Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

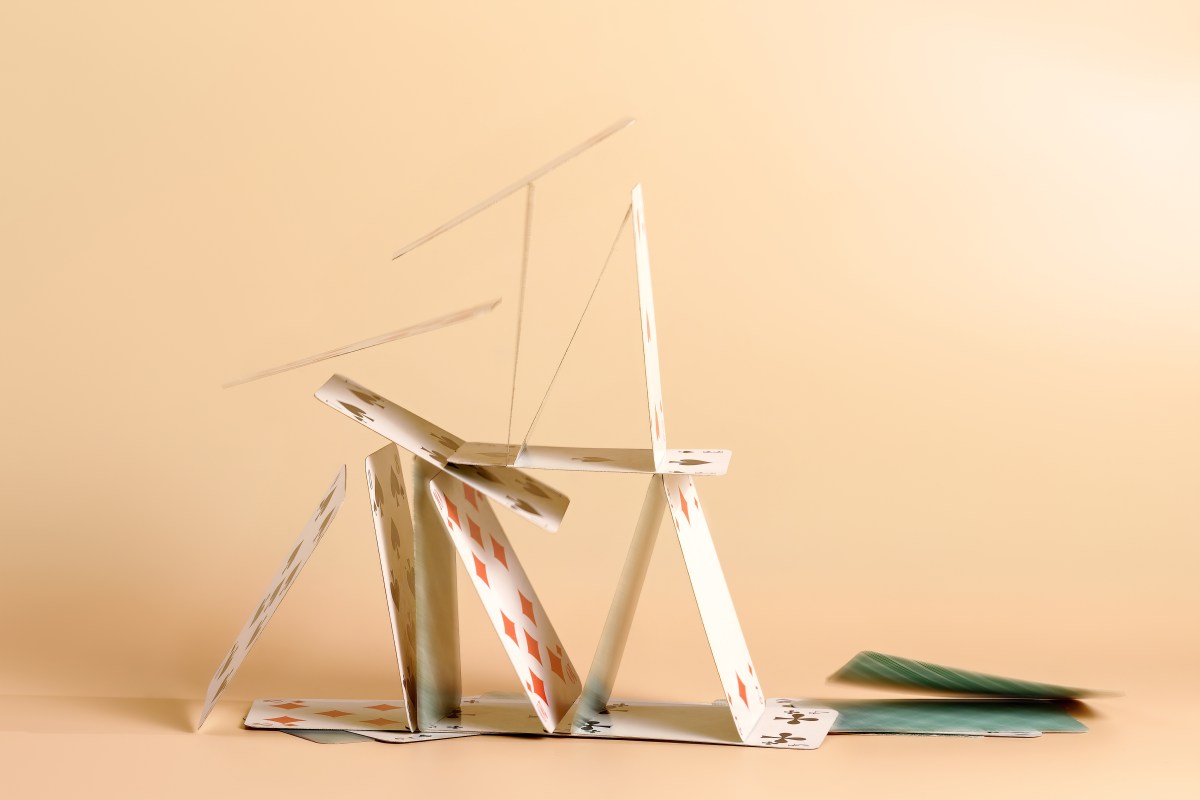

Many proptech startups, born and funded during the heyday of low interest rates, are in the fray. With investments in US-based real estate startups falling from $11.1 billion in 2021 to $3.7 billion last year, according to PitchBook data, some are selling off, while others are closing up shop.

The two most recent examples are the latest victims of a challenging interest rate environment and the long years slowdown in real estate fintech financing.

Divvy Homes, a rental proptech startup, has been acquired in a fire sale by Maymont Homes, Fast Company of Charleston, South Carolina. reported last week. Maymont is a division of Brookfield Properties.

EasyKnock ends abruptly, NPR reported last month. This closure follows several lawsuits filed against the proptech company and an FTC Consumer Alert on its controversial sale-leaseback models, which involved buying homes from owners and simultaneously renting the homes to them.

While 9-year-old Divvy declined to comment, a source familiar with the matter confirmed to TechCrunch that Divvy is in talks with Brookfield and is “close to signing a purchase agreement.” This person disputed that the purchase was a fire sale. However, neither the company nor the source shared how much Brookfield could pay for Divvy, so it’s still unclear whether the price is a bargain or a bargain.

Its sale, fire or not, is not just a shock. Signs of trouble began to appear at Divvy in 2022, when the company began to lay off staff. In November 2023, Divvy had made its third layoff in a year.

The one-time startup that was struggling had raised more than $700 million in debt and equity from well-known investors such as Tiger Global Management, GGV Capital and Andreessen Horowitz (a16z), among others. Divvy’s last known funding took place in August 2021 – a $200 million Series D financing led by Tiger Global Management and Caffeinated Capital at a $2 billion valuation. The D series was announced just six months later a $110 million Series C. The last known valuation of Divvy Homes was $2.3 billion in 2021, according to PitchBook.

EasyKnock, a startup that billed itself as the first technology-enabled residential sale-leaseback provider, was founded in 2016 and had raised $455 million in funding from backers, including Blumberg Capital, QED Investors, and the corporate venture arm of Northwestern Mutual, according to PitchBook. data. About $200 million of that capital was in the form of debt that allowed the company to buy homes, according to a person familiar with the startup.

So what went wrong?

In its heyday, Divvy Homes said it was different from other real estate technology companies because it worked with renters who wanted to become homeowners by buying the house they wanted and renting it to them for three years while they built “the savings needed to own it,” he said.

But the Federal Reserve has begun raising interest rates in 2022 in a mission to curb inflation. For companies like Divvy Homes, which bought homes as part of their business model, the high taxes were devastating, limiting their ability to buy homes and make money from those purchases.

EasyKnock’s business model also involved buying houses and renting them. But their deal appealed to homeowners with poor credit scores because it gave them access to quick cash, with the option to buy back the home at a future date.

High interest rates also hurt, as it took on debt to finance its operations, sources familiar with the company told TechCrunch. But EasyKnock had additional problems. More than two dozen lawsuits were filed against EasyKnocks, and Attorney General of Michigan stated that the company used “deceptive practices“Acquiring houses from those in financial stress at low prices and then charging them high rents.

According to our sources, EasyKnock was insolvent when it closed, overwhelmed by debt.

And with interest rates still relatively high, and financing still hard to come by, we can probably expect more of this kind of news from the real estate fintech space in the coming months and perhaps throughout 2025.

Do you know a struggling proptech startup? Contact Mary Ann at [email protected] or via Signal at 408.204.3036 or Marina.temkin at techcrunch.com.

[ad_2]

Source link