Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Res. Deng hader, Peng.

Res. Deng hader, Pennsylvania, supported the White House Proposed tax growth For people who earn more than $ 1 million.

“I believe that we need to help the president express his promise of the tax and regulatory plan that supports pro-American economic growth and production growth, as well as provides the vast majority of Americans-creation and promoting financial liability. Any adjustments in taxes to achieve these goals must be considered.

Last week, White House Chase started to swim quietly Home Republicans This would raise the tax rate up to 40% for Americans who earn more than $ 1 million, Fox News Digital sources reported about previous discussions. The plan will draw profit for the financing of the Donald Trump’s ambitious company Donald Trump to eliminate taxes on overtime, tips and social security.

On Thursday, Meyser said he offered “in the morning with Mary” by less than 2% tax raising the “wealthy, high -quality” tax tax “a month ago. He noted that the law on reducing taxes and jobs in 2017 reduced the high tax rate from 39.6% to 37%, so its increase of up to 38.6% will still keep it below the TCJA by almost one percent.

White House quietly swims on a millionaire tax

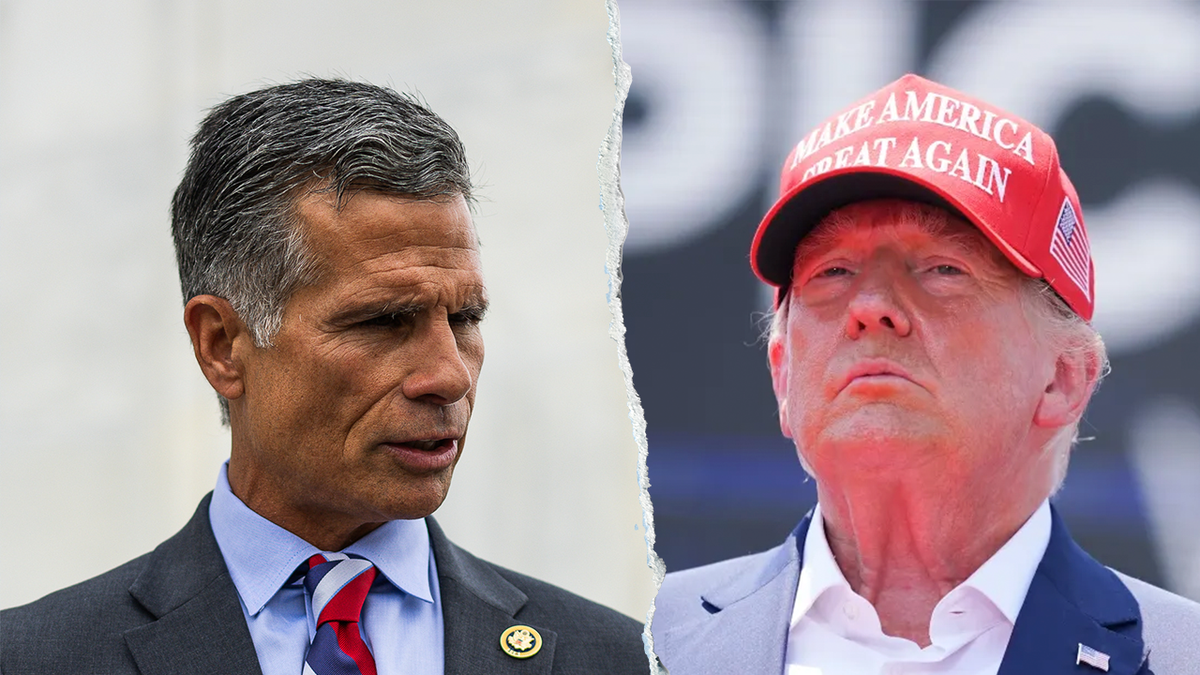

Res. Danzer had a Peng, signed the support of tax campaigns for the richest Americans to pay for the ambitious budget program Donald Trump. (Getti Image)

“We are fighting for a small business. We are fighting for all America and for job creators that may be in these categories. Thus, if you raised it 1 point, it brings $ 15 billion, so? With no elasticity that can happen. To bring out payments to the origin, which are included in the economy.

Pennsylvania Republican who joined Trump on the 2024 company and is considered a potential candidate to challenge Gov. Josh Shapiro In 2026, he emphasized everything because of Trump’s tax approach.

Res. And Meiser (Michael M. Santiago/Getti Image/File)

“The president is the time not to have a standard-and this is my view, from what i’ve Based Upon Him, I’M Not Putting In His Mouth-A Standard Republican-Style Budget. of all America, Middle-Income American, Small Businesses, and By the Way, We Would Be Talking About An Exemption for Pass-Trough Small Businesses So they Would Not Be Pay At The Higher Rate, As a Thy DO NOW NOW, AS THE COMMUS Level Rate, ‘Meuser said.

While Meyser stated that the warmth to the idea of tax trips for ultra-account, other conservatives remained unwavering in refusing taxes.

Senator Josh Khli, P-MA.. said Fox News Digital Last week, that reducing taxes is “that Republicans are good” when he called on his republican counterparts to protect taxes for the Americans who are fueled by Trump’s database. More Republicans, including Senator Mike South Dakot and Tom Tiffani from Wisconsin, are encouraged to decline Trump’s taxes in 2017, which is considered a republican priority during the budget talks.

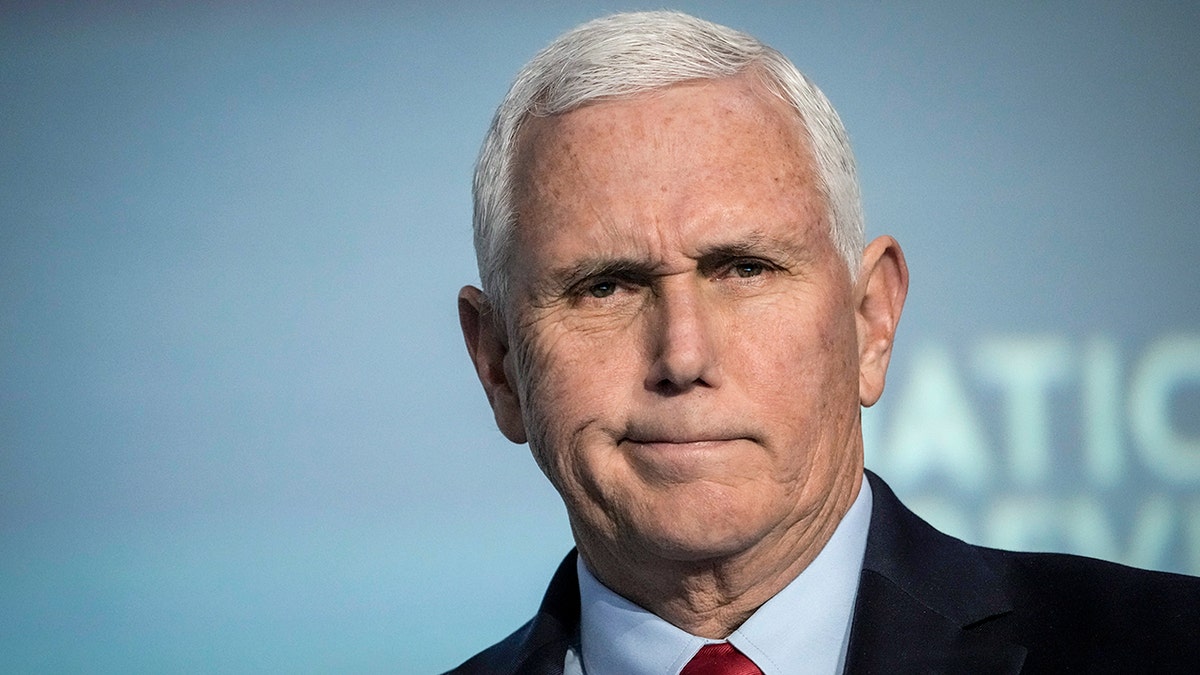

Former Vice President Mike PenceCalling a 2017 tax decline as a “Trump-Penes Tax Reduction”, last week called on the Republicans of the House of Representatives to stand firmly against raising taxes on the country’s best salaries and reducing taxes in 2017 permanent.

Former Vice President Mike Pence (Second Image/File Getty/Getty)

Click here to get the Fox News app

Towards US Liberty, the PENE Conservative Policy Group, sent a letter from the Republican Congress, including the Chairman of the Committee on Homes and Means, the representative of the Committee Jason Smith, Ma-M.

This report contributed to Elizabeth Elcind Fox News Digital.