Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Climate and scientific reporter

BBC

BBCDonald Trump’s return to the White House is a “main blow to world climatic action”. This is how Christian Figeles said, former UN climate chief after he was elected in November.

Listen to ESME Read this article.

Since his entry, Trump has abandoned the United States of what is considered to be the most important global climate pact, the Paris Climate Agreement. It is reported that it also prevented us from participating in international climatic research and has removed national electric vehicles.

In addition, he made fun of his predecessor’s attempts to develop a new green technology “a new green scam”.

And yet, despite its climate history, Trump sought to make a deal with the President of Ukraine on critical minerals. He is also very interested in Greenland and Canada – both nations rich in critical minerals.

Gets the image

Gets the imageCritical purchases of minerals have been the main attention for Trump since he has taken office. These minerals are crucial in areas, including aerospace and protection, but they also have another major use – for the production of green technology.

So, can Trump focus on getting these minerals to have an effect and help unlock the US potential in the green technology sector?

Trump’s rights understands more than most of the importance of critical minerals in the green transition. Space X and Tesla – Elon Musk leads – largely rested on critical minerals as graphite (in electric cars), lithium (in batteries) and nickel (in rockets).

Elizabeth Holly, Associate Professor of the Department of Useful Engineering in Colorado -School of Marsh, explains that each nation has its own list of critical minerals, but they are usually made up of rare lands and other metals such as lithium.

According to her, demand flourishes – in 2023 the demand for lithium increased by 30%. This moves mainly by rapid growth of pure energy and electric cars.

For two decades, they will be almost 90% of the demand for lithium, 70% of the cobalt demand and 40% for rare land, the International Energy Agency reports.

Such was the concern of Moscow to capture some of these minerals that he wrote three years ago: “The price of the lithium has gone to insane levels! Tesla would actually have to enter mining and refinement directly if the costs do not improve.”

He continued to write that the element lacked, but the mining pace is slow.

The weakness of the US position in rare lands and critical minerals (such as Cobalt and Nickel) was considered in a report published by the US Government Committee in December 2023. It states: “The United States should review its political approach to critical networks of mineral and rare elements due to the risks that relate to our current dependence on the People’s Republic of China.”

Failure to comply with this, prevented, can force “the production of defense has stopped and stifled the production of other advanced technologies.”

China’s domination on the market has occurred from the early recognition of economic opportunities offered by green technology.

“China has decided about 10 years ago on where the tendency was, and strategically pursued the development of not only renewable sources but also electric cars, and now dominates the market,” says Bob Ward, Director of the London School of Economics (LSE) Grantham Scientific and Research Institute and Environment.

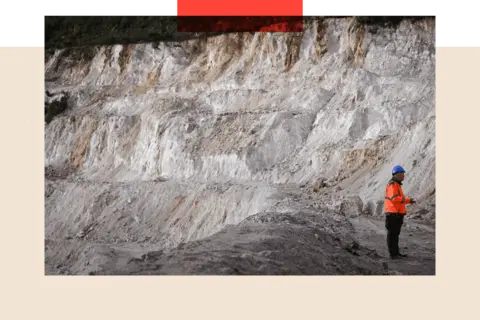

Gets the image

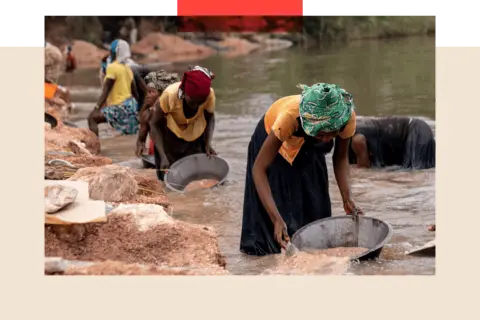

Gets the imageDaisy Jennings Greek, Head of the Price Department at the Benchmark Mineral Intelligence Agency, explains that they are critical minerals because they are geologically limited. “You can’t guarantee that you will have reserves subject to economics in every country.”

Some minerals such as lithium are rich on the ground, but often they are in difficult places, so the logistics of the mining project can be very expensive. In other cases, there is a dependence on one country that produces a large proportion of global nutrition – such as cobalt from the Democratic Republic of the Congo. This means that if there is a natural disaster or political unrest, it affects the price, says Ms Jennings Greek.

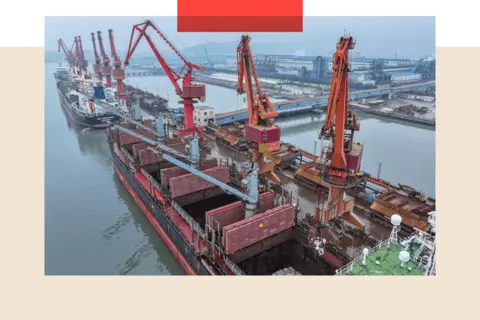

China managed to attract supply by investing large funds in Africa and South America, but where it really has the strengthening of the market is in processing (or the mineral separation from other elements in the rock).

Gets the image

Gets the image“China is 60% of world -wide land production, but nearly 90% (IT) is dominated at this stage,” says Grekelin Basquera, director of the Critical Mineral Security Program at the Washington Strategic and International Studies Center.

She says the country understands how important it is in economic trade – a few days after Trump introduced the tariffs in China, its government was reflected by entering export control over more than 20 critical minerals, including graphite and tungsten.

Motivates Trump is the fear of being in a disadvantage, according to Christopher Knotel, Professor of the Applied Economy at the Massachusette Technology Institute (MIT).

“I think it drives because China is a dominant player on the handling side,” he says. “This is a processing stage that is a high -profit business stage, so China makes a lot of money.”

As he claims, it is a “happy coincidence” that it can support green technology.

The key question, however, is whether the US is too late to use the sector.

In the early days, the green transition was “issued as a burden” for the countries, Bob Ward reports.

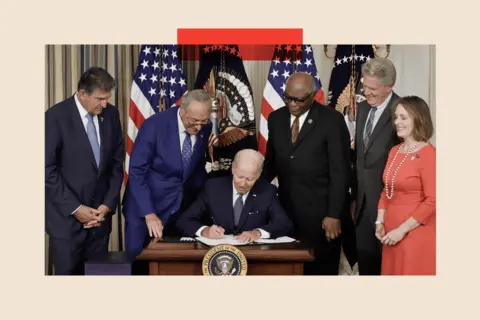

In August 2022, the Biden administration received high support for Green Technology Industries by imposing inflation cuts (IRA), which offers tax loans, loans and other stimuli for technology that reduces greenhouse gas emissions from battery technology to solar batteries.

By August 2024, it was estimated to have been investing $ 493 billion (£ 382 billion) into the US green industry, Monital Investment Monitor reports.

Gets the image

Gets the imageAnd yet, little work on supporting processes on the current, such as receiving critical minerals, says Ms Gray with Benchmark Intelligence. Instead, the Biden administration has greatly focused on the production down on the current – the process of obtaining products from the manufacturer to the final consumer.

But the recent steps of Trump on the purchase of these critical minerals suggest focusing on the higher current.

“IRA has put a lot of legislation to limit trade and deliveries only from friendships,” explains Ms Gray.

“Trump changes Tack and looks at the provision of critical minerals that are owed by the US.”

There may be further steps from Trump descending along the line. Those who work in this sector say the whisper in the corridors of the White House believes that it can adopt a “critical executive order of minerals”, which can transfer further investments to this purpose.

The exact details that may be included in the executive order remain unclear, but experts who know the issue said they could include measures to accelerate mining in the United States, including rapid tracking and investment investments.

Although working to provide these minerals, Professor Willy Shi from Harvard Business Schools believes that the US administration lacks an understanding of the technical complexity of the supply mineral networks and emphasizes the necessary obligations on time. “If you want to build a new mine and processing, it can take 10 years.”

Gets the image

Gets the imageAs a policy of his predecessor, and the one that is so obviously cursed, Trump spoke against the maintenance of Ira. But its success in the Red States means that many republican senators are trying to persuade it to keep it in some form in the proposed “big, beautiful bill” – the plan to impose all the main goals of Trump’s policy in one mega – should be revealed at the end of this month.

Pure investment monitoring analysis over the last 18 months, which the Republican states have received 77% of investments.

D -R Bookstel Mit says for states such as Georgia, which has become part of what is now known as a “battery belt” after the battery boo after IRA support, these tax credits are crucial for the survival of these industries.

He adds that failure to comply with this is a true political threat to us who seek re -election in less than two years.

If Trump loses even one place to Democrats in the middle of 2026, he loses most of the House of Representatives – limiting his ability to adopt key legislation.

Gets the image

Gets the imageCarl Fleming was an advisor to the Renewable Energy and Effective Effective Effective Effective Committee and is a partner of McDermott, Will & Emery, advising customers in clean technology and energy space. He says that despite uncertainty, investors remain confident. “In the last month, my practice was more occupied than if -something, and it has since last year after Ira.”

He also believes that there is a recognition of the need to support parts of the IRA – although it may be together with the expansion of some fossil fuel. “If you are really trying to become” America first “and the energy safe, you want to pull all your levers. Keep solar energy and store battery storage and add more natural gas to release energy in America.”

But the uncertainty of the US position is little consolation for the lack of an international climate, says Bob Ward. “When Americans are on the ball, it helps to move people in the right direction, and that’s how we received the Paris Climate Agreement.”

For those who are in the climatic space, Trump is definitely not an environmentalist. It is clear that he is not concerned that his heritage is environmentally friendly, but he could reach the first if he could make sure that it will increase the economy.

Best picture: Getty Images

BBC Indepth is home to the site and application for better analysis, with fresh prospects that dispute assumptions and a deep report on the biggest issues of the day. And we demonstrate the contents that cause reasoning, from different BBC sounds, and iPlayer too. You can send us your reviews in the Indepth section by clicking the button below.