Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Getty Images

Getty ImagesEven artificial intelligence can’t predict the future (yet), but two of our tech editors took a look ahead at what they think will be big in 2025.

As 2022 drew to a close, the outlook for the cryptocurrency business was bleak.

One of the most famous firms, FTX, collapsed with $8bn (£6.3bn) unaccounted customer funds.

In March 2024, the company was co-founded by Sam Bankman-Fried received 25 years in prison to defraud customers and investors.

The scandal has undermined confidence in the entire sector.

Cryptocurrencies seemed destined to remain a niche product with a passionate but relatively limited following.

But just a few months later, the industry was bubbling with optimism again. Behind the enthusiasm is the success of Donald Trump in the presidential elections on November 5.

There was a feeling that it would be more favorable to the cryptocurrency sector, and so far it seems to be the case.

In early December, Trump said he would nominate Former Securities and Exchange Commission (SEC) Commissioner Paul Atkins will take over as chief executive of the Wall Street regulator.

Mr. Atkins is seen as much more of a fan of cryptocurrency than outgoing CEO Gary Gensler.

The announcement helped push the value of a single bitcoin, the largest of the many cryptocurrencies, to $100,000.

“You can imagine that with Trump winning in 2025, you’re going to get pro-regulation. You’ll get some negative regulation lifted, which will then allow banks and other institutions into this space,” says Jeffrey Kendrick, global head of digital asset research at Standard Chartered.

In particular, Mr. Kendrick points to the SEC’s guidance called SAB 121. Since its entry into force in 2022, it has been difficult for banks and other financial companies to provide cryptocurrency services.

Such a move could help Trump fulfill his July pledge to make the U.S the cryptocurrency capital of the world.

If he follows through on that promise, it will be a remarkable turnaround from 2021, when Trump called bitcoin a “fraud”.

Getty Images

Getty ImagesAs AI tools move into our phones – Apple, Google and Samsung have launched services that can edit photos, translate languages and search the web – we’re at the dawn of an era in which AI becomes an integral part of our of digital life and increasingly useful on a personal level.

That’s if we allow it, because it takes a little faith.

Take keeping a diary as an example. An AI tool can manage your diary effectively if you let it access it. But how far should it go?

To be truly helpful, does that mean he also needs to know who you don’t want to date, or relationships you want to keep secret, and from whom?

Do you want him to provide you with consultation or medical appointment summaries?

This is very personal information that could potentially be very embarrassing and extremely valuable if some glitch meant it was shared. Do you trust big tech firms with this kind of data?

Microsoft is pushing hard on this particular door. In 2024, he got into trouble for demonstrating a tool called Recall that took snapshots of laptop desktops every few seconds to help users find content they’d seen but couldn’t remember where.

It has now made a number of changes to a product that was never launched, but is sticking with it.

“I think we’re moving toward a fundamentally new era of having ever-present, persistent, and highly capable co-pilot companions in your everyday life,” the firm’s AI chief, Mustafa Suleiman, told me recently.

Despite the challenges, Ben Wood, principal analyst at technology research firm CCS Insight, expects more personalized AI services to emerge in 2025.

“The data will be constantly updated with new data sources such as emails, messages, documents and social media interactions.

“This will enable the AI service to be tailored specifically to a person’s communication style, needs and preferences,” he says.

But Mr Wood admits that allowing AI to reveal your personal information will be a big step.

“Trust is going to be essential,” says Mr Wood.

Getty Images

Getty ImagesThe more money poured into artificial intelligence, the more data centers will need to be built.

Training and controlling artificial intelligence requires a lot of processing power and works best with the latest computer chips and servers.

Over the next five years, the biggest data users, including Google, Microsoft and Meta, could invest up to $1 trillion in data centers. according to CCS Insight.

In Europe alone, data center capacity is expected to grow by an average of 9% annually between 2024 and 2028, according to real estate firm Savills.

But these new facilities are unlikely to be built in current data centers such as London, Frankfurt and Amsterdam.

High property prices in these cities – Savills says that land prices in London can be as much as £17 million per acre – plus a tight power supply means developers will look elsewhere.

UK cities such as Cambridge, Manchester and Birmingham could see the next wave of data center construction.

Elsewhere, Prague, Genoa, Munich, Düsseldorf and Milan are likely to be considered in Europe.

Getty Images

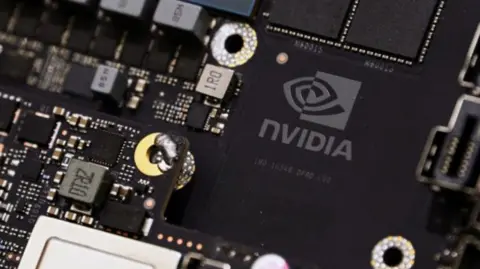

Getty ImagesAt the heart of some of these new data centers will be the latest computer chips from Nvidia, the company that dominates the market for chips used for artificial intelligence.

Presented in March 2024Blackwell’s chip is expected to begin shipping in significant quantities in 2025.

According to Vivek Arya, senior semiconductor analyst at Bank of America Securities, the new chip should allow tech firms to train AI four times faster and see AI work 30 times faster than current computer chips.

Biggest customers Nvidia, Microsoft, Amazon, Meta and Coreweave are likely to get the technology first, according to reports.

But it may be difficult for other customers to get hold of the superchip, as according to Mr Arya, “supply will be limited in 2025”.