Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

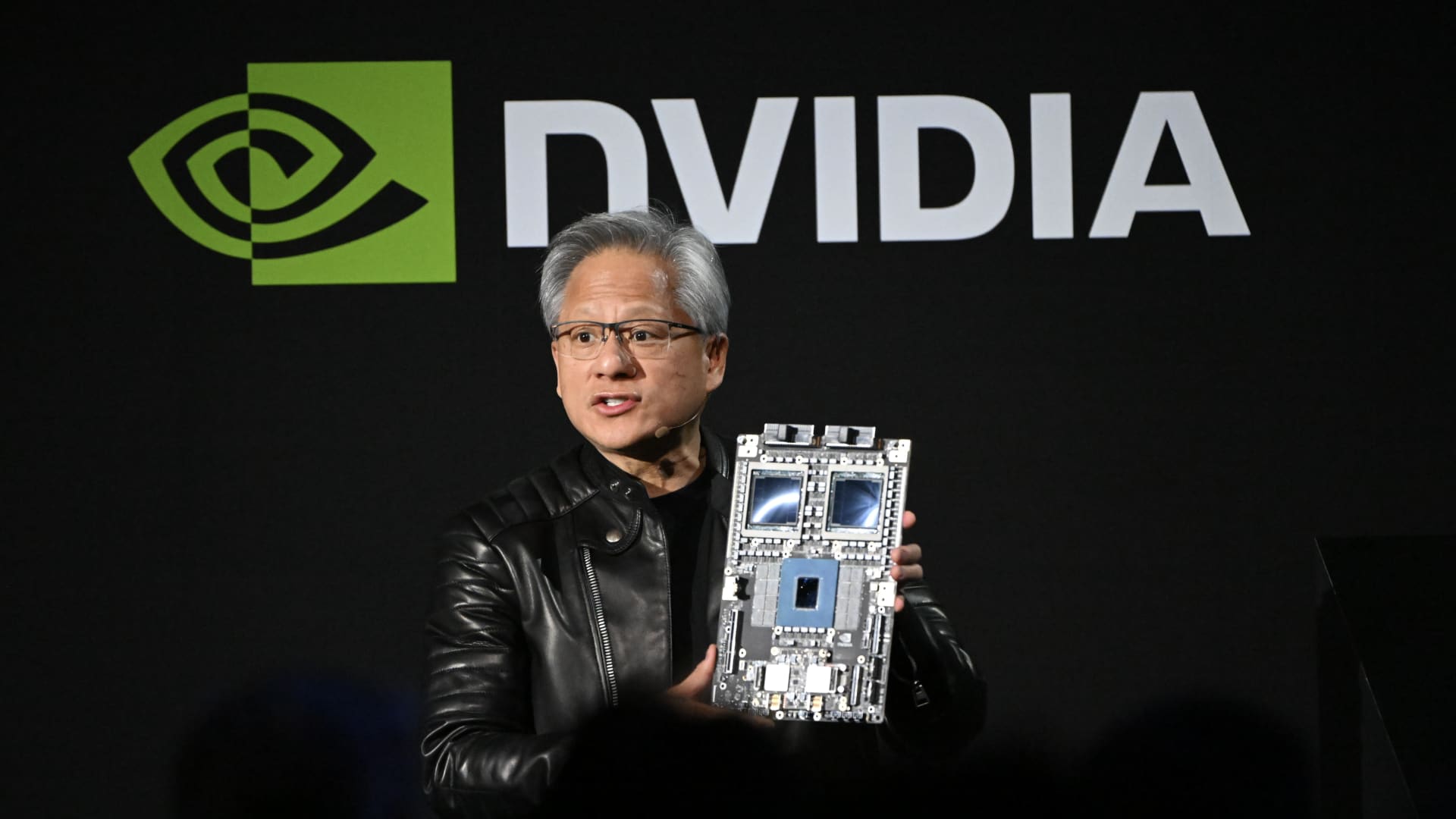

Jensen Huang, co-founder and CEO of Nvidia Corporation, holds up the company’s artificial intelligence accelerator chips for data centers during a speech during the Nvidia AI Summit Japan in Tokyo on November 13, 2024.

Akio Kon | Bloomberg | Getty Images

Artificial intelligence is still an abstract concept for many everyday consumers who don’t know how it will change their lives. But there is no doubt that businesses find value in it.

Some of the biggest winners of this year’s stock market rally, which saw the Nasdaq jump 33% and other U.S. indexes rise by double digits, have direct ties to the rapid development of artificial intelligence. Manufacturer of microcircuits Nvidia among them, but not alone.

Another particular theme that led to better performance this year is crypto. Starting with launch spot exchange traded funds in january cryptocurrencies had a big year 2024 marked Donald Trump election victory that was is financed largely of the crypto industry. A number of crypto-related stocks have seen big gains.

There are four trading days left until the end of the year. Here are the five best-performing US tech stocks in 2024 among companies valued at $5 billion or more.

Adam Forugi, CEO of AppLovin.

CNBC

AppLovin entered the year with a market capitalization of about $13 billion and was best known for investing in a collection of mobile game studios that created titles such as Woody Block Puzzle, Clockmaker and Bingo Story.

At the end of the year, AppLovin’s valuation exceeded $110 billion, making it worth more than Starbucks, Intel and Airbnb. As of Tuesday, AppLovin shares are up 758% this year. surpassing all other technology companies.

While AppLovin became public In 2021, on the wave of the online gaming hype of the Covid era, business is now centered around online advertising and booming profits from advances in artificial intelligence.

Last year, AppLovin released an updated version 2.0 of its ad-finding system, called AXON, which helps place more targeted ads in game apps it owns and is also used by studios that license the technology. Software platform revenue increased 66% to $835 million in the third quarter, outpacing overall growth of 39%.

Net income soared 300% in the quarter, pushing the company’s profit margin to 36.3% from 12.6% year over year.

AppLovin CEO Adam Forughi, whose net worth surpassed $10 billion, even more excited for what’s to come. During the company’s November phone call, Forugi raved about an e-commerce test project that allows companies to offer targeted ads in games.

“In all my years, this is the best product I’ve ever seen that we’ve put out, it’s the fastest growing, but it’s still in the pilot stage,” he said.

Price Photo | Nurphoto | Getty Images

After rock climbing 346% in 2023 it was hard to imagine MicroStrategy’s reserve find another gear. But it worked.

The price of the company’s shares is jumped 467% this year based on the bitcoin buying strategy that made founder Michael Saylor a crypto-cult hero.

In mid-2020, the company announced its intention to start buying bitcoins. Up until this point, MicroStrategy was a mid-sized business intelligence software vendor, but since then it has acquired more than 444,000 bitcoins, using its ever-rising stock price as a way to sell shares, increase debt and buy more coins.

It is now the world’s fourth largest owner of bitcoins, second only to creator Satoshi Nakamoto. Bitcoin Trust iShares BlackRock and crypto exchange Binance, whose reserves are estimated at nearly $44 billion. MicroStrategy’s market capitalization has grown from about $1.1 billion when it was just a software company to $80 billion today.

Although the rally continued well into November, Trump’s election victory last month added strength. Since then, the stock is up 57%, while Bitcoin is up about 44%. Trump once called bitcoin a “fraud,” but this election it was the industry’s preferred choice and received significant support from some of the top players, including Coinbase.

“With the red swing, Bitcoin is going up with the tailwind, and the rest of the digital assets are going to start going up as well,” Saylor told CNBC shortly after the election. He said bitcoin remains a “safe haven” in the crypto space, but as a “digital asset framework” is created for the broader crypto market, “there will be a surge in the entire digital asset industry.”

Alex Karp, CEO of Palantir Technologies, walks into the morning session of the Allen & Co. media technology conference. in Sun Valley, Idaho on July 10, 2024.

David Paul Morris | Bloomberg | Getty Images

Palantir in 2024, there were many big runs on the way to a 380% increase in share price. One of the best stretches came last month, when the software company upgraded its earnings forecast a day before the presidential election.

A company that sells data analysis tools to defense agencies, came across its 2024 target, with a fourth-quarter forecast that beat analysts’ estimates. Palantir also beat third-quarter results, which led to a statement from the company’s CEO, Alex Karp profit release“We’ve completely gutted this quarter, driven by relentless demand for AI that won’t slow down.”

The stock jumped 23% after the earnings report and then another 8.6% the day after Trump’s victory. Co-founder and board member of Palantir Peter Thiel was a big boost for Trump in the 2016 campaign and helped organize meeting with technical managers at Trump Tower shortly after this election. Carp was one of those present.

Karp, however, openly supported the vice president Kamala Harriscandidate from the Democratic Party, in the 2024 campaign. He said The New York Times the material, published in August, said Thiel’s earlier support for Trump and the subsequent backlash made it “actually more difficult to get the job done.”

Still, Wall Street rallied behind Palantir after the election on optimism that more military spending would flow into the company.

Karp’s comments in the pre-election earnings report suggest the company will be fine either way.

“Our business growth is accelerating and our financials are outperforming expectations as we meet the continued demand for the most advanced artificial intelligence technologies from the US government and commercial customers,” Karp said in letter to shareholders.

Analysts expect revenue to grow by about 24% to $3.5 billion in 2025, according to LSEG.

Robinhood shares have more than tripled in value this year despite falling 17% on Oct. 31, following disappointing earnings.

A few days later, investors skimmed through the numbers, sending the stock up 20% after Trump’s election victory, as everything crypto-related rallied. One of Robinhood’s biggest growth drivers is crypto, which retail investors can easily purchase within the app alongside their stocks.

Revenue from crypto transactions jumped 165% in the third quarter from a year earlier to $61 million, accounting for 10% of total net revenue.

In addition to Bitcoin, Robinhood users can easily purchase around 20 other cryptocurrencies, ranging from popular digital assets like Ethereum to altcoins like Dogecoin, Shiba Inu, and Bonk. At the company’s investor day in November, Robinhood CEO Vlad Tenev said that crypto is more than just an investment, but also a “disruptive technology that will change the underlying infrastructure under payments, credit and a wide range of tradable assets.”

Analysts expect Robinhood to report revenue growth of more than 70% to $805.7 million in the fourth quarter, according to LSEG, which would be the fastest growth rate for any quarter since 2021, the year the company became public.

Robinhood’s rally this year has outpaced that of Coinbase, which has jumped 61%. But with a market cap of $70 billion, Coinbase is still worth twice as much.

Nvidia the stunning run continued.

After last year’s Up 239% thanks to hype around generative artificial intelligence, Nvidia has soared another 183% this year, adding a whopping $2.2 trillion to its market cap.

Twice this year Nvidia captured the title from the world’s most valuable public company. an apple jumped ahead to close to $4 trillion, Nvidia at $3.4 trillion and Microsoft for 3.3 trillion dollars.

Nvidia remains the biggest beneficiary of the AI boom as the biggest cloud providers and internet companies snap up all the GPUs they can find. Annual revenue has grown at least 94% in each of the past six quarters, with growth exceeding 200% three times during that period.

CEO Jensen Huang said in the company latest income statement that a next-generation AI chip called Blackwell is in “full production.” Chief Financial Officer Colette Kress said the company is approaching “several billion dollars” in Blackwell revenue in the fourth quarter.

“Every customer wants to be first to market,” Kress said. “Blackwell is now in the hands of all our core partners and they are working to build their data centers.”

While growth is expected to remain strong for a company the size of Nvidia, the inevitable slowdown is coming. Analysts forecast a year-over-year slowdown over the next few quarters, with growth dipping into the mid-40s by the second half of next year.

Nvidia relies on huge revenue from several tech giants, so any economic fluctuations represent significant risk for investors.

That helps explain why Nvidia likes to tell Wall Street about the extensive list of companies that are building new AI services and “racing to accelerate the development of these applications with the potential to deploy billions of agents in the coming years,” Kress said. on the salary call.

WATCH: Next year – “stock market”

[ad_2]

Source link