Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

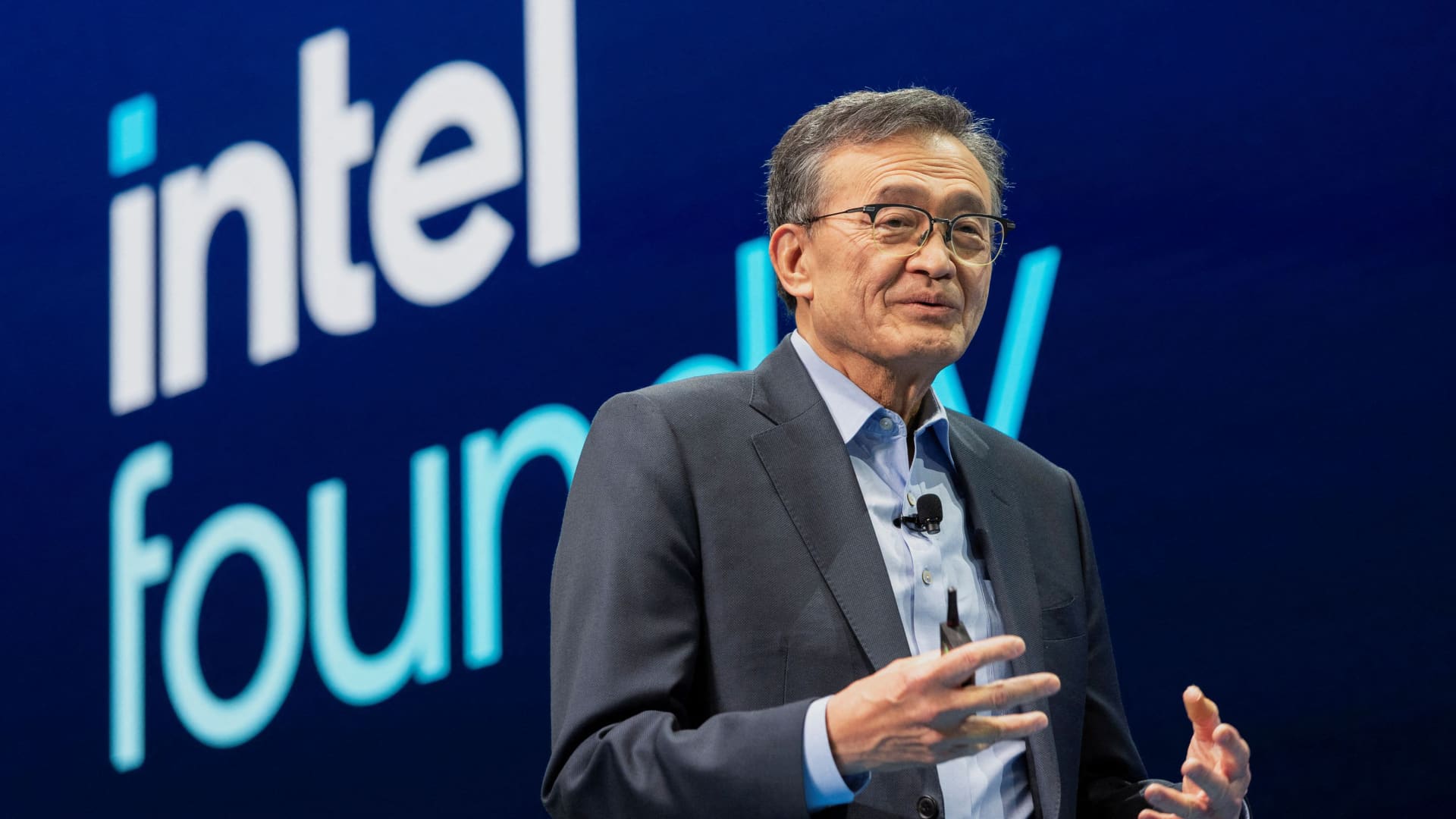

Intel Lip-Bu Tan CEO speaks at the annual company conference in San Jose, California, USA on April 29, 2025.

Laure andillon | Reuters

Intel Monday warned of “side -effects” from investors, staff and others to Trump administration Taking 10% of the stock in the company, in supply Referring to the risks related to the deal.

The key problem Fiscal year comes out of the US borders. According to the application to the Securities and Exchange Commission. The company had $ 53.1 billion income For the 2024 financial year, falling by 2% compared to this.

For international Intel customers, the company is now directly linked to the president Donald Trump‘s constantly changing rate and trade policy.

“There may be adverse reactions immediately or over time from investors, employees, customers, suppliers, other business or commercial partners, foreign governments and competitors,” the company wrote. “There may also be trials related to the deal, either otherwise, and an increase in public or political control against the company.”

Intel also said the potential for changing political landscape in Washington could challenge or cancel the deal and create risks for current and future shareholders.

The transaction that was announced on Friday gives Department of Trade Up to 433.3 million shares of company bred for existing shareholders. Purchase shares are largely financed by money already presented by Intel under the President Joe BidenThe act of chips.

Intel has already received $ 2.2 billion from the program and has been set by another $ 5.7 billion. According to the release, a separate federal program sentenced $ 3.2 billion, a total of $ 11.1 billion.

Trump called the “Great for America” agreement and stated that the building of advanced chips “is important for the future of our nation.”

Intel’s shares were rallied as an impetus built before the transaction in August, the shares amounted to about 25%.

The agreement requires the government to vote with the Intel Board. On Monday, the company noted that the government’s share “reduces voting and other shareholders’ rights and may restrict potential future operations that may be profitable by shareholders.”

In addition, the company admitted in the submission that it did not complete the analysis of all “financial, tax and accounting consequences”.

The rapid financial year Intel 2024 included exit CEO Pat Helinger In December after a four -year stay, during which the shares were tanned and the company lost position for competitors in Artificial intelligence Boom.

CEO lips-tan took the helm in March.