Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

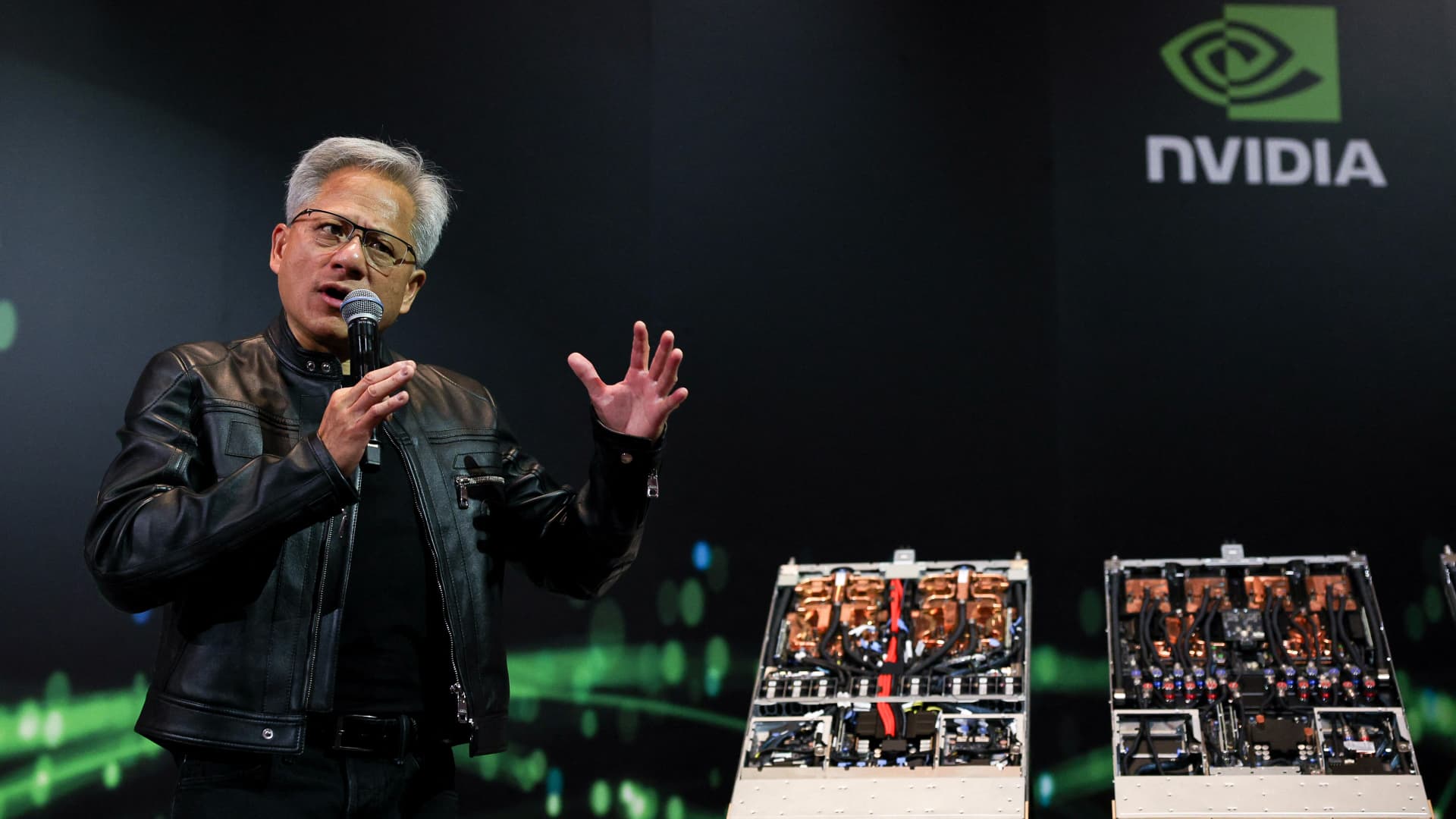

Jensen Juan, co-founder and CEO of Nvidia Corp., speaks during a press conference in Taipei on May 21, 2025.

I-Hwa Cheng | AFP | Gets the image

Nvidia Continues to see the mass growth from the sales of graphic processors, and the demand for artificial intelligence infrastructure does not show signs of cooling.

But for the manufacturer of the AI mood chips is different from the income report on Wednesday than in the last quarters. There is one big reason why: China.

On April 9, the Trump administration sent a NVIDIa letter and stated that it requires an export license for a H20 chip, a version of its Hopper processor specially designed for the Chinese market to comply with previous restrictions in the US.

Rising up to President Joe Biden, US Government is concerned that AI chips from Nvidia and other semiconductor companies such as such as Extended micro -device You can use to create supercomputers for military purposes.

Following the new Nvidia restrictions said it would be needed 5.5 billion in recording on inventory. Analysts have called this the largest listing in the history of the chips. The potential impact on the future income is hefty.

“This stock recording implies $ 15 billion H20 for 12 months,” writes David O’Conn, BNP Paribas analyst, on Tuesday’s report.

Analysts expect Nvidia to go 66% of income growth up to $ 43.28 billion in the quarter, ended in April, LSEG reports. Although this growth level is much higher than the expansion in any of Nvidia Megacap peers, it notes a sharp slowdown from a year ago when the company enroll growth of more than 250%.

There is a lot of uncertainty related to forecasts during the rest of the year. The average analyst’s assessment predicts a 53%increase in the current quarter, a similar number is expected for the full financial year, which ends in January.

In the report on Tuesday, Morgan Stanley analysts wrote that Nvidia faces a big hit than expected.

“While our thinking at the time was that it was at least partially waiting for the management group, after the ban it became clear that the company had received signs that the H20 would be in order and that they were significantly surprised,” analysts write.

Nvidia’s shares jumped off at the end after the rough start of the year and now increased about 1% in 2025, and Nasdaq decreased by approximately 1%.

Earlier this month, Nvidia CEO Jensen Juan said in Taiwan that Nvidia had 95% share of market graphic processing in China, but that’s the case has been reduced up to 50% Under restriction of chips. The application for the securities and exchanges commission in February Nvidia said it had recorded $ 17.1 billion of annual sales to customers who had addressed in China, including Hong Kong, the fourth -largest company market.

In recent weeks, Juan has claimed that NVIDIA’s exports to China only motivated engineers to come up with their own processors, strengthening the AI AI AI country and even more threatening US technological leadership.

Nvidia got good news in May when Trump’s administration announced it is there storeroom “Diffusion Diffusion”, which is associated with even greater export restrictions to China and other countries. Nvidia and AMD opposed the restrictions.

However, the Trump administration did not completely depart from the NVIDIA export regulation, saying that at the time that plans a new, easier replacement for the rules of diffusion.

Morgan Stanley analysts expect questions to be replaced by NVIDIA H20 and its plans for China after the income report this week. They noted that Nvidia lobbying the license to send H20 that could be provided According to the current system.

“There is a talk that China will eventually be allowed, but probably not on this salary,” they wrote.