Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

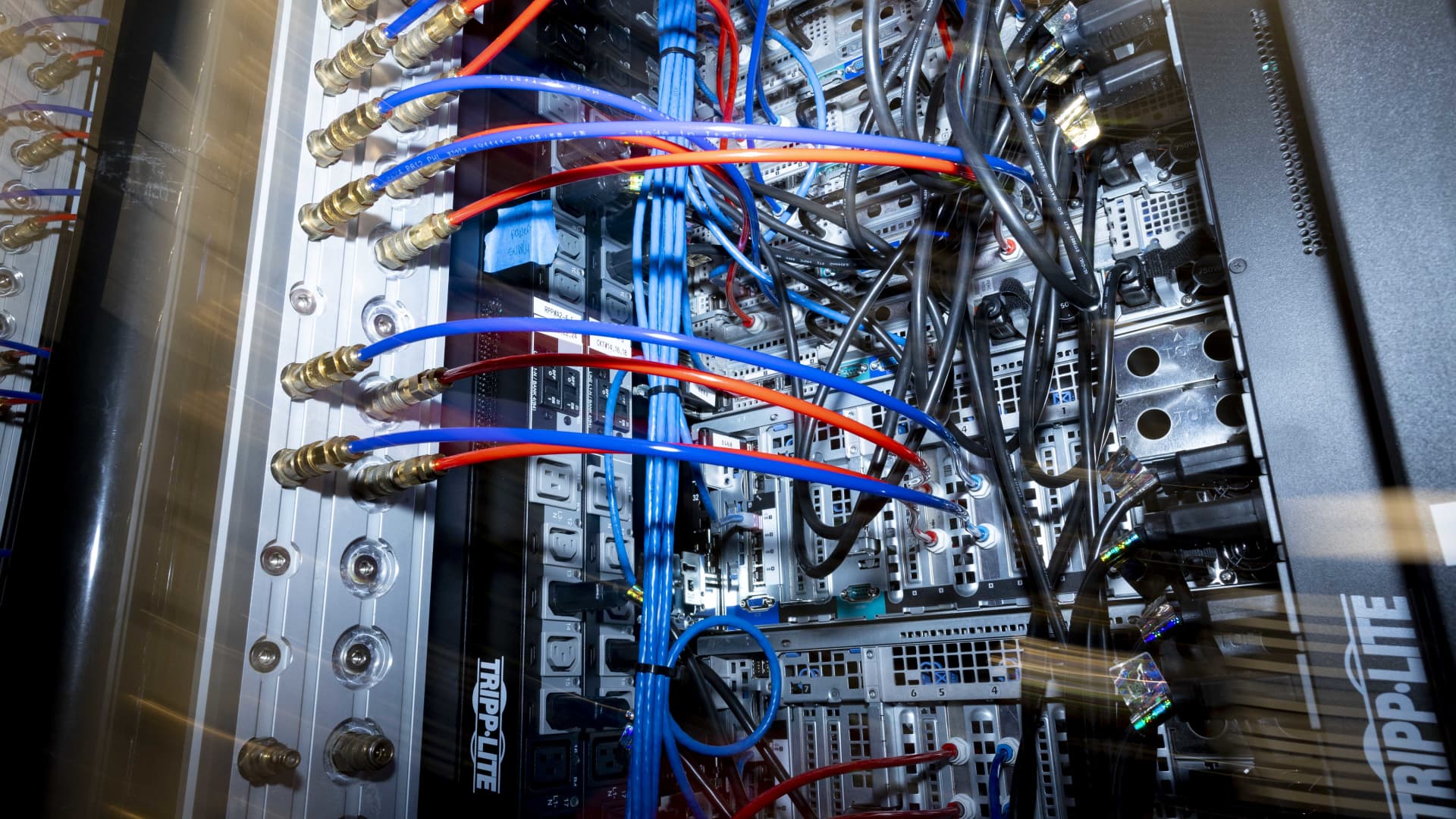

Inside one of the internal operations Equinix at the Equinix data center in Ashburn, Virginia, May 9, 2024.

Amanda Andrade-Rhoades | The Washington Post | Gets the image

Business: Queinix It is confidence in real estate investments and operators of 270 data centers in 75 subway areas worldwide, providing services on the colocration and interconnections of networks, providers, enterprises and hypersalers. The company platform combines the global trail of the International Business Exchange (IBX) and XSCale Data, which support the customer’s need for implementation, exploitation and support for its deployment. Equinix data centers are located primarily in the key markets of the end users in the regions of America, Asia-Pacific and Europe, the Middle East and Africa (EMEA).

The stock market value: $ 75.53b ($ 771.75 per share)

Stock Equinix in 2025

Property: N/a

Average cost: N/a

Activist comment: Elliott is a very successful and insightful investor -activist. The firm’s team includes analysts of leading technology firms, engineers and operating partners – former technology and CEOS. Evaluating the investment, the firm also hires special consultants and general management consultants, analysts of experts and industry specialists. Elliott has often been watching companies over the years before investing and having a wide stable impressive council. Elliott has historically focused on strategic activism in the technology sector and is very successful with this strategy. However, over the past few years, its activity group has grown. The firm is engaged in much more activity -oriented activity and creates value with the level of the council on a much larger width of companies.

Elliott took a position in Equinix.

Equinix is Reit and Operator from 270 data centers in 75 subway areas worldwide, providing coloclation and relationships for networks, providers, enterprises and hypersalers. Companies are increasingly relying on data, and the most effective solution was to use cloud services such as Equinix. High costs associated with the construction and maintenance of internal data centers, combined with fluctuations, allow companies such as Equinix, thrive. Data processing centers allow users to rent space for their equipment rather than use their own space for this purpose. In this market, Equinix is differentiated through its globally interconnected data centers located next to the tops of the top end users, making its deals sticky for data providers. Despite this, the price of Equinix’s stock decreased by 17.75%between June 24 and June 26. This drop was in response to the company analysts when Equinix discovered higher than expenses of $ 3.3 billion for $ 2025 and $ 5 billion from 2026 to 2029, as well as a reduced forecast for the funds for operations (AFFO) to 5%. Previously, it was a range of 7% to 10%.

Such an increase in Capex and drop Affo scared inexperienced and short -term investors, but it was an opportunity for experienced long -term investors such as Elliott Investment Management, which announced it increased its position in Equinix because it initially revealed a 0.15% position in the company in the last 13F. It is important to note that Elliott has a huge experience with data centers. Everyone knows Elliot as one of the most prolific investors today, but what distinguishes the company here is his experience as an investor, director and owner/operator of data centers. Elliott ruled Activists’ Company in Switching Operator Processing Center In 2021, where the investor focused on the Council’s Senior Manager for Elliot Jason Genrich. The firm ultimately came out of switching through sale with 48.33% profits against -14.97% of Russell 2000 over the same period. But more important is the experience and perspective of Elliot as the owner and UK operator Ark Data Datas Centers since 2012. Not only does it give firm experience, but also a more general perspective with a leadership that can greet more friendly relationships.

Thus, when the market saw Capex as a drain of a cash flow, which will not pay off for two or three years, as long as the data -leased and rented processing centers, investors, as an eliot, saw it as a response to increased demand. Over the past few quarters, Equinix has had orders from the rear winds of artificial intelligence and the growth of hypers. With 5% of capital value, Capex, which will make revenue from 20% to 30%, great for the company’s long -term prospects. Accordingly, AFFO is expected to drop to 5% next year, which scares short -term and less famous investors. But as Capex, it will grow up to 8% over the next three years and will eventually return to 9%. This will happen without the help of Elliot. But there are ways to Elliot can use his knowledge of the industry and experience as an activist and operator to accelerate and strengthen these income. For the first time, Equinix can better transfer your plans to the market. Given the reaction on the company’s analyst day, Equinix can clearly benefit from improving market communication around its Capex plan, AI strategy and long -term growth forecasts. In particular, while Equinix does not train AI Model, it has a unique opportunity to play a central role in the AI export – or the deployment of AI models for end users. As AI applies, the demand for export will increase, and Equinix can benefit as the largest provider of data centers in the world with deeply interconnected data centers on key final users. There are also opportunities for the company to optimize the cost structure and reduced interest costs. The management has already taken some steps in this direction and by 2029 it is aimed at the increase in profitability of 300 basic points from 49% to 52% – the highest goal, which is set by the company. However, this is still a conservative assessment, since many peers, including near trustees, digital reality (DRL), have higher profitability. In addition, a small financial engineering can reduce the company’s interest rate and improve Equinix affection.

Historically, Equinix ordered a premium, and its share has moved almost in accordance with DRL. However, since its analyst day, the Equinix return has reduced DRL by about 11 percentage points, and the company is now trading with slightly reduced 24 times The value of the business/ebitda Compared to 29 for DRL. The company goes on the right track, but can use a little help from an experienced investor, such as Elliot in the implementation of his plan and transfer it to the market. Elliott could do this as an active shareholder or with a council seat. From the experience of the industry industry and a similar point of view, we will not be surprised to see how he was invited to the Council until the next annual meeting in May 2026.

Ken Skvir is the founder and president of the 13D monitor, an institutional scientific and research service for shareholders’ activity, as well as the founder and managers of the 13D -activist fund portfolio, a mutual fund that investes in the portfolio of 13D investments.