Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

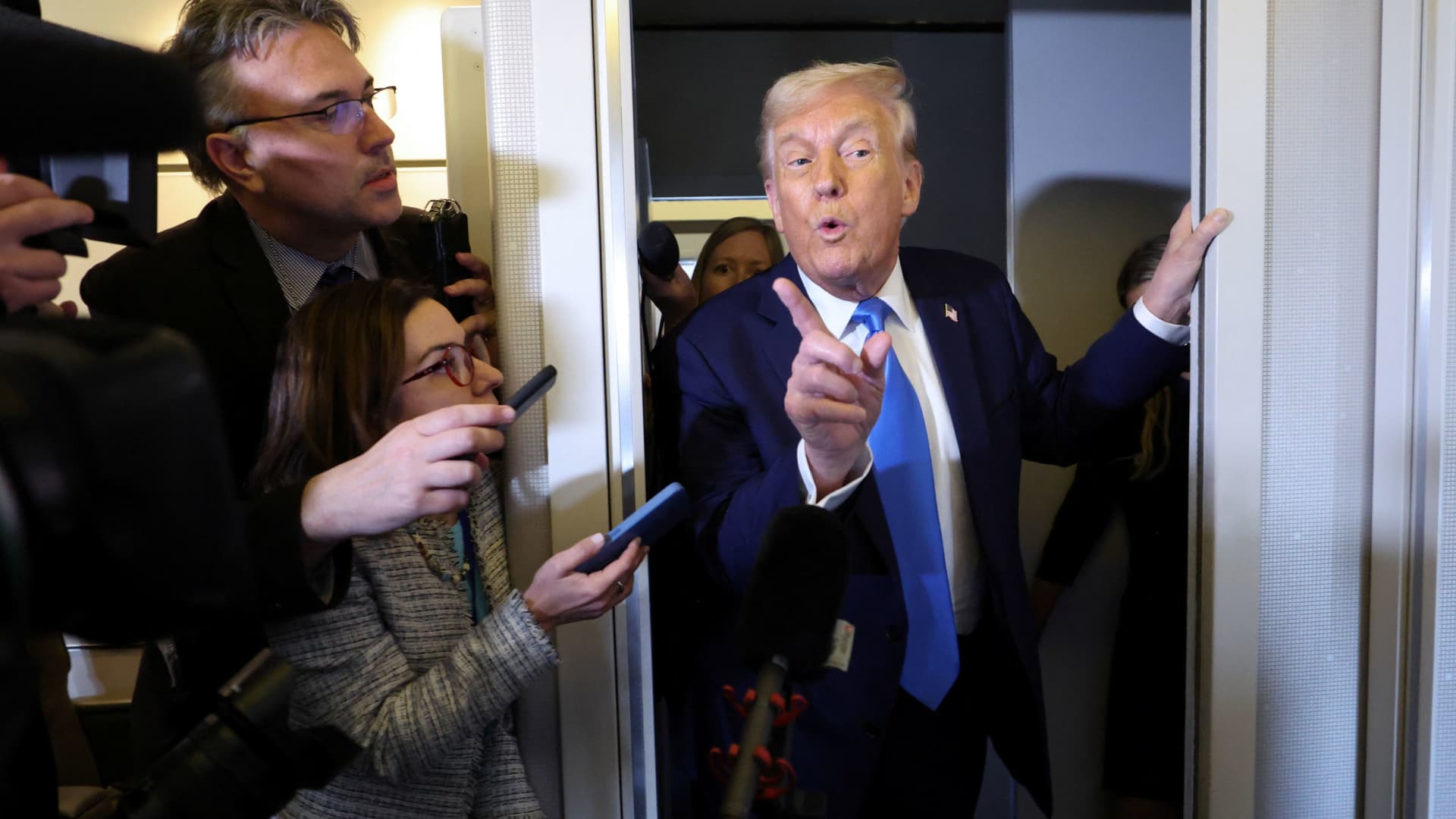

US President Donald Trump talks to the media on board the Air Force one before landing in Western Palm Bich, Florida, USA, March 28, 2025.

Kevin Lamark | Reuters

The uncertainty policy and new broad tariffs from the Trump administration are united to create a forecast for the US economy in the latest CNBC Rapid update.

Fast renewal, on average of 14 economists for GDP and inflation, in the first quarter registered by 0.3% compared to 2.3%, which was reported in the fourth quarter of 2024. This will be the weakest in 2022, when the economy came out of the pandemic.

The main inflation of PCE, meanwhile, the preferred Fed inflation, will be delayed at approximately 2.9% over much of the year before resuming the fourth quarter.

Behind Dour GDP forecasts, there is new evidence that a decrease in consumer and business sentiment is manifested in real economic activity. The Department of Trade on Friday reported that consumer expenses with real or inflations in February increased by only 0.1% after a -0.6% decrease in January. The fourth quarter economy reduced the cost of only 0.2% of 4%.

“Signs of slowing data on hard activity are becoming more convincing, after the pre -deterioration of the mood,” Barclay writes over the weekend.

Another factor: an import splash (subtracted from GDP), which appears to have poured into the United States ahead of the tariffs.

Good news is the import effect, and only two of the 12 economists surveyed see negative growth in 1 quarter. No predicted economic reduction quarters. Oxford Economics, which has the lowest Q1 estimate, is -1.6%, expects the traction from imports, but in the second quarter it bounces to 1.9%as this import will eventually increase growth if they are taken into account in inventory or sales measures.

On average, most economists predict a gradual rebound, with GDP in the second quarter of 1.4%, the third quarter – 1.6%, and the final quarter of the year increased to 2%.

Danger is an economy with anemic growth of only 0.3% can easily slip into the negative territory. And with the new tariffs that will come this week, not everyone is so confident in the rebound.

“Although our base line does not show a decrease in real GDP, given the mounting of the global trading war and DOGE to reduce jobs and financing, there is a good chance that GDP will decrease in the first and even the second quarter of this year,” Mark Zandy said Moody’s analytics. “And the recession will be likely if the president does not start to retreat from tariffs to the third quarter.”

Moody’s is looking for an anemic Q1 growth by a total of 0.4%, which by the end of the year jumps up to 1.6%, which is still modest below the trend.

Stubborn inflation complicate the Fed’s ability to respond to the growth of the pulse. The main PCE is expected in 2.8% in this quarter, increasing to 3% in the next quarter and remaining at this level until it drops to 2.6% a year.

While the market seems to be the banking banking, the Fed can find them difficult to justify until inflation starts more convincing at the end of the year.