Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

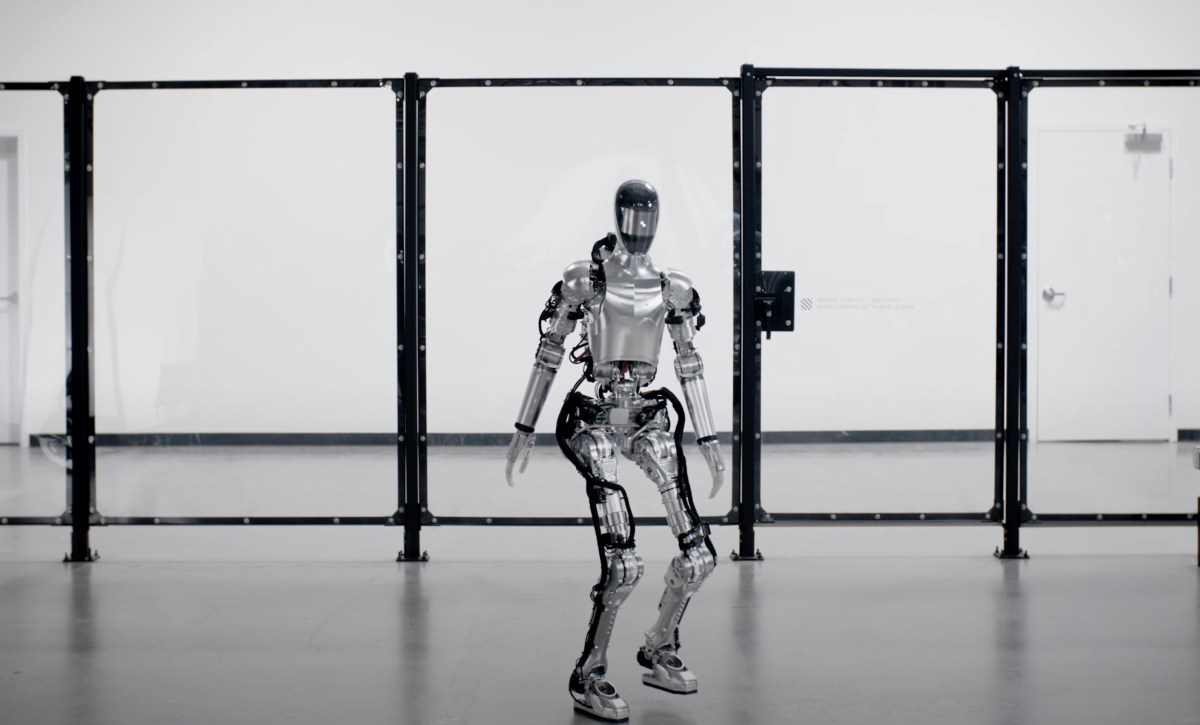

Last Month, Brett AdCock, bottom of a rotted Starting Figure AI, claimed in a post on x That his company “is now # 1 more searched to the private stock in the secondary market.”

But the company sent letters and desired at least two brokers who manage the side markets, those broker, figure owls, the letters of the AI

The two braces said they have received the letters for the first time after Bloomberg reported The middle of February that the figure he was looking for $ 1.5 billion at a $ 39.5 billion evaluation – an increase of 15 times from the $ 2.6 billion Evaluate uttered in February, 2024.

A porter for the Figure AIthey has said the company sends letters when society has not authorized the broker of selling its stock, suggestion she has a long story.

“That year, when we will not authorize the third groomer was approval, the sharp and have made a celebrate of the partitioned in our share of the authorization and company will be contagded to protect the edge of the market.”

Because the figure is a private company, no public, its stock cannot be facilitate the volunteer by their investors, particularly without a business event. This restriction is why the secondary markets are emerged and including those who offer that the investings warm alternatives to obtain ahead of ahead of a ipo, as secured loans from their startup action that becomes refundable when a company goes public.

The secondary markets on the end of the figure letter recovery that have other theories about why some CEO don’t like the sale of his markets.

Existing Azting tried to sell their bag in a price that was under the new $ 39.5 billion of 39.5, these broker. Both Brokers told Techcrough that some companies are salnative to the prospective in the low side could compete with the new turn.

Without commenting on the figure specifically, SIM desires, founder and CEO of Secondarire Sha Martlett Porcesaid to Techcrough that companies sometimes block the second secondary sale because they believe “is a zero game.”

Desai, natural, support that the reverses can be true: Active market trade could attract more interest for the primary nuts in a new sauce.

But if the secondary market activity fails to drive interest in the primary round, the problem can lie with the assessment. “If someone has a hard time selling something, it’s just a price function and evaluation rather than capital available”

Figure has also been the subject of many news items, describe the progress of the figure with their marching client, BMW. Figure he got her at least one, tellingus that the joint had many taxation that mostly overline.

As far as how figure you grow next – and in which evaluation, which remains to be seen. Whether the existing investors may fall before in the secondary transactions is also determined.