Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

US Treasury Secretary Scott Infant Donald TrumpThe proposal of companies that report a half -head basis will be good news for investors.

Trump suggested writing quarterly income reports in Truth Social post on MondaySaying that this will allow the company executives to focus on long -term purposes rather than securing short -term indicators.

“President Trump realizes that this is the UK, (or) this US, our state markets are atrophic, and this may be one way to return and reduce the costs for state -owned companies without harming investors,” London’s inset said in London.

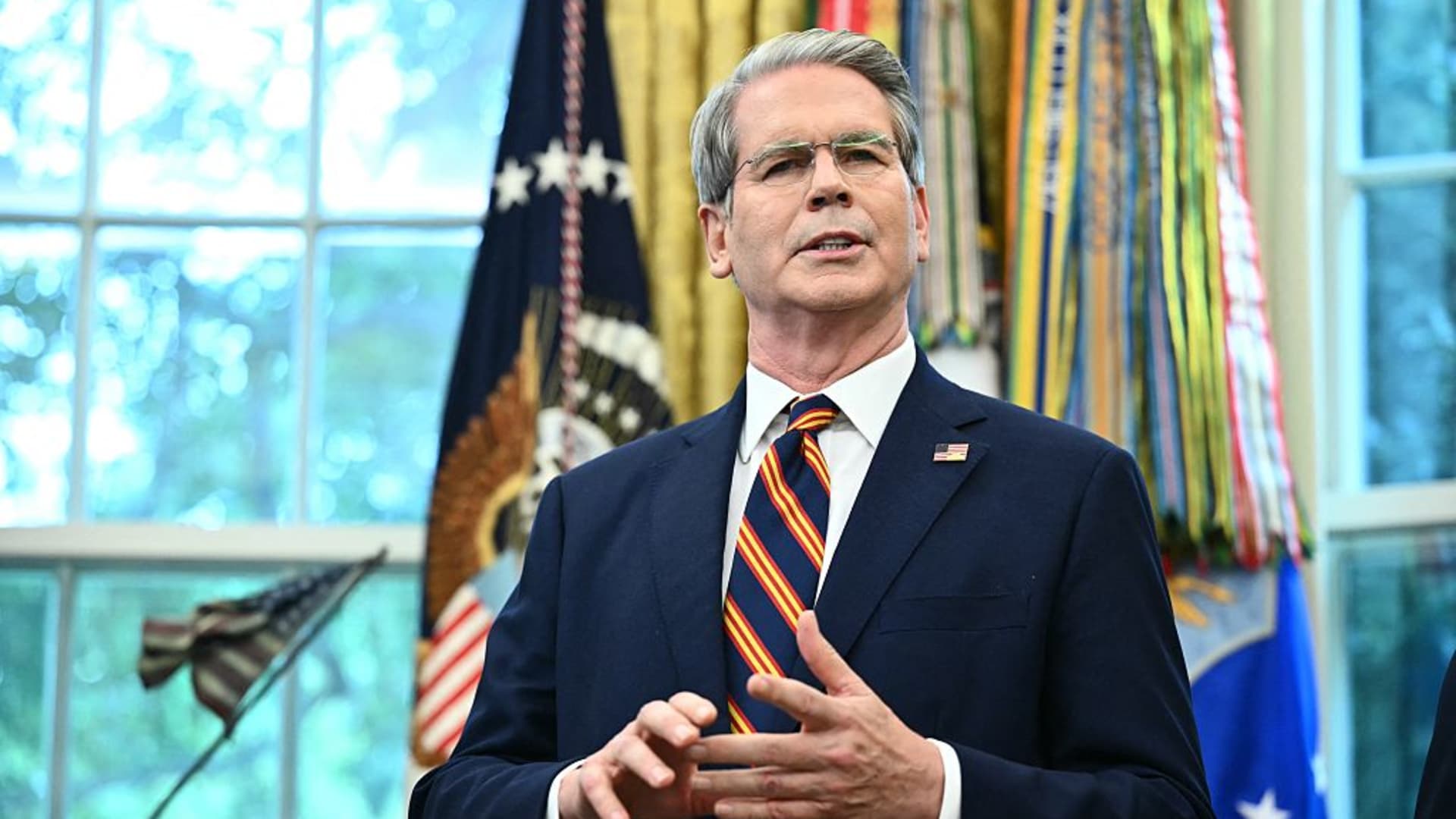

US Finance Minister Scott Infant in CNBC Studios in London.

US Finance Minister Scott Infant in CNBC Studios in London.

This comes, because many companies choose to stay private, rather than list publicly, partly from the increase in check and the cost of fulfilling requirements in each quarter. The number of state -owned companies in the US fell With more than 7000 in 1996 to less than 4000 in 2020.

Trump also suggested that the cancellation of quarterly reports would bring the United States to many foreign jurisdictions that have already adhered to the half -year reporting regime.

“If you have heard the statement that” China has a view of the company management of 50 to 100 years, while we are quarterly managed by our companies ??? Not good !!! “,” said Trump.

While the companies listed in China’s report, every quarter, the stock on Hong Kong reports are subject to reporting every six months.

In the UK and the European Union, companies also report half -class, but can issue quarterly reports if they want.

However, some investors have previously warned, quarterly income reports help to defend their interests, making the finance of companies more transparent and regular.

Council of Institutional Investors, or CII, Group representing Retirement funds invested in stocks, suggested that the lack of quarterly reporting cannot “protect” to investors.

Foreign companies listed in the USA as part of a foreign private issuer, such as Arm and HoldThey are also released from the need to report quarterly, but some voluntarily report quarterly.

CII has stated that many of the liberations that foreign companies use in the US can now “undermine” effective corporate management.

Over the last decade, there have been a number of high -profile companies that have been leaving their home markets in the US, which have been raised by higher estimates reached by American peers, and some regulatory benefits.

Deviation from quarterly reporting can make the US market even more attractive to European companies as it will reduce the cost of compliance with those who consider this step.

“I don’t think it is a development that changes the game when it should be implemented, but it will definitely come in combination for a company that thinks about how and how they want to list in the US,” said Mike Bienenfeld, a lawyer who specializes in the requirements of the Linklaters.

Asked if this step in the US will even more attractive for European companies, the Treasury secretary said: “It’s hard to be popular.”