bruntwood parade, New York, July 4, 2025 (Scott’s company Brown)

And pointing to the Pappas whose family has for a century owns the landmark of the Manchester Puritan rear room, Brown said, “For someone, how Chris Papas, imagine how to go to the restaurant he owns and tells his staff, by the way, I am not going to support your tax that does not file tax.” How do you do it? “

Click here to get the Fox News app

Asked about GoP attacks, Pope said: “I support a focused tax reduction for workers, for our small businesses and make sure that we are aimed at it to people who need it, not billionaires, the largest corporations, which adds $ 4 trillion.”

“We hoped that there would be an opportunity for a two -party tax conversation and how we could invest in the middle class and workers and our small businesses, and, unfortunately, this did not happen,” he added.