Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

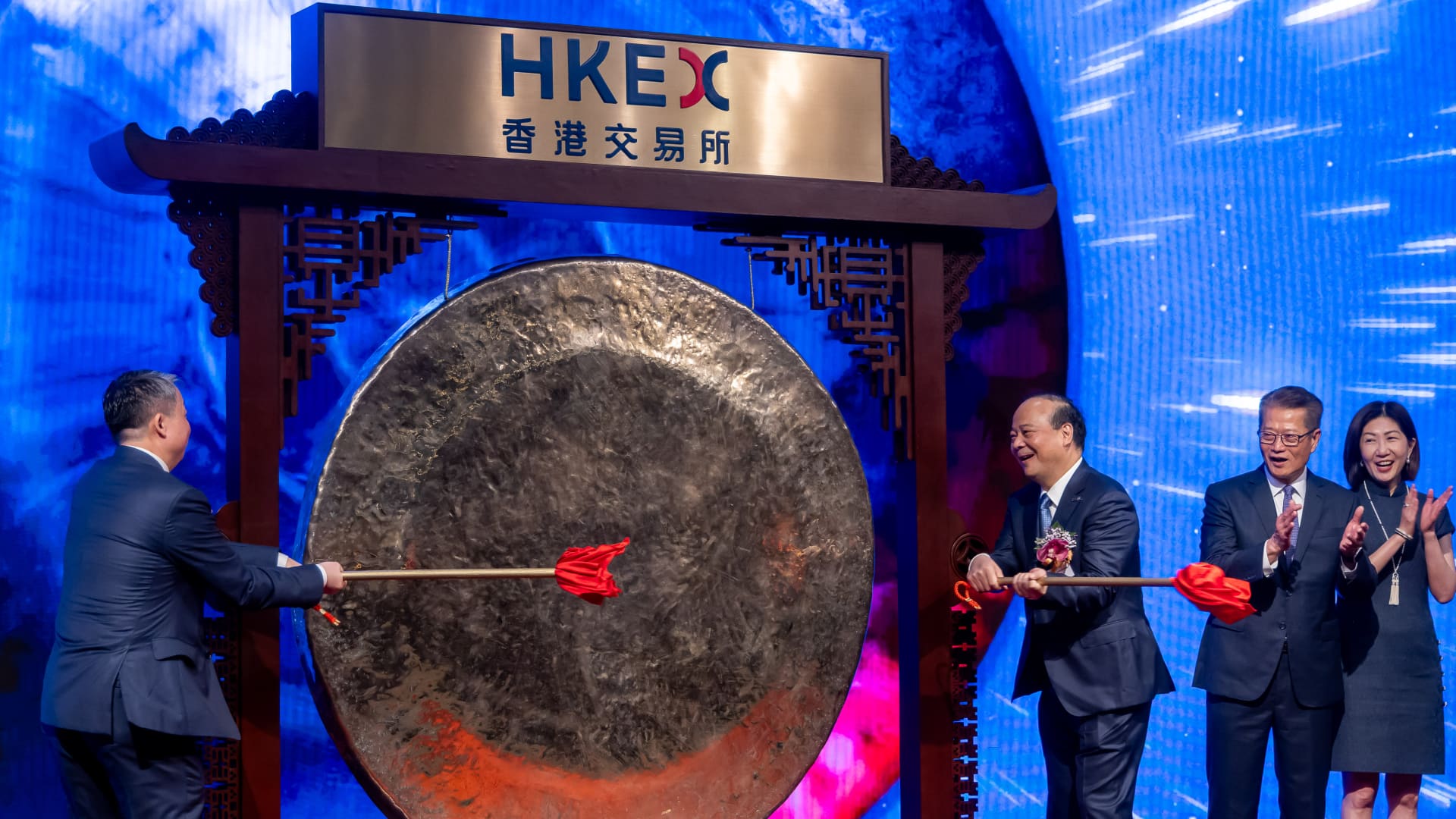

Robin Zeng, Founder and Chairman of Contemporary Amprex Technology Co. Ltd. (Catl), Third Right, Strikes A Gong As Paul Chan, Hong Kong’s Financial Secretary, Second Right, and Bonnie Chan, Chief Executive Officer of Hong Kong Exchanges & Clearing Ltd. (HKEX), Right, Applaud During the Catl Listing Ceremony at the Hong Kong Stock Exchange in Hong Kong, China, On Tuesday, May 20, 2025.

Paul Jung | Bloomberg | Gets the image

The enthusiasm for investors and enterprises to the capital markets of Hong Kong rap back when Chinese companies flocked to the city to raise funds, causing madness on the market that has been left in recent years.

Negative transactions and a Pressed with the support of the state For the companies listed on the mainland exchanges to look for a list in Hong Kong, the volume of equity up to the strongest in the first half of 2021 has the data provider of Dealogic.

The new volumes of the list on the Hong Kong Stock Exchange jumped about eight times to $ 14 billion in the first half of this year, from total $ 1.8 billion over the same period of 2024, Dealogic reports. This excluded the lists of space or company to acquire special goals created solely to attract capital through IPO, to eventually buy or merge with another company.

It puts the city on the track to become the world’s largest leistable point this year, surpassing Nasdaq and New York Stock Exchange. Pwc Forecast to 100 IPO In Hong Kong this year with a total fundraiser exceeding $ 25.5 billion.

Madness occurred after many years Important IPO activity in the city Among the post-pandemic moods and the stuttering of economic growth.

In the first half of this year, there were 43 new lists in Hong Kong, and the proceeds amounted to $ 13.6 billion, which exceeded the total amount raised in 2024, showed the financial data platform.

For comparison, there were only 73 lists in 2023By collecting only $ 5.9 billion, according to HKEX.

The updated interest is caused by the fusion of factors, including in Beijing’s regulatory tails, muted rates of actions A, sufficient market liquidity and deposition of fear in the US markets, driving mainstream companies to raise funds in Hong Kong, according to Stephen Sun, Chinese Strategy.

“IPO BOOM on the Hong Kong market is definitely due to the double list of A-TEN-H (stocks),” Sun said. A-actions refer to the stocks listed by the mainland, and the H-Feis is listed in Hong Kong.

“More and more companies are using the proceeds to finance their globalization strategy,” Song said, because Dollar Hong Kong is more mad than Chinese yuan in world markets.

Jump in Chinese prices to capital In September last yearcaused by the expectations of stronger economic stimulation, helped to translate the tide on the bears about China.

Earlier this year, the issue of inexpensive but powerful Deepseek models has further pushed the action in Chinese actions when investors began to overestimate China’s ability to innovate by pushing a reserve copy of Chinese stocks.

“The market estimates as a whole have improved to the middle level of historical, which provides the best background for companies that seek fundraising,” said China’s head of China’s capital strategy at Macquarie.

As of Wednesday’s closing, this year, Hang Kong Hang Seng has purchased a 21%starry, making it one of the most effective major markets worldwide.

Hope the Chinese authorities are likely to unleash additional financial costs to protect the economy from any shock related to trade, even more investor business and confidence.

In an obvious shift to support the private sector, the President of the Chinese XI Jinping told Top Business Business Country in February that the country needs help to ensure economic growth.

This shift combined with the long -awaited Beijing approval for mainland firms listed the offshore, unleashed the wave of demanded demand, especially for quality companies that go into consumer, less exposed to geopolitical wind, Lorraine Tang, director of ownership studies in Morningstar.

Chinese securities regulator last year issued A lot of measures aimed at quick tracking Approval of the main technology companies in the Hong Kong list. Hong Kong regulators also launched the so -called “Technology Enterprises Channel” In May, to facilitate the IPO approval for specialized technology and biotechnology companies, especially those already listed in the mainland.

“The policy that encourages leading corporate citizens to the list in Hong Kong has provided a necessary shot in the hand” in the revival of IPO activities in the city, said Perris Lee, the head of the capital market in Dealogic.

Another driver on the market rally Hong Kong was the wide liquidity provided by the mainland investor, consisting of Hong Kong’s action, pursuing a fierce intelligence caused by Deepek breakthroughs and incorporating in major capital collection deals.

Southern pure tributary that traces through the cross -border connection Scheme of stock connectionAs in 2014, high record high was launched as this scheme was launched in 2014.

In a sharp contrast, the Chinese benchmark CSI 300 has practically not risen this year, which is 0.2% today, according to LSEG.

This pushed on the shore of investors to move money to shares that list Hong Kong, strengthening the inflow in the south direction to take into account the almost half of the daily turnover of Hong Kong shares, according to Sun.

These factors have helped push the flurry of the mainstream companies, to seek secondary lists in Hong Kong, including the battery manufacturer Modern AMPEREX technology.

The company is already listed in Shenzhen More than $ 5 billion in A A secondary list in Hong Kong In May, it is the world’s largest proposal this year.

In addition, the Hong Kong market is more “included” by new sectors such as AI, renewable energy, digital consumption and biotechnology that meet the needs of mainland firms, said Vai Lee, the head of many investments in China in BNP Paribas.

Among the more than 200 IPO active entrants in the pipeline, which will be listed on HKEX, more than 40 companies that have already been listed on the mainland exchanges showed information about the wind.

Other high-profile companies that this year have sought the main list in Hong Kong include Group Mixue Group Bubble Tea Mixue, Guming Holding and Ride-Hainding Platform Caocao Inc.

The Hong Kong list for Chinese companies will also help their global expansion plans.

Against the backdrop of competition in the field of slot and overtake trading tensions from the US, Beijing urged its leading companies to expand globally and diversify its production places.

“The appetite to collect offshores, especially in HKD, is a reflection of wider plans to expand in foreign markets,” Hsiao said.

Increased tensions in the US-Chita made Hong Kong’s preferred purpose for many Chinese firms, due to the concern that the Trump administration could order a US exchange.

“The secondary list, essentially, provides additional insurance for Chinese companies that list the United States in an unlikely event when the bust becomes unclear,” Lee said, believing that companies will probably make financial advisers knock out “Plan B” with or without translation.